Even though there is often talk of a “blue planet”, water is becoming an increasingly scarce commodity in some parts of the world. Climate change is altering the availability, distribution and quality of water. While water scarcity seemed to be a foreign concept in Europe for a long time, a number of headlines in recent years have made it clear that dry periods and droughts are becoming more frequent in this country too – as are other extremes such as heavy rainfall events and flooding.

This also poses new challenges for the economy, individual companies and therefore the financial markets. After all, water is an important production and therefore success factor in many industries. How are companies dealing with the increasing water risks and how can investors invest in innovative solutions for the future? We explain this in this blog post.

Drought is also becoming more frequent in Europe

According to the United Nations World Water Report from 2023, around two billion people worldwide have no access to a safe drinking water supply – this corresponds to around a quarter of the world’s population. Experts expect the global water supply situation to become even more acute in the coming decades. The demand for clean water will continue to increase due to population growth, among other things. Over the past 40 years, global water consumption has risen by around one percent per year. According to the UN World Water Report, this increase is expected to continue at a similar rate until 2050.

It is not the volume of water per se that is the problem, as the amount of water available worldwide basically remains the same. What is changing, however, is the local and temporal distribution as well as the water quality. Global warming brings with it a crucial problem: rainfall is becoming less frequent, but more intense. Warmer air can also store more water. If the heavier rainfall then falls on parched soils, these can only absorb the water poorly.

The devastating damage that such heavy rainfall can cause was only seen last year with the floods of the century in parts of Austria. The total extent of the damage was estimated at around 1.3 billion euros. Around 700 companies were severely affected by the flooding.

The 2024 floods in eastern Austria caused damage amounting to around 1.3 billion euros. HELMUT FOHRINGER / APA / picturedesk.com

In other parts of Europe, however, a different extreme became a challenge over the course of the year: in Catalonia, for example, an emergency package had to be adopted in 2024 to drastically limit water consumption. The reason was the persistent drought – and not in midsummer, but in the winter month of February. Water scarcity is no longer just a problem in emerging countries, but is also prevalent in industrialized countries. In Las Vegas, the “Water Patrol” has been monitoring whether gardens are being watered without permission for several years now, and in California the water shortage exacerbated the forest fires at the beginning of the year – at times there was no water left to extinguish them.

However, the measures taken in Catalonia did not only affect private households. Industry and agriculture had to reduce their irrigation by up to 80%. The availability of water, a raw material that many people almost take for granted, can also become a risk factor for companies in an emergency and lead to rising costs and delays in production.

The underestimated economic factor

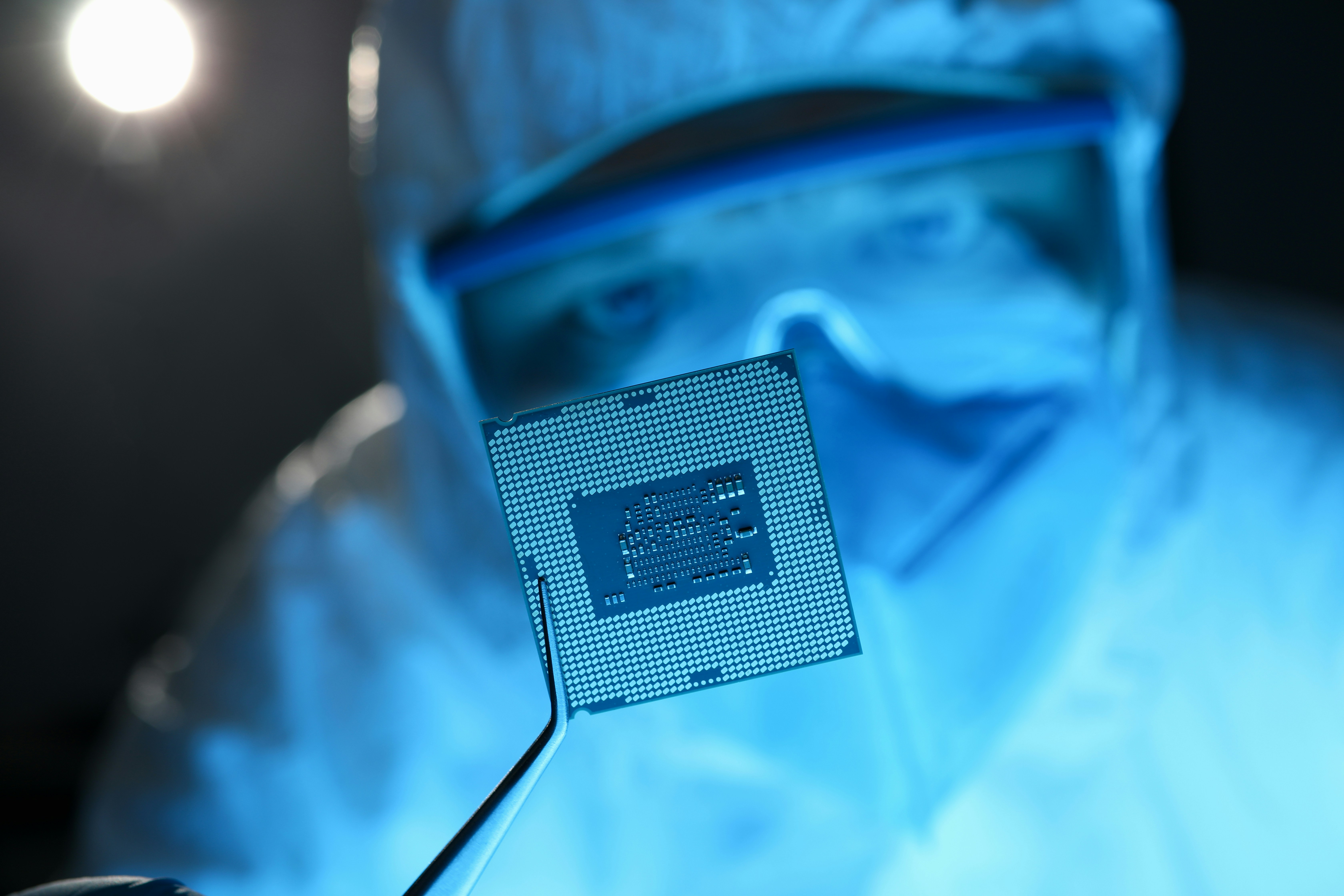

Water is an important factor in production in many industries – even in those where one would not necessarily expect high water consumption in the first instance, for example in the manufacture of chips and processors. It takes several thousand liters of water to produce wafers. This refers to the wafers on which the semiconductors are produced. In addition, the chip industry requires very special water for production, so-called ultrapure water. Tap water has to be purified at great expense for this. More efficient methods are already being used to produce ultrapure water and recycled water is sometimes used. Nevertheless, the high water consumption for chip production still poses a challenge in some regions.

In Germany, the US chip company Intel could become the largest industrial water consumer in the state with its planned plant in Saxony-Anhalt. Official estimates from the state assume that the plant will consume around 18,000 cubic meters of water every day. Extrapolated over the year, this would be a water consumption of 6.5 million cubic meters.

Large quantities of water are required for the production of semiconductors. © unsplash.com

Many companies have recognized the immense importance of water for their business and are trying to manage their consumption efficiently. However, in order to develop sustainable concepts for reducing water consumption, companies first need to know how high this consumption actually is and to what extent they are exposed to potential risk factors.

The key indicator of how dependent a company is on clean water is its water footprint. This not only measures a company’s pure water consumption. The regional component – i.e. where a company needs water – is particularly important. For example, higher consumption in water-poor regions such as Spain, due to production facilities located there, has a greater impact than in water-rich regions such as Austria. The World Resources Institute’s risk classification provides an overview of which regions of the world are affected by water risks and to what extent. Here, a distinction is made between low (e.g. Austria in the Alps), medium (e.g. Germany) and high (e.g. Spain) stress regions.

The water footprint is also a good indicator for investors to analyze the extent to which their own portfolio could be affected by water risks. For our sustainable investment funds, we publish the water footprint on our website every year on World Water Day. The results show that a sustainable investment approach helps to reduce water risks in the portfolio. The global equity fund ERSTE RESPONSIBLE STOCK GLOBAL for example, has a much smaller water footprint than the global equity index MSCI World.

Note: Please note that investing in securities involves risks as well as opportunities.

How can the topic of water be covered from an investor’s perspective?

Looking at the water footprint of companies is one way. If you want to invest even more specifically in the topic of water and technologies as well as innovations in this area, you can do so via an impact fund such as ERSTE GREEN INVEST. One of the five investment themes of the equity fund is “water”. It therefore invests specifically in pioneers in the fields of water treatment and water management. As an impact fund, it aims to have a positive and measurable impact on the environment or society in addition to financial returns. The companies in the water sector in which the fund invests have recently supplied more than 13 million people with clean drinking water. You can find more information on the impact of the companies in the fund in the ERSTE GREEN INVEST impact folder on our website.

The US company Xylem, one of the largest and most important water management companies in the world, is currently one of the top positions in the fund. The company is a leader in the treatment of water and the removal of toxic chemicals. Xylem’s core business also includes the provision of process water (required, among other things, for further processing into ultrapure water for the semiconductor industry). But there are other exciting companies from the water industry on the stock market.

Note: Please note that investing in securities involves risks as well as opportunities. The companies listed here have been selected as examples and do not constitute an investment recommendation.

Innovative companies for sustainable water management

- Kurita Water Industries

The Tokyo-based company manufactures water treatment systems and offers both the equipment for these as well as large and complex systems. Kurita places a strong focus on the purification of water and the provision of clean water.

- American Water Works

The company is one of the largest water suppliers in the USA and provides water for millions of households in over 20 states – this includes virtually the entire infrastructure relating to drinking water supply: Pipes, treatment, wastewater treatment plants, etc.

- Ecolab

Ecolab is active in several areas of the water industry. These include things like water treatment and smart metering. The US company has a market capitalization of just under 76 billion US dollars.

- Watts Water

The producer of water-related equipment is valued at around USD 8 billion on the stock exchange. The company’s products include all kinds of parts used in the construction industry, such as valves, pumps and pipes. New buildings account for 40% of the business, with the majority of sales coming from the REplace & REpair segment.

- Pentair

The Irish conglomerate’s business is divided into three main segments: Flow Control, Drinking Water and Pools. The former includes the production of pumps and components for irrigation and wastewater systems. The drinking water segment produces systems for the filtration of water for private households and industry. The third segment, as the name suggests, comprises the manufacture of components for swimming pools.

- Industry De Nora

The Italian company is active in several business sectors, including green hydrogen. The water management sector accounts for around a third of its business. The company specializes in the disinfection and filtration of water for industry and wastewater treatment plants. It also manufactures system components for the pool sector.

Conclusion: Water as an underestimated economic factor and forward-looking investment theme

Water is also increasingly becoming a critical production factor for companies. Climate change is not only altering the availability, but also the quality and distribution of this vital resource. Companies worldwide – from agriculture to the high-tech industry – are faced with the challenge of managing their water consumption efficiently and protecting themselves against water risks.

A key tool for the economy is the water footprint – it reflects the extent to which companies are exposed to water risks and therefore also offers investors a good indicator for assessing the risk of their portfolio. At the same time, impact funds such as the ERSTE GREEN INVEST enable targeted investments in companies that contribute to water treatment and supply with innovative solutions.

Note: Please note that investing in securities involves risks as well as opportunities.

Risk notes ERSTE RESPONSIBLE STOCK GLOBAL

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK GLOBAL as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK GLOBAL, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK GLOBAL as described in the Fund Documents.

Risk notes ERSTE GREEN INVEST

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE GREEN INVEST as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE GREEN INVEST, consideration should be given to any characteristics or objectives of the ERSTE GREEN INVEST as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.