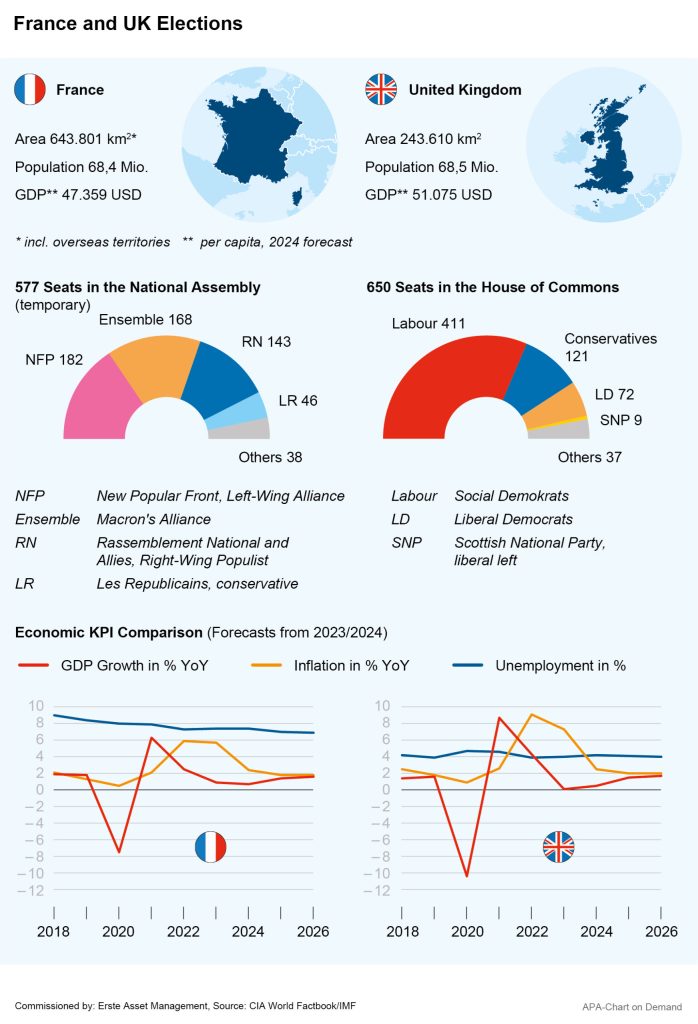

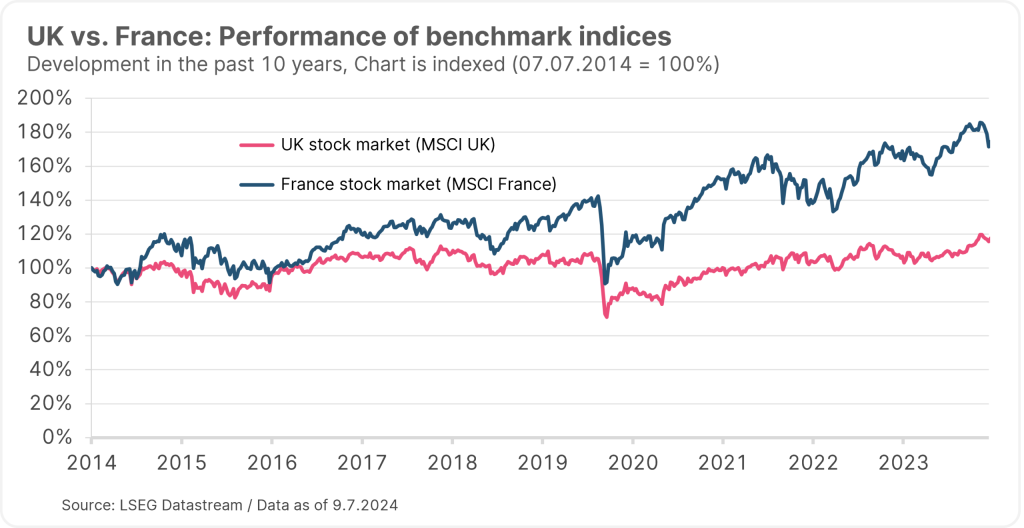

The recent elections in France and the UK have brought about a shift of the political power structures in both countries, and thus also a new start for economic policy in their respective economies. However, while the British Labour Party wants to get started as quickly as possible with measures to boost the economy after its landslide victory, the formation of a government in France could initially prove difficult after the surprising victory of the left-wing opposition alliance, New Popular Front (NFP).

Note: Past performance is not a reliable indicator of future performance.

The alliance led by left-wing populist Jean-Luc Mélenchon won 182 of the 589 seats in the National Assembly, putting it ahead of the presidential alliance Ensemble with 168 seats and the right-wing populists of Marine Le Pen with 143 seats. The victorious left-wing alliance immediately claimed the right to form a government. However, despite its victory, the left-wing alliance is still a long way from having a majority in the new National Assembly.

Government formation in France could prove challenging

In theory, the party could govern the country with a relative majority, but experts warn that this could prove difficult. A coalition of the NFP with “centrist” parties is technically possible, but the NFP has already rejected such an alliance. Differences are likely to arise here, among other things, on major economic policy issues.

The Popular Front wants to reverse the pension reform pushed through by President Emmanuel Macron, which raised the retirement age from 62 to 64. The election programme calls for a pension at 60. The pension reform was a key element of Macron’s term in office, and on this point in particular the positions are likely to be incompatible with those of the previous government.

The New Popular Front wants to focus on climate policy, planning to massively expand renewable energies in order to achieve climate neutrality by 2050. In addition, the Popular Front has made numerous and generous promises during the election campaign: an increase of the minimum wage from EUR 1,400 to EUR 1,600, automatic cost of living adjustment, the freezing of prices for energy, fuel and staple foods.

Left-wing alliance wants to finance measures with taxes, experts warn of higher deficits

The plan is to finance all of this through taxes: a reintroduced wealth tax, a climate levy and an increased inheritance tax for the wealthy. There will also be a new tax on “super profits”. “We will reach into the pockets of those who can afford it,” said Socialist leader Olivier Faure.

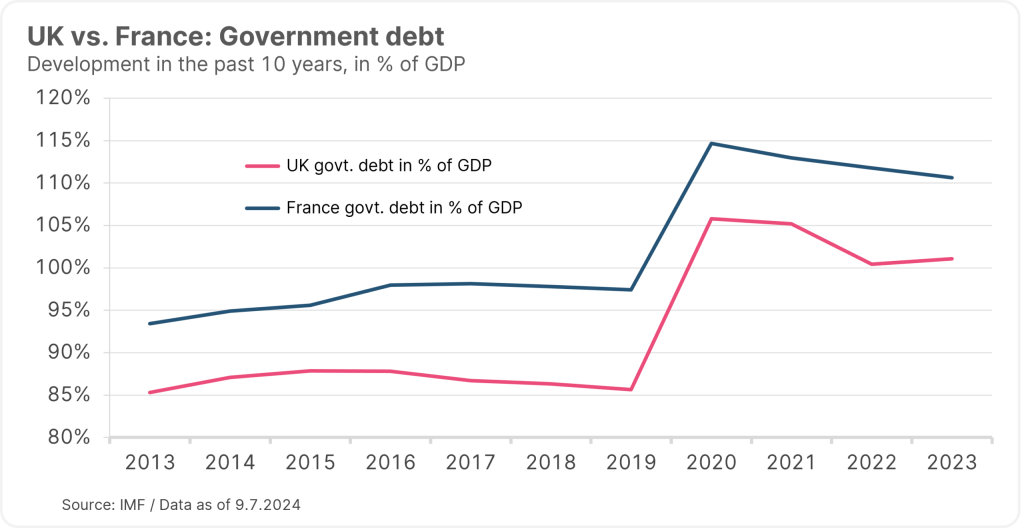

Economists have already warned that tax increases will not be enough to finance the planned measures. The high-spending programmes could also lead to a further increase in France’s debt. The Popular Front has already announced that it wants to abolish the EU’s debt limits.

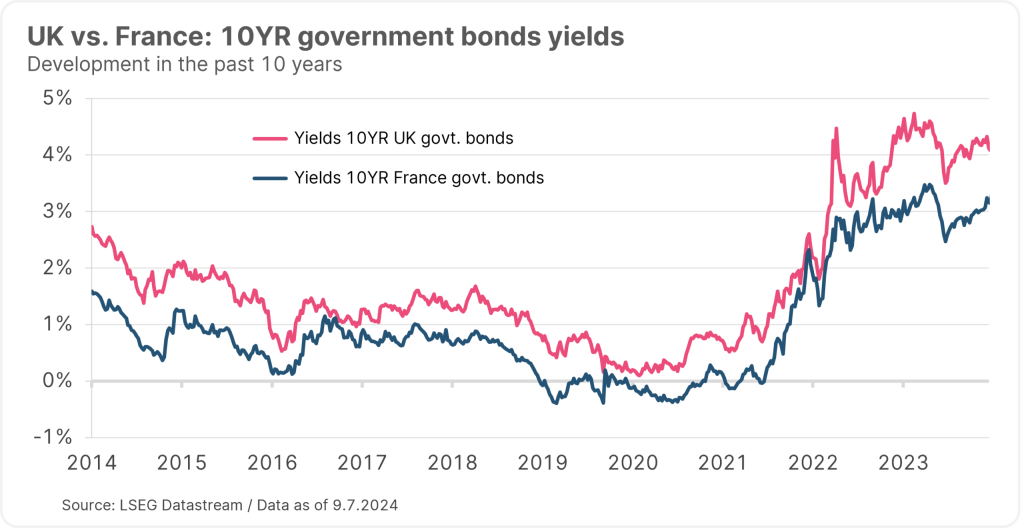

In the financial markets, fears of a high budget deficit in the event of a victory for the far left or right in France had already led to a rise in risk premiums for French government bonds in the run-up to the elections. However, the election result itself did not initially have any major impact on the markets.

Note: Past performance is not a reliable indicator of future performance.

Labour party plans quick restart for British economy

The UK also faces a change of course following the landslide victory of the social democratic Labour Party. The Labour Party won by a large margin against the previously ruling Conservatives, putting it back in power for the first time in 14 years. Labour won 412 seats in the election, 210 more than in the last vote. The Conservatives lost 244 seats and, with 121 seats, are left with the worst result in their history.

Experts explain the crash with the dissatisfaction of voters with high living costs, ailing public institutions such as the NHS and high taxes. The tax burden is higher than it has been since the end of the Second World War. Net debt is almost equivalent to annual economic output, and shortly before the elections, the UKs national debt rose to its highest level in over 60 years. The standard of living has been stagnating for many years and is now likely even declining.

The new Prime Minister and Labour Party leader Keir Starmer has now announced a “major restart” for the country after the election and has declared the quick stimulation of the economy to be his most important goal. The new Chancellor of the Exchequer, Rachel Reeves, also wants to move quickly: “We have no time to lose,” said Reeves, who previously worked as an economist at the Bank of England.

However, both implored the British people to be patient. “Im not promising you that it will be easy,” said Starmer, “changing a country is not like flicking a switch.” Reeves also warned against exaggerated expectations: “We know that we can’t turn things around overnight. We are facing a difficult legacy.”

Growth planned to fund public investment without tax increases

The new government now wants to boost economic growth so that, as promised in the election campaign, higher spending on public services can be financed without increasing taxes or further increasing national debt. Starmer announced that under Labour, the UK would achieve the strongest sustainable growth among the G7 countries.

To get the economy moving again, the first steps will be to remove blockades on important infrastructure projects and private investments and to make it easier to obtain the necessary permits. Reeves also wants to bring back those investors who turned their backs on the UK after the Brexit vote in 2016. “In an uncertain world, the UK is a place where you can do business,” said the Chancellor of the Exchequer, promoting her country.

The new government is also focused on promoting green energy generation, planning to double onshore wind energy, triple solar energy and quadruple offshore wind energy by 2030. The government wants to significantly speed up the planning approvals for these projects. In addition, GBP 8.3bn is to be invested in the state-owned company Great British Energy, which is yet to be established.

Stronger relations with the EU planned, but Brexit reversal ruled out

Another focus point is a new start of the relations with Europe. Here too, the new government wants to move quickly, with the new Foreign Secretary David Lammy making his first visit to Germany just 48 hours after the election. In particular, Lammy wants to improve trade relations with the EU.

The UK and the EU have the same food standards, said the new Trade Minister Jonathan Reynolds in an interview with Sky News. “If we can sell more whisky and salmon in a market that is so important to us, we should explore such opportunities.”

Reynolds blamed the previous Conservative government in particular for problems in bilateral trade. EU diplomats and German business representatives also criticised the stubbornness of the ousted government. Reynolds now hinted at “reasonable and pragmatic” solutions, such as mutual recognition of professional qualifications or visa rules for artists and musicians. The new foreign minister, Lammy, also hinted at a security pact between the UK and the EU to deepen relations. This could cover topics such as defence, energy and climate.

However, the new government has ruled out reversing Brexit and rejoining the EU. “We will not rejoin the single market or the customs union, but there is much we can do together,” said Lammy.

British economy with slight recovery from recession

Current economic data is supporting the new British government. The UK has recovered from a short recession, with GDP growing again by 0.7 per cent in Q1 of 2024. After a long period of high inflation, it fell back to the central bank’s 2 per cent target in May. Although sentiment in British companies has clouded over somewhat in June, it remains more positive than expected. The corresponding Purchasing Managers’ Index from S&P Global fell by 0.7 to 52.3 points, but remained above the 50-point mark signaling growth.

Note: Past performance is not a reliable indicator of future performance.

“The UK manufacturing sector is experiencing its strongest growth in more than two years, with production and new orders continuing to expand at rates similar to the recent highs in May,” wrote Rob Dobson, director at S&P Global Market. According to Dobson, growth is currently driven

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.