High-yield (HY) bonds are debt instruments rated below investment grade, offering higher returns to compensate for their elevated risk, one of which is the possibility that the issuing company may be unable to meet its debt obligations. As such, corporate defaults are an inherent part of investing in HY bonds and understanding how they unfold is key to managing risk and expectations. When a company defaults, it means it has failed to meet its financial obligations, such as paying interest or repaying the principal on time.

Please note: Past performance is no reliable indicator of future value development. Please note that an investment in securities entails risks in addition to the opportunities described.

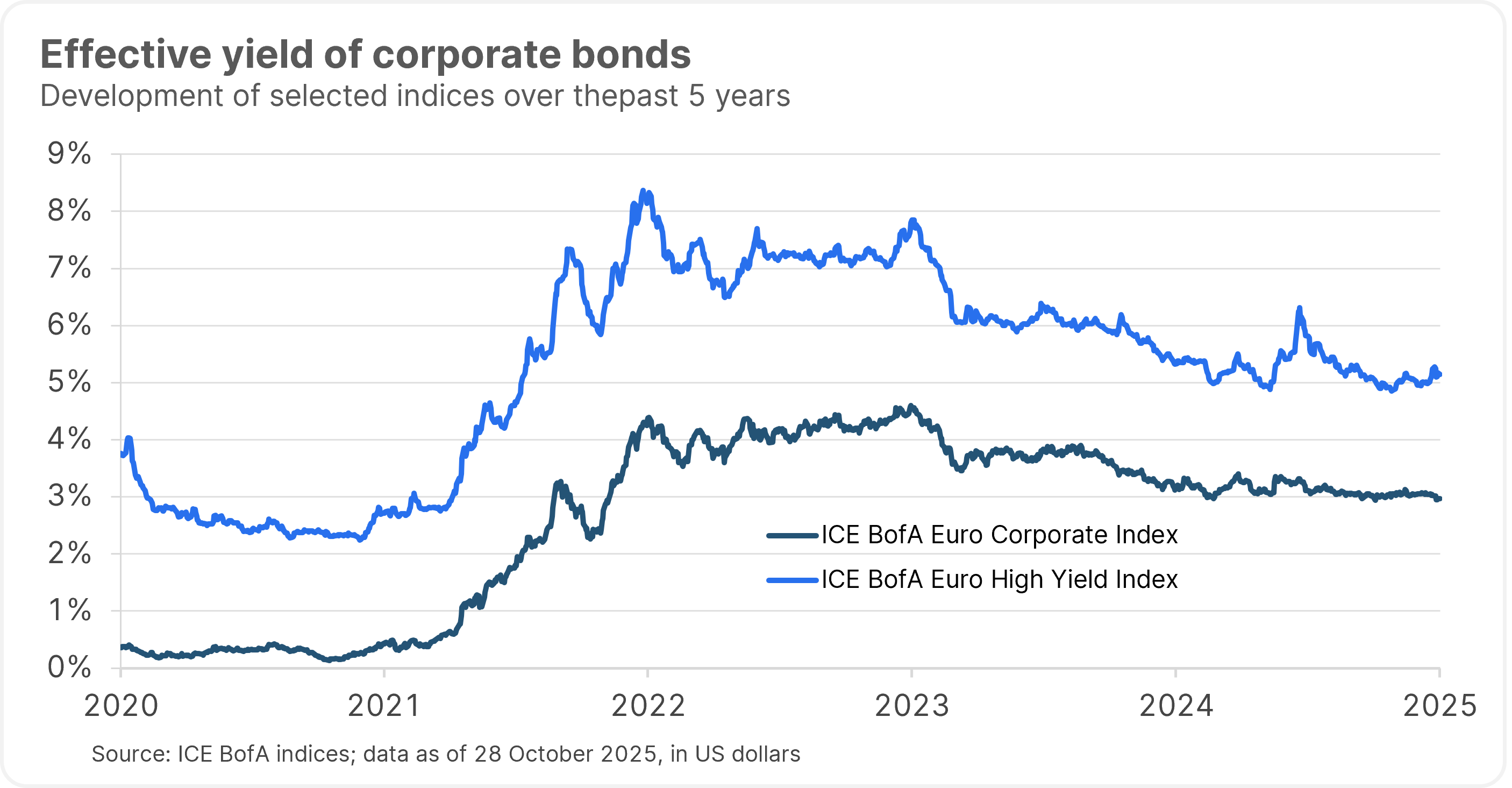

The yields of HY bonds have consistently been higher than IG yields over the years, reflecting the additional credit risk investors take on. This yield premium is the reward for bearing the higher credit risk and volatility due to potential losses from defaults and restructurings.

Defaults can happen for many reasons: falling revenues, rising costs, poor management decisions, or external shocks like economic downturns. But a default doesn’t usually mean the end of a company or a full loss on the bond investment. Often, it’s the beginning of a restructuring process aimed at saving the business and recovering as much value as possible for creditors.

What triggers a default event?

A default is usually triggered when a company:

- missed interest or principal payments

- violates bond or loan covenants (the rules set by lenders)

- files for insolvency or bankruptcy

Before defaulting, companies often try to negotiate with creditors. They may seek debt restructuring, which can include extending maturities, reducing interest rates or principal (a haircut), amending or temporarily waiving the covenants or converting debt into equity.

The difference between a default event and bankruptcy

A default event is a contractual breach, such as missing an interest payment or violating a covenant, that signals financial distress but doesn’t necessarily mean the company is bankrupt. In contrast, a bankruptcy filing is a formal legal process designed to address that distress and put the company back on track. Reasons why companies may file for bankruptcy are:

- a liquidity crisis

- an unsustainable capital structure

- overwhelming litigation risk

Bankruptcy is one of the available paths to restructuring, but restructuring doesn’t always mean bankruptcy.

Companies in distress have several tools to stabilize their finances. Another path is a Liability Management Exercise (LME), where debt terms are renegotiated directly with creditors. Another is a capital raise, where fresh equity is injected to improve liquidity and reduce pressure on the balance sheet.

If these measures fail or are not feasible, the company may enter formal bankruptcy proceedings, which offer a legal framework to restructure or liquidate. Each approach aims to cure the default and, ideally, restore viability, but the chosen path depends on urgency, stakeholder support, and legal environment. For bond investors, all scenarios offer potential for partial or full recovery depending on the structure and seniority of the debt.

What happens during a bankruptcy proceeding?

In a court-supervised restructuring or bankruptcy proceeding, the process typically begins with the filing for insolvency, usually by the company itself. This triggers a legal pause on creditor claims (a moratorium) and opens the door for a structured solution. The court may appoint an insolvency administrator or allow the company to continue under self-administration. The company then proposes a plan of reorganization, which outlines how much creditors will be repaid and over what timeframe.

Creditors vote on the plan, and if approved, it becomes binding. In some cases, fresh capital is injected, or assets are sold to support the plan. The goal is to stabilize the business, preserve value, and offer creditors a better outcome than liquidation.

Seniority and subordination in bankruptcy

In a bankruptcy or court-supervised restructuring, claims are handled according to a strict hierarchy of seniority. At the top are secured creditors, whose claims are backed by specific assets. These creditors are usually repaid first from the proceeds of those assets. Next come unsecured creditors, who have no collateral but still hold contractual claims. Below them are subordinated debt holders, whose claims are ranked lower and often face deeper losses. At the bottom of the hierarchy are equity holders, who usually only receive value if all other claims are satisfied.

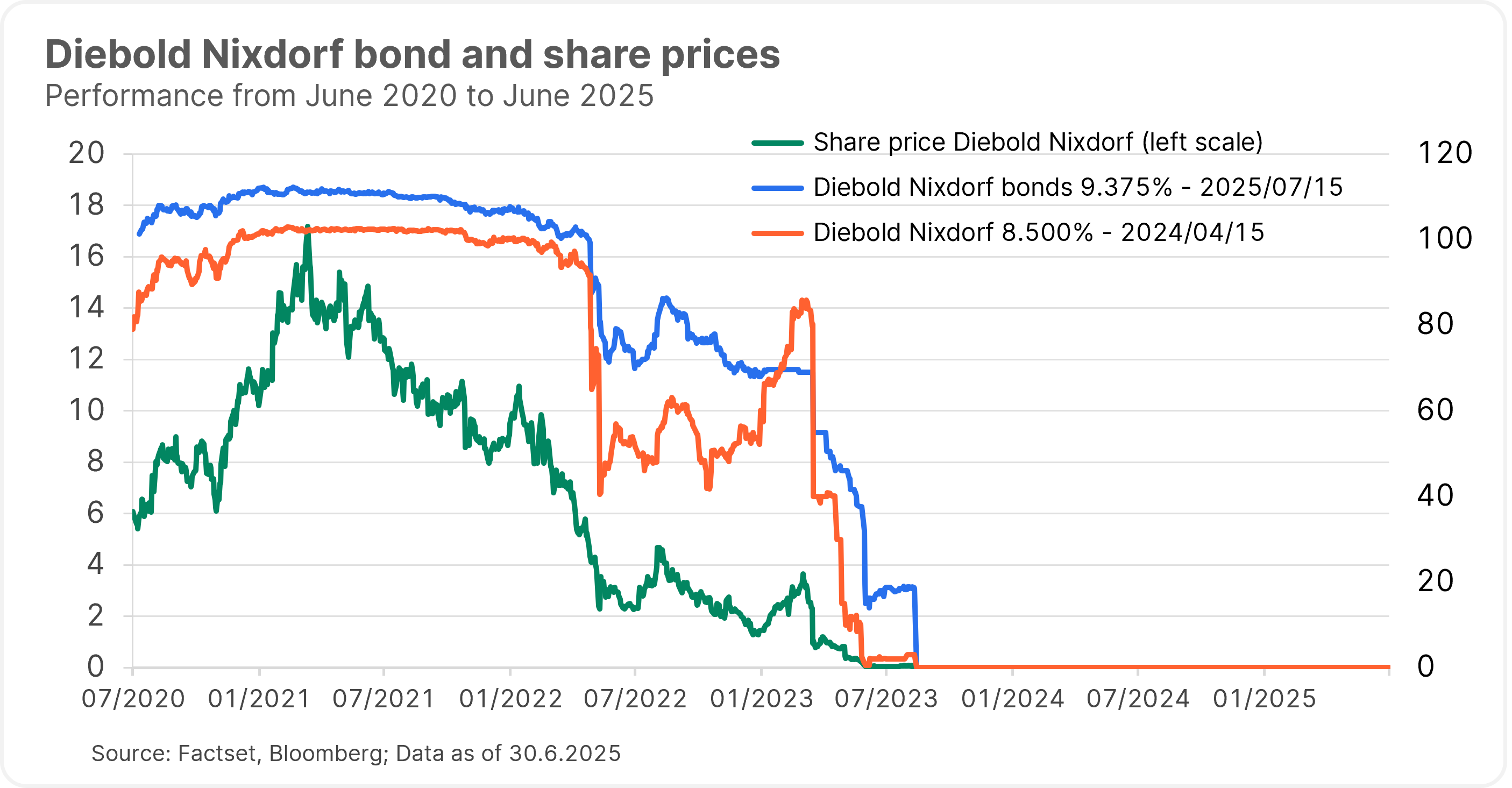

The chart below shows the share price and bond prices of two bonds from Diebold Nixdorf, a company specializing in ATMs and point-of-sales systems, that ran into financial trouble after 2022. While the secured bond held up relatively well due to collateral backing, the senior unsecured bond dropped sharply as restructuring fears grew. The company finally restructured in August 2023. While the secured bonds received approximately 98% of new equity, unsecured bonds had minimal recoveries and shareholders were wiped out entirely.

Please note: Past performance is no reliable indicator of future value development. The companies listed in this article have been selected as examples and do not constitute an investment recommendation.

How restructuring works in different countries

The legal framework for corporate restructuring varies by country and can significantly impact bondholder outcomes. In Austria, companies can restructure either before insolvency under the Restrukturierungsordnung (ReO), introduced in 2021, or during insolvency via a court-supervised Sanierungsverfahren, often with partial debt repayment over two years. The ReO marked a major modernization step, replacing a bankruptcy regime that dated back to the Austro-Hungarian Empire. It was implemented in response to the EU Restructuring Directive (2019/1023), adopted in June 2019, which aimed to harmonize preventive restructuring tools across member states.

Germany offers a dual-track approach: pre-insolvency restructuring under StaRUG (Stabilisierungs- und Restrukturierungsrahmen für Unternehmen), and formal insolvency proceedings under the Insolvenzordnung (InsO). StaRUG, also enacted in 2021, allows companies facing imminent illiquidity to restructure outside of insolvency through a court-supervised plan.

In the US, Chapter 11 allows companies to reorganize under court protection while continuing operations, whereas Chapter 7 leads to liquidation. U.S. procedures are more flexible but often slower and costlier. For investors, understanding these differences helps assess recovery potential and risk more accurately.

Companies can sometimes strategically choose the jurisdiction by relocating their registered office or initiating proceedings in a country where the legal framework is more favorable, such as more flexible restructuring tools or debtor-friendly procedures. This choice can significantly affect the restructuring outcome and recovery prospects for bondholders.

Impact on bondholders and investment funds

For bondholders, a default usually means:

- Volatility and possible loss of value: Bonds may be traded at steep discounts.

- Uncertainty: Recovery depends on the restructuring outcome.

- Delayed payments: Repayment can take years.

Despite default or restructuring, corporate bonds usually remain tradable, which preserves their liquidity for investors.

In a high-yield bond fund, active management plays a crucial role in navigating credit risk. By continuously monitoring issuers, assessing financial health, and reacting early to warning signs, fund managers can avoid troubled credits or reduce exposure before defaults occur. This proactive approach not only helps protect capital but can also improve long-term performance by focusing on resilient issuers and identifying recovery opportunities during restructurings.

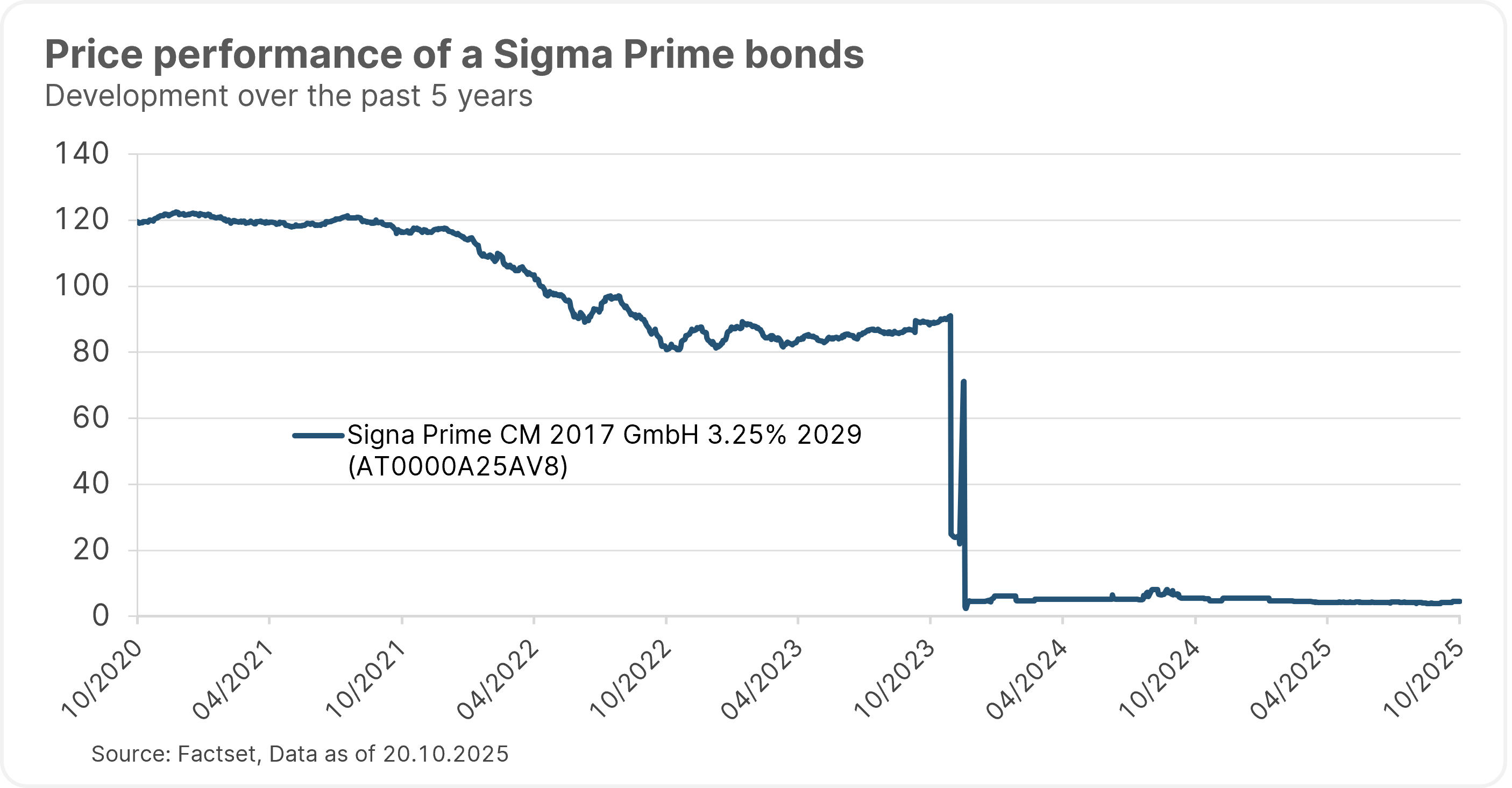

Case study 1: Signa Group – Austria’s largest bankruptcy

Signa, a major Austrian real estate group, collapsed in late 2023. Its subsidiaries, Signa Prime and Signa Development, entered insolvency after failing to meet debt obligations. The restructuring plan, which included a trust-based solution, was rejected by Austrian courts. Eventually, the assets were put into liquidation.

Bondholders faced significant losses, with some bonds now trading below 10 cents on the euro. The case highlights how complex and uncertain restructurings can be.

Note: Past performance is not a reliable indicator of future performance.

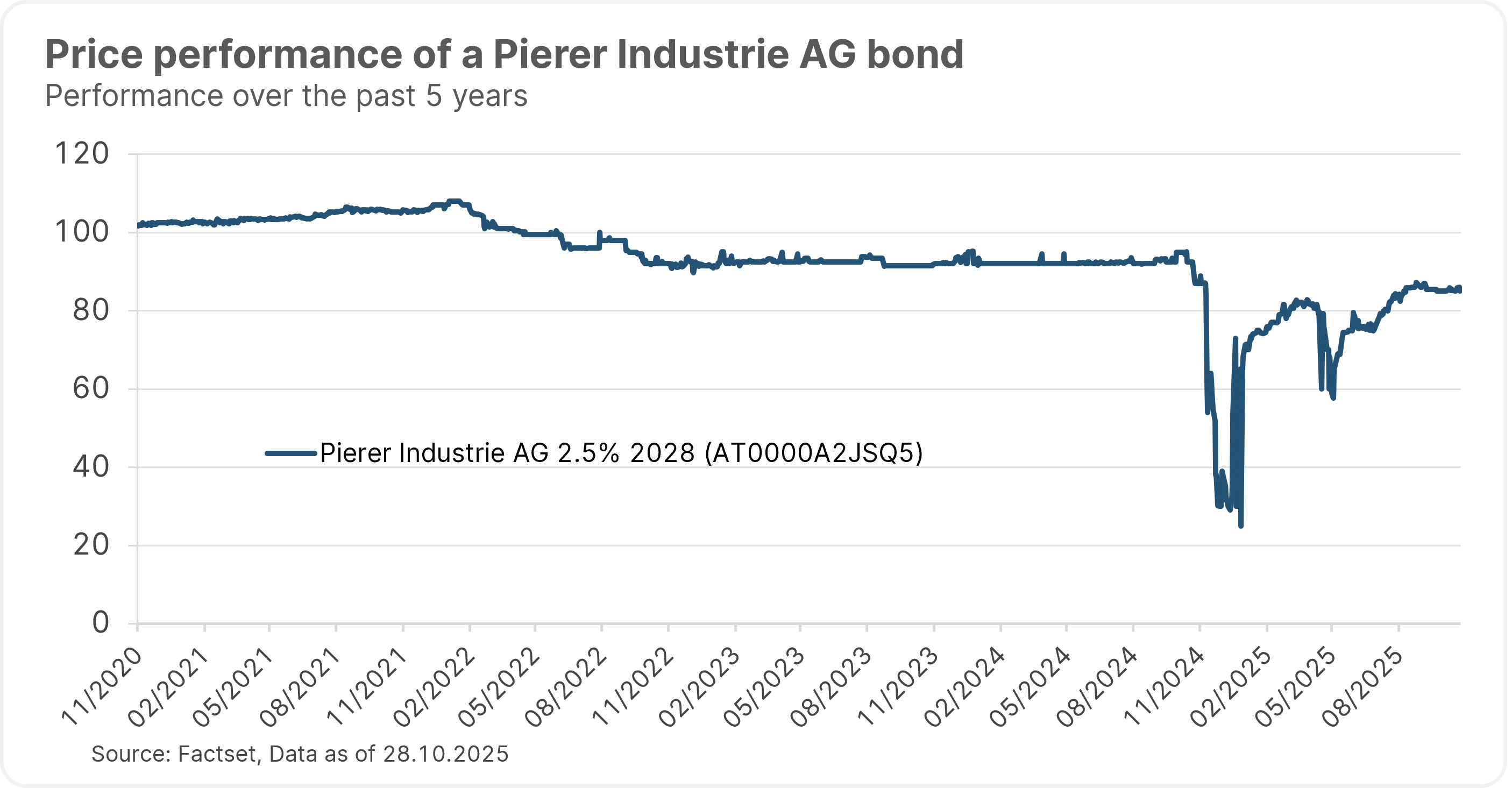

Case study 2: Pierer Mobility/KTM – A Structured Recovery

In contrast, Pierer Mobility, the parent of KTM, took a proactive approach. Facing over €2 billion in debt, KTM entered court-supervised restructuring in late 2024. Creditors approved a plan to repay 30% of claims by May 2025, supported by fresh capital of €800 million. Production was paused but resumed in March 2025, and the company avoided liquidation.

Pierer Industrie AG, the holding company that sits on top of Pierer Mobility, avoided insolvency through a pre-insolvency restructuring under Austria’s new EU-aligned framework, with creditors agreeing to a full repayment of claims over an extended timeline through 2027.

The outstanding bond of Pierer Industrie AG that matures in 2028 quickly recovered most of its loss, showing that early action and transparent communication can lead to better outcomes.

Note: Past performance is not a reliable indicator of future performance.

Main takeaways

For investors in high-yield corporate bond funds it’s important to understand that defaults are part of the investment landscape, but they rarely result in a total loss. The outcome depends heavily on the restructuring path taken and the seniority of the bond within the capital structure. Legal frameworks vary across countries, influencing recovery rates and timelines. Even in the event of a default or restructuring, corporate bonds are usually still tradable and therefore liquid.

Crucially, high-yield bonds compensate for their elevated risk through higher credit spreads and yields, offering attractive returns compared to investment-grade bonds. However, this reward comes with volatility and complexity. That’s why an active investment approach – involving careful issuer selection, ongoing credit monitoring, and timely portfolio adjustments – is essential. It helps avoid defaults, seize restructuring opportunities, and ultimately improve fund performance. Additionally, diversification within the fund helps cushion the impact of individual defaults, ensuring more stable outcomes for investors.

Invest broadly in high-yield bonds

The ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD bond fund allows investors to invest primarily and broadly in high-yield corporate bonds. As part of a holistic ESG approach, environmental, social, and corporate governance factors are integrated into the fund’s investment process.

👉 Read more

Note: Please note that investing in securities also involves risks besides the opportunities described.

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.