The UN Climate Change Conference “COP30” in Brazil came to an end at the weekend after tough negotiations. Ultimately, delegates from around 200 countries were able to agree on a final text after difficult negotiations. According to the declaration, rich countries want to increase their climate aid to poorer countries so that they can better cope with the effects of climate change. Specifically, tripling aid by 2035 was discussed. The final text also includes measures to accelerate climate protection and a review of trade barriers.

The delegates were unable to agree on a binding commitment to move away from fossil fuels. “We know that some of you had greater ambitions for some of the issues at hand,” admitted conference president Andre Correa do Lago during the closing plenary session. However, there are plans for a side agreement on fossil fuels outside the regular agreement.

The EU wanted to agree to this, even if the word “fossil” is only mentioned indirectly. “I want to be clear: we are not fighting fossil fuels. We are fighting emissions,” EU Commission President Ursula von der Leyen said recently, relativising the move away from fossil fuels. Oil-producing countries such as Saudi Arabia were particularly opposed to the establishment of such a roadmap for phasing out coal, oil and gas, nor did China want to go along with it, but decisions at the UN Climate Change Conference must be taken by consensus.

Data as of 26.11.2025

Brazil launches new fund to protect the rainforest

Brazil has also launched a new fund to protect the rainforest called TFFF, which is intended to financially reward tropical countries that protect their rainforests. The fund will generate interest income from capital contributions from government and private investors. This income will be paid out to all countries that protect their rainforests for conservation purposes. Norway has already pledged around USD 3bn (EUR 2.6bn) for forest protection at COP30. This is the largest contribution to the TFFF to date. French President Emmanuel Macron pledged EUR 500m to the fund.

However, the conference did not adopt a concrete “forest action plan” to curb deforestation. It merely reiterated an earlier decision to halt deforestation by 2030. In addition, the watering down of the EU deforestation regulation will do little to help protect forests.

Mixed reactions

India and other major emerging economies expressed satisfaction with the outcome of the global climate conference. A representative of India said on Saturday on behalf of the so-called BASIC countries, which include Brazil, China and South Africa, that a “significant” agreement had been reached in the difficult negotiations. He praised the “outstanding efforts” of the Brazilian COP presidency.

UN Secretary-General António Guterres acknowledged that the outcome of COP30 was not satisfactory for everyone (c) APA-Images / AFP / PABLO PORCIUNCULA

EU Climate Commissioner Wopke Hoekstra said that although the EU would have liked to see “more ambition” in the outcome of the conference, it did not oppose the result. However, diplomats from the EU circle spoke of “an unsatisfactory outcome”. “It was not a step backwards, it was not a step forwards, but a step to the side,” observers of the process told the APA. The term “minimal compromise” was often used.

UN Secretary-General António Guterres gave a mixed assessment. The conference “did not achieve everything that is necessary,” Guterres said on Saturday. He acknowledged that “many may be disappointed” with the results, including indigenous peoples and young people. “The gap between where we are and what science demands remains dangerously large,” the UN Secretary-General emphasised.

Fossil fuel production and climate targets continue to diverge

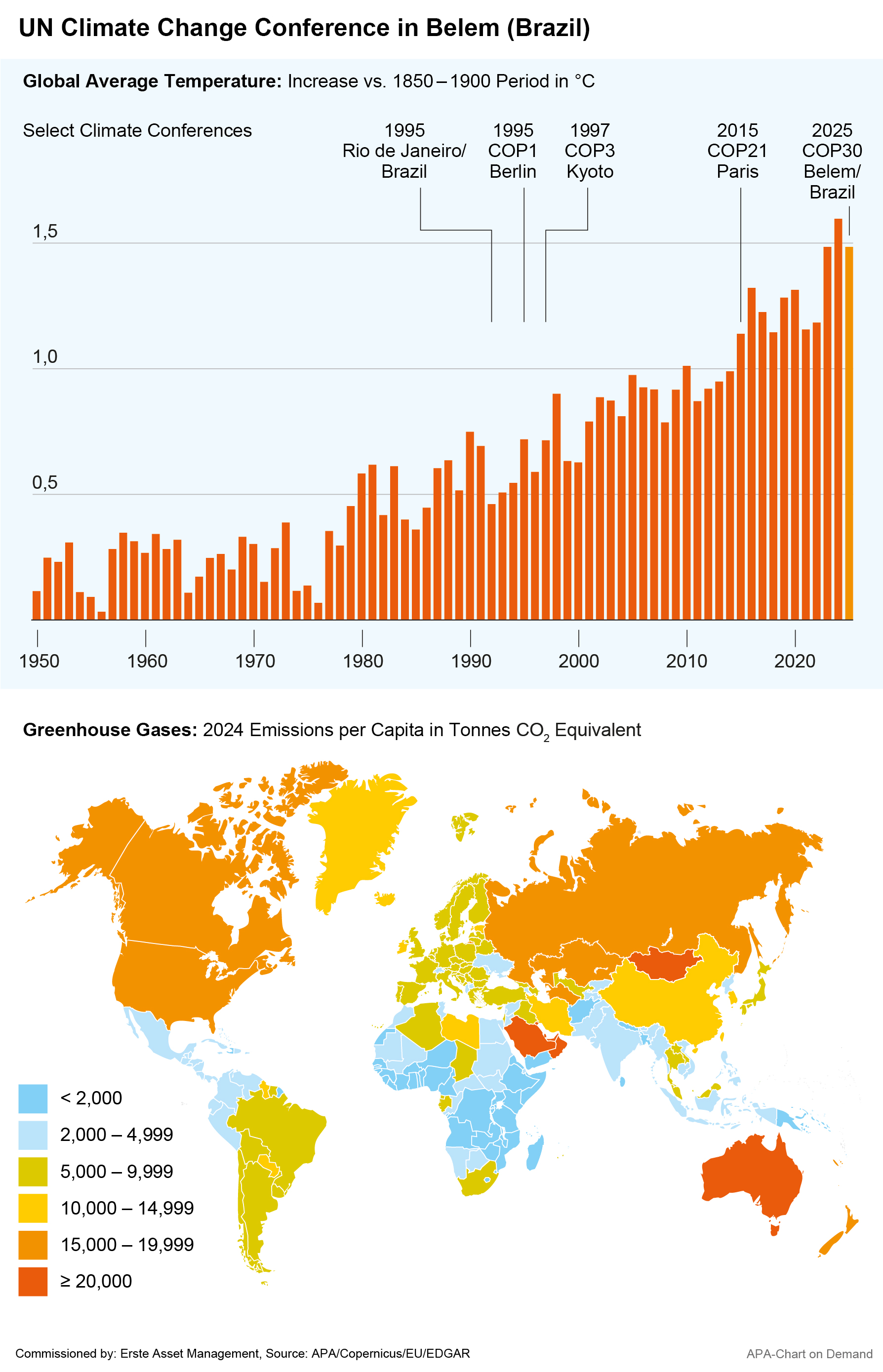

Domestic researchers drew a mixed conclusion after the conclusion of the World Climate Conference. Initial reactions were positive that the climate target of the Paris Agreement was still included in the final text. In the 2015 climate agreement, the international community committed to limiting global warming to well below two degrees, but preferably 1.5 degrees, compared to the pre-industrial era.

However, according to a study published in September, there is still a wide gap between the commitments in the Paris Climate Agreement and the plans of countries to use fossil fuels. There remains “a disconnect between climate ambitions and what countries are actually planning in terms of fossil fuel production,” said study co-author Derik Broekhoff of the Stockholm Environment Institute (SEI), summarising research conducted by more than 50 international researchers. The study states that the planned production of coal, oil and gas by 2030 currently exceeds the amount compatible with the 1.5-degree target by more than 120 per cent. Even the two-degree target will be exceeded by 77 per cent with the current plans.

“Naturally, as with every COP since the Paris Climate Summit, expectations were higher than the results ultimately achieved,” comments Walter Hatak, Head of Responsible Investments at Erste Asset Management, on the decisions made at the World Climate Conference. But despite these unfulfilled expectations, global warming has been reduced from over 3 degrees to now below 2.5 degrees in recent years, while economic growth has remained positive. “Even if the 1.5-degree target seems increasingly unrealistic, the Paris target of below 2 degrees is still achievable with the appropriate efforts.” According to Hatak, every tenth of a degree counts, especially because of the tipping points in the climate that could trigger negative consequences.

Renewable energies still on the rise

While no global roadmap for phasing out fossil fuels has been agreed upon, the expansion of renewable energies is continuing at an unchanged pace. According to Hatak, China in particular has invested heavily in the expansion of renewable energy infrastructure in recent years. “China has made these investments not for ideological reasons but primarily for economic reasons, while the US under Trump is taking the opposite path and assuming a special global role,” he comments.

Another milestone was reached in the first half of this year: for the first time, energy production from renewables has grown faster than global demand, displacing fossil fuels. “There is therefore every reason to remain positive about the future and look forward to the next COP with high expectations,” says Hatak, looking positively to the future.

Conclusion

COP30 has shown how challenging international climate policy remains. Despite important progress in climate aid and rainforest protection, key issues such as a global path to phasing out fossil fuels remain unresolved.

Hatak, an expert in responsible investment, is certain that global cooperation and dialogue in the form of the World Climate Conference are still needed: “Even if there are no major breakthroughs, every COP is an important step toward creating transparency, measuring progress, and maintaining pressure. It is crucial to take advantage of the momentum and continue working on ambitious solutions.”

What the next steps will look like and whether the international community can pick up the pace on climate protection remains to be seen—and will also shape future conferences.

Broad investment in renewable energies and environmental technologies

With impact equity funds such as the ERSTE WWF STOCK ENVIRONMENT or the ERSTE GREEN INVEST, investors can specifically invest in companies that are active in the field of environmental technologies. Both funds pursue the goal of achieving a measurable positive benefit for the environment and/or society with their investments.

👉 You can find more information on this on our website

Note: Please note that an investment in securities entails risks in addition to the opportunities described.

Risk notes ERSTE WWF STOCK ENVIRONMENT

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE WWF STOCK ENVIRONMENT as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE WWF STOCK ENVIRONMENT, consideration should be given to any characteristics or objectives of the ERSTE WWF STOCK ENVIRONMENT as described in the Fund Documents.

Risk notes ERSTE GREEN INVEST

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE GREEN INVEST as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE GREEN INVEST, consideration should be given to any characteristics or objectives of the ERSTE GREEN INVEST as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.