“The news of my death is greatly exaggerated” – this famous quote from Mark Twain can also be applied to the current situation in the emerging markets. Since the looming (or at least possible) election victory of Donald Trump in the US presidential elections last year, there has been noticeable pressure on growth forecasts in these regions. However, a look back at the year to date in the global emerging markets shows that the feared dip in growth has failed to materialize.

The year of tariffs

Memories of President Trump’s first term in office came back into focus, which was characterized by a comprehensive trade war with the most important industrial nations under the motto “America First”.

This issue was dealt with even more intensively by the Trump administration after he took office in January 2025 and de facto covered all countries worldwide with more or less high tariffs. Trade agreements or at least declarations of intent were subsequently concluded with some trading partners.

But even after “Liberation Day” on April 2, 2025, US tariff policy remained volatile, with recent threats of higher tariffs on pharmaceutical products and pasta from the European Union, among other things, and another threat of generally high tariffs on China.

Emerging markets surprisingly resilient to US trade policy

In macroeconomic terms, these tariffs were expected to act as a significant brake on growth in the emerging markets. As a result, GDP forecasts were adjusted downwards. Fortunately, however, the historian Eugen Rosenstock-Huessy’s quote that “announced revolutions do not take place” can be relied upon here.

Fortunately, the feared slump in growth did not materialize – on the contrary, the emerging markets proved to be remarkably resilient to the disadvantageous US tariff policy! The growth forecast for 2025 was recently revised significantly upwards.

There are currently several reasons given for this positive – yet surprising – development:

- Due to the threat of tariffs, purchases in the USA were brought forward in many cases. This led to correspondingly higher exports (and higher GDP) in the first quarter of 2025, particularly in Asia.

- The weaker US dollar since the beginning of the year has led to improved financing conditions in the emerging markets. Due to low inflation, the respective central banks were able to lower their key interest rates and thus support growth.

Note: Past performance is not a reliable indicator of future performance.

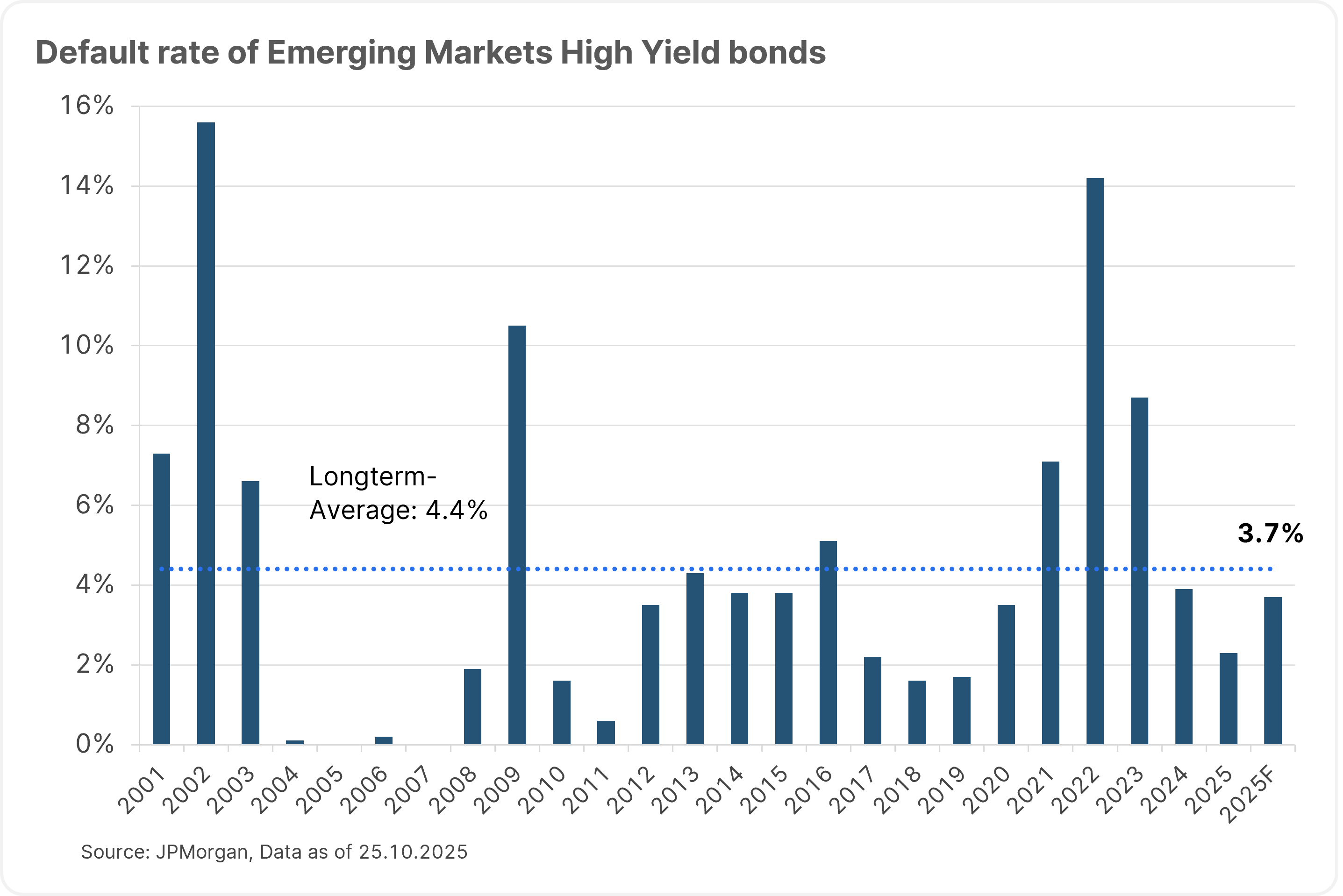

The improved financing conditions also resulted in lower defaults on high-yield corporate bonds in emerging markets. This refers to bonds issued by companies with a lower rating. These companies have a lower credit rating, which means that they also have a higher risk. In return, these bonds generally offer a higher interest rate.

At the end of September, 2.3% of bonds had defaulted this year, while the US investment bank JPMorgan expects an increase of 0.5% to a total of 2.8%. This is well below the previous annual forecast of 3.7% and the long-term average of 4.4%.

- The advantageous composition of exports in Asia must also be taken into account. The current AI boom and other technological developments are leading to strong demand for these products there. Also noteworthy in this context is the potentially sustainable production advantage that Chinese companies in particular have recently gained. As the NY Times recently reported, more robotics capacity has been installed in production in China in the past 5 years than in the rest of the world combined!

- The lower oil price (currently around 20% below the average for 2024) is also very positive for importing countries.

Emerging markets among the top performers

What is striking about the emerging markets, however, is the continuing difference between the emerging markets in Asia and Europe (with Latin America between these two poles).

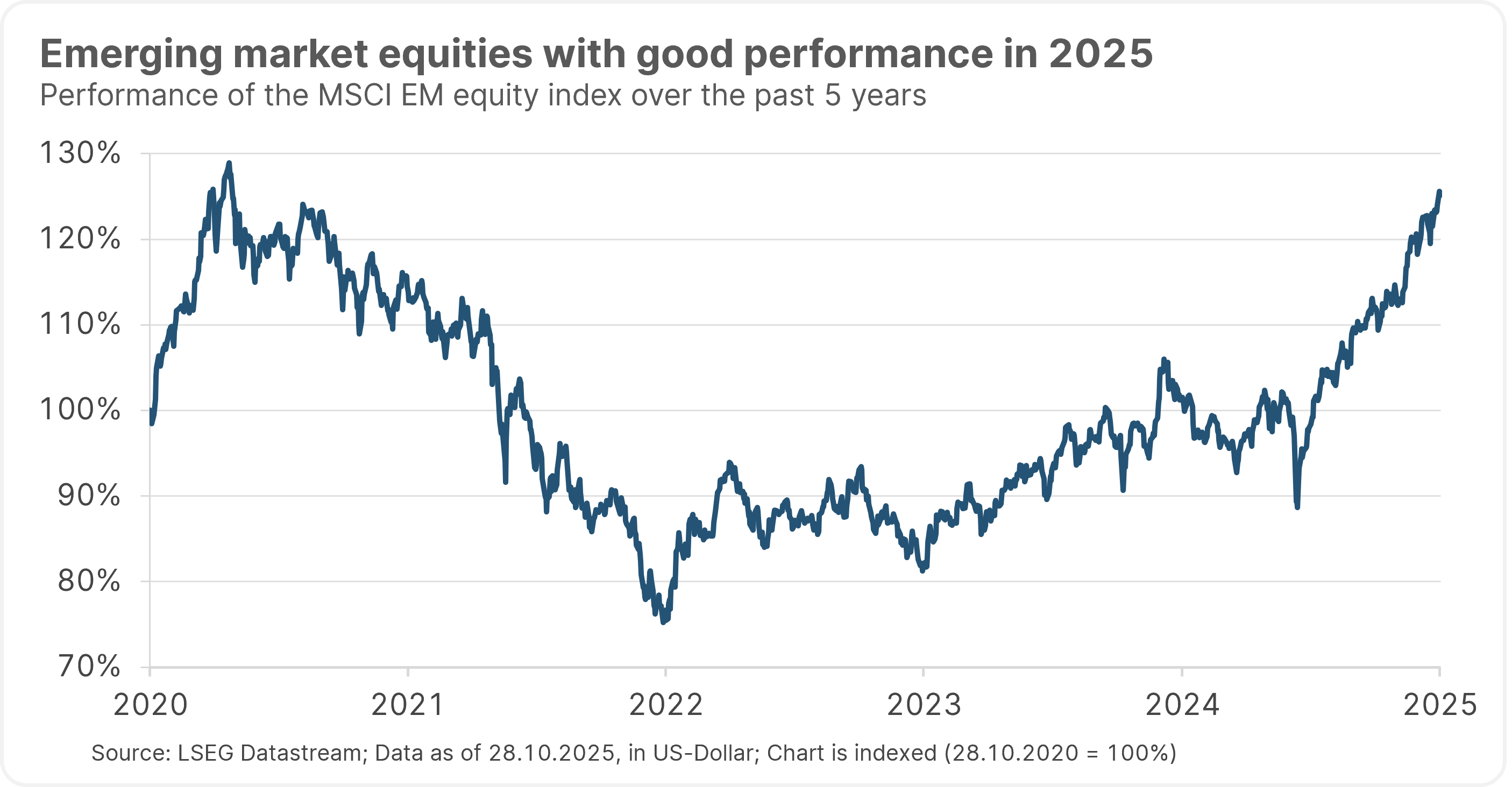

The markets are also taking note of the positive development this year and have triggered a rally on the global emerging markets equity markets: since the beginning of the year, the MSCI EM – a global emerging markets equity index – has risen by around USD 1.5 billion. 24%. This is the highest annual increase since 2009. In comparison, the MSCI World, which tracks the performance of shares in global industrialized countries, has risen by 15% in the year to date. Emerging market bonds in local currency also recorded the highest price increase since 2016.

Note: Past performance is not a reliable indicator of future performance. Investments in securities entail risks as well as opportunities.

Conclusion

Despite the political uncertainties and the tightened US tariff policy, the feared negative effects on the emerging markets have so far failed to materialize. Even though growth in the global emerging markets is currently expected to be lower in 2026 than this year, the trend can still be described as clearly positive.

Above all, the resilience of this asset class to significantly negative external events allows us to look to the future with optimism. Investors can therefore remain optimistic about the emerging markets, as recent developments show that these regions offer opportunities even in challenging times.

Investing in Emerging Markets

Interested and risk-aware investors can invest in shares of leading companies from global emerging markets with the ERSTE STOCK EM GLOBAL equity fund, including globally active corporations such as chip manufacturer Taiwan Semiconductors and Chinese internet group Tencent. In addition, the ERSTE STOCK EUROPE EMERGING fund also invests in emerging market equities, but with a focus on European companies.

On the bond side, investors can invest in government bonds from the emerging market segment with the ERSTE BOND EM GOVERNMENT fund. The bond fund ERSTE RESPONSIBLE BOND EM GOVERNMENT focuses on corporate bonds from emerging markets and takes environmental and social factors as well as aspects of corporate governance into account when investing.

Note: The companies listed here have been selected as examples and do not constitute investment recommendations. Investments in securities involve both opportunities and risks.

Risk notes ERSTE STOCK EM GLOBAL

The fund employs an active investment policy. The assets are selected on a discretionary basis. The fund is oriented towards a benchmark (for licensing reasons, the specific naming of the index used is made in the prospectus (12.) or KID “Ziele”). The composition and performance of the fund can deviate substantially or entirely in a positive or negative direction from that of the benchmark over the short term or long term. The discretionary power of the Management Company is not limited.

Risk notes ERSTE STOCK EUROPE EMERGING

The fund employs an active investment policy. The assets are selected on a discretionary basis. The fund is oriented towards a benchmark (for licensing reasons, the specific naming of the index used is made in the prospectus (12.) or KID “Ziele”). The composition and performance of the fund can deviate substantially or entirely in a positive or negative direction from that of the benchmark over the short term or long term. The discretionary power of the Management Company is not limited.

Risk notes ERSTE BOND EM GOVERNMENT

The fund employs an active investment policy. The assets are selected on a discretionary basis. The fund is oriented towards a benchmark (for licensing reasons, the specific naming of the index used is made in the prospectus (12.) or KID “Ziele”). The composition and performance of the fund can deviate substantially or entirely in a positive or negative direction from that of the benchmark over the short term or long term. The discretionary power of the Management Company is not limited.

Risk notes ERSTE RESPONSIBLE BOND EM CORPORATE

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE BOND EM CORPORATE as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE BOND EM CORPORATE, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE BOND EM CORPORATE as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.