As the main proxy season is drawing to a close, this year’s Annual General Meetings (AGMs), at which we also exercised our voting rights, were once again the scene of diverging negotiations about old and new environmental and social issues, as well as about the consideration of environmental and social issues in investment strategies in general and with regard to fundamental shareholder rights.

Anti-woke shareholder motions received limited support

The first analyses from our proxy partner, ISS, have been available for the US market since April. They inform us that the number of motions with environmental and social issues continues to rise, or at the very least is not decreasing. The reason for the rapid rise in 2023 was the changes to an SEC regulation that made it more difficult for companies to withhold motions. The change resulted in a maximum of 643 motions being submitted in 2023, of which 372 were put to the vote. Similar figures are expected for 2024.

Climate issues will also dominate in 2024, as will DEI (diversity, equity, and inclusion) and corporate lobbying activities. For the first time, however, there was also a focus on the pricing and accessibility of medicines, reproductive health, artificial intelligence, and biodiversity. For some time now, we have also noticed so-called “counter motions” in our analyses. These can also be assigned to environmental or social issues but take a partially opposing angle: they are “anti-ESG” or “anti-woke” motions, which were also put to the vote in 2024. These motions take a sceptical stance towards important E and S issues, such as climate protection or diversity, either in general or when it comes to proposed solutions.

An evaluation of Teneo’s “CEO and Investor survey”, which analysed the voting results of 500 S&P companies for the period January-May 2023 and 2024, showed that while “anti-ESG” motions increased in number, the average support was only 1.9% (2% in the previous year). According to the results of the study, the arguments of the anti-ESG factions, in conjunction with the latest regulatory initiatives in this regard, appear to have little resonance with large institutional investors.

Is ESG a fiduciary duty?

And what about general support for environmental and social issues? After they received less support on the US market in 2023, the question remains as to whether this trend will continue to the same extent in 2024. Initial estimates by the Sustainable Investment Institute in April 2024 suggested that that larger investment houses would likely continue withdrawing their support. A crucial part of the debate revolves around investment strategies and the fiduciary obligation/necessity to take social or environmental aspects into account. The global context in terms of conflicts that drive up energy prices etc., is also part of the discussion and has led to various legal disputes: generally speaking, anti-ESG parties have questioned whether shareholder motions should/may continue to be tabled.

Exxon Mobil, for example, sued investors for submitting a climate motion. After the proposal was ultimately withdrawn, Exxon Mobil continued its efforts to prevent such actions in the future.

The case of TotalEnergies is similar: the French oil and gas company’s request was to split the roles of CEO and chairman of the executive board in order to accelerate the transition away from fossil fuels. “Separating the roles could improve dialogue with the board…. on climate change issues and ensure a better balance of power at a time when many investors believe TotalEnergies’ transition strategy is not ambitious enough,” the motion said, according to Reuters. In the end, the motion could not be put to a vote in this case either.

Erste AM stands up for fundamental shareholder rights

As Erste Asset Management, we have positioned ourselves against all attempts to restrict fundamental shareholder rights and to prevent shareholder-demanded votes that seek to align companies more closely with the Paris climate goals.

We are opposing these endeavours, on the one hand as a co-signatory of an open letter to the United States Securities and Exchange Commission (SEC). On the other hand, in the case of TotalEnergies, by supporting an emergency petition before the French Commercial Court. (For a more detailed explanation of our involvement with Total Energies, please see the blog post by Nadja Othman and Varvara Shershneva)

We also continue to pursue the goal of supporting environmental and social issues through our voting behaviour: as of 12 June 2024, we had already exercised our voting rights at almost 500 companies and supported 41 motions from the environmental area, 141 motions from the social area, and 64 motions that could be allocated to both areas.

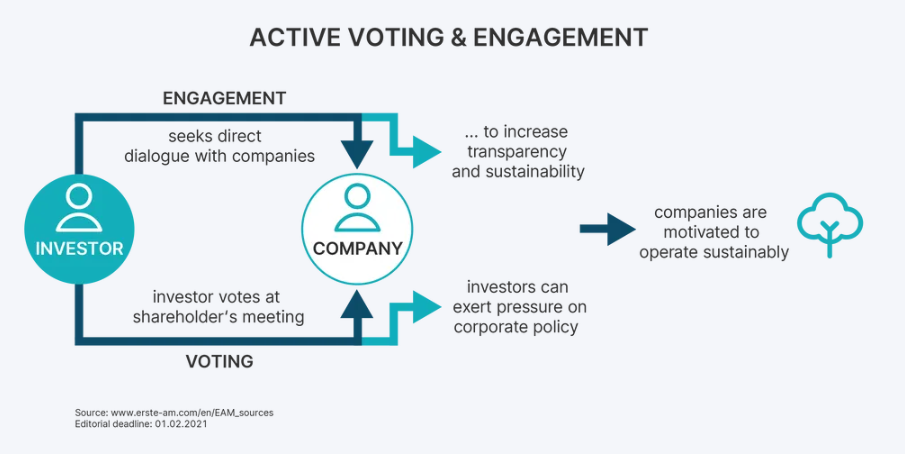

Actively exercising our voting rights is a key instrument for encouraging companies to engage in sustainable business practice. Detailed information on our voting behaviour at Annual General Meetings in the previous year can be found in our Engagement & Voting Report 2023.

Biodiversity is also a topic at AGMs

Since 2023, we have increasingly supported shareholder proposals to protect biodiversity and the services provided by important ecosystems in accordance with the corresponding optimisation of our voting rights guidelines.

At this year’s PepsiCo Annual General Meeting, for example, we called for an assessment of the company’s dependence on biodiversity and the publication of a corresponding report. This primarily concerned the company’s supply chains. The motion states that the loss of biodiversity is a global, systemic risk and that the food and beverage industry in particular is dependent on natural services for USD 1.4 trillion in added value. Failure to assess this risk could pose a significant risk to the sector. More reporting requirements can also be expected from the regulatory front (source: ISS).

As Erste Asset Management, we have decided to recommend reporting in accordance with TNFD (Taskforce on Nature-related Financial Disclosure) standards for our investments with a focus on biodiversity. The content should be aligned with the Kunming-Montreal Global Biodiversity Framework (GBF), whose goal it is to halt the loss of biodiversity by 2030. 320 companies have already undertaken to report according to these standards. The shareholder motion would like to see PepsiCo as part of this, which we supported. (For more information on our commitments on this topic, see Varvara Shershneva’s blog post).

The desire for TNFD standards was also expressed at this year’s Home Depot AGM. As the world’s largest retailer of home improvement products, the company is exposed to risks related to deforestation in addition to its dependence on biodiversity. The company’s products could also contribute to a loss in biodiversity, which should be recognised and improved (source: ISS).

World Ocean Day: increasing levels of plastic contamination

Finally, we should also wish to mention the global challenge of plastic pollution and its negative impact on biodiversity. On 8 June, World Ocean Day was celebrated again. The oceans are home to 80% of global biodiversity and are burdened by ongoing plastic contamination.

About three quarters of the waste in the oceans consists of plastic. Or in specific figures, 4.8-12.7 million tonnes of plastic end up in the oceans every year, as reported by WWF Germany. UNEP FI also warns that around half of the plastic produced is intended for single use.

How the use of plastic can be reduced was also addressed by shareholders at Amazon this year: the company’s plastic footprint should be reduced, and a target should be set to ensure that packaging was recyclable, reusable, or compostable by 2025. For Amazon, contributing to global plastic pollution would result in risks, both of a financial and an operational nature, when it comes to the company’s reputation. The corresponding motion explained that companies could be held accountable by governments for paying for their waste. This in turn could result in costs totalling around USD 100bn (source: ISS).

This article is part of the July 2024 issue of our ESGenius Letter. All other articles in this issue, as well as previous versions of our sustainability publication ESGenius Letter, can be found on our website.

👉 Read now

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.