The stable share performance since the beginning of the year experienced a certain, limited setback from the end of March. This raises the question of whether such turning points in the market can be read off the data in advance. Obviously there are no one hundred percent indicators, but there are various approaches.

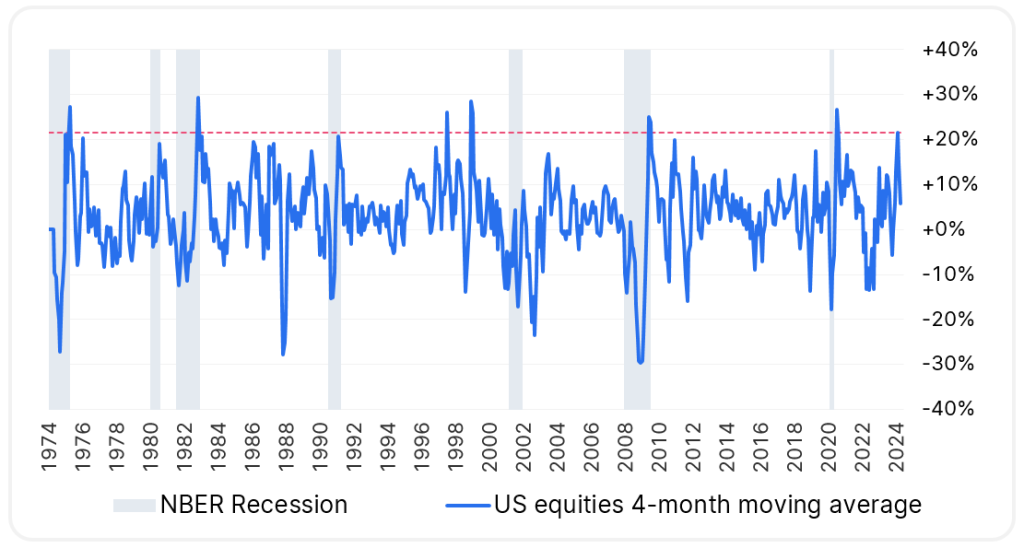

Momentum US equities

The markets have been momentum-driven since the beginning of the year. This means that prices have risen steadily without new, positive news constantly arriving. The disadvantage of momentum is that it tends to end unexpectedly and suddenly.

Momentum can be measured in different ways, e.g. using so-called autocorrelation. A “tangible” measure is the performance of the last 4 months. This shows that the 2024 momentum of the equity rally (the red line in the chart) reached a historical peak:

Note: Past performance is not a reliable indicator of future performance. Investments in securities entail risks in addition to the opportunities. Representation of an index, no direct investment possible.

Source: Bloomberg; Erste AM Multi_Asset_Chartbook; presentation of US Equities based on MSCI USA

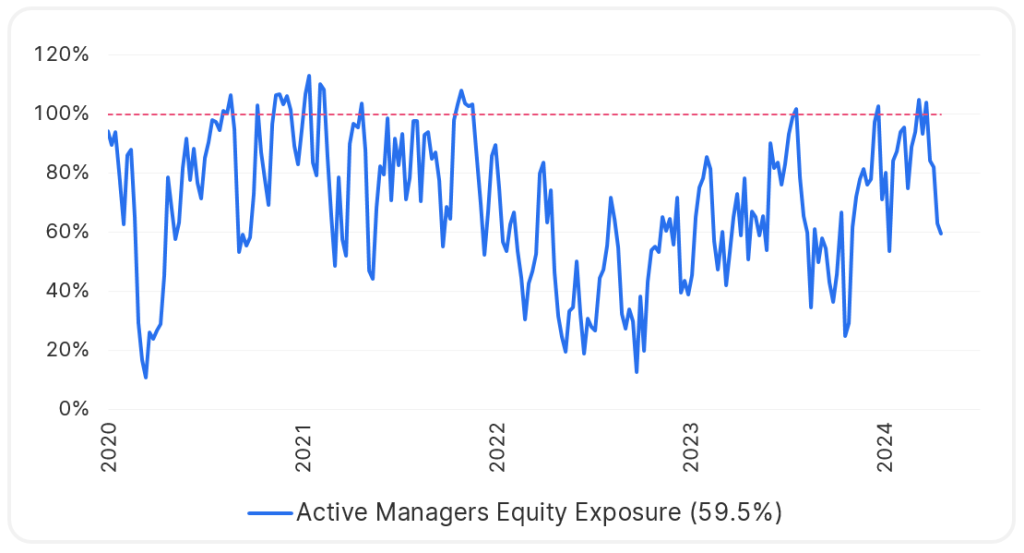

Equity share of active managers

A second measure is the equity exposure index of the market participants grouped in the Association of Active Investment Managers. The index basically has a range of 0-100% (plus leverage where applicable). If the index reaches 100% (the red line in the chart), the managers are already fully invested. This has not often been achieved in recent years. This can therefore be a further indicator of a turning point.

Note: Past performance is not a reliable indicator of future performance. Investments in securities entail risks in addition to the opportunities. Representation of an index, no direct investment possible.

Source: Bloomberg; Erste AM Multi_Asset_Chartbook

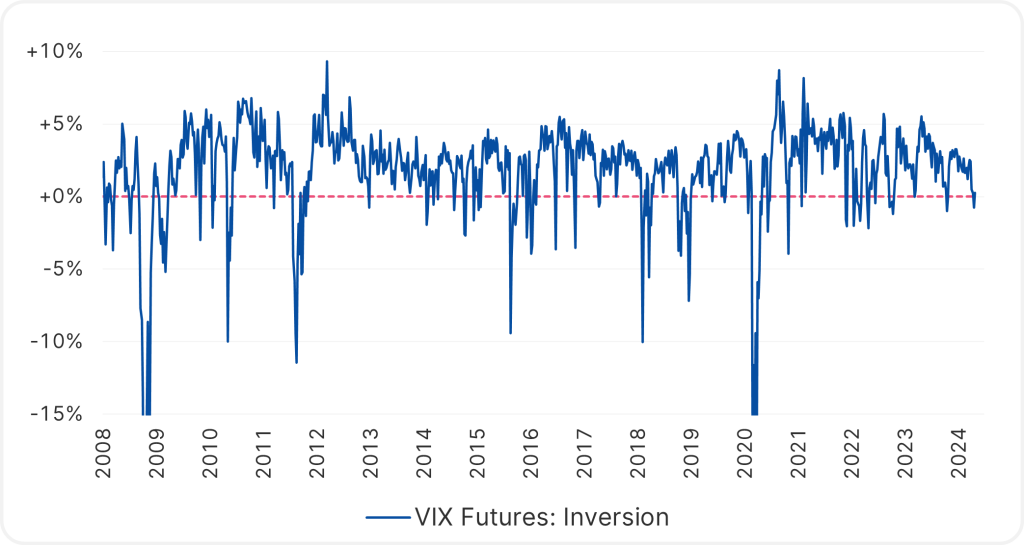

Inversion VIX futures

The so-called inversion of VIX futures is somewhat more complex. The VIX measures the volatility of the stock markets – a sharp rise in the VIX indicates a crisis. The VIX can be invested in via associated futures, which are available in various maturities.

An inversion occurs when the immediate future rises in price more than the next longest future – because this signals that volatility and “fear” are rising selectively and immediately. The following chart shows that this condition is fulfilled in April (the blue line crosses below the red line):

Note: Past performance is not a reliable indicator of future performance. Investments in securities entail risks in addition to the opportunities. Representation of an index, no direct investment possible.

Source: Bloomberg; Erste AM Multi_Asset_Chartbook

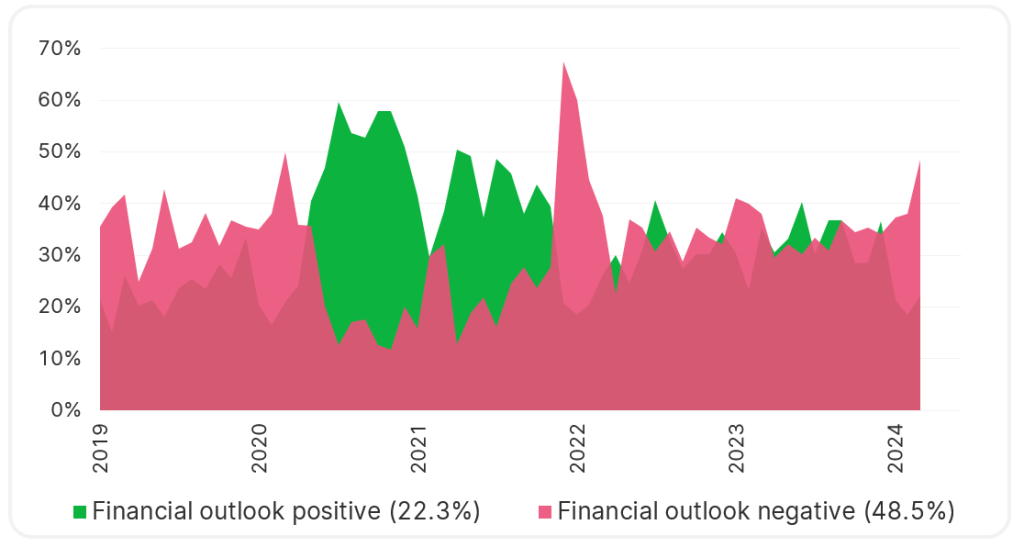

Financial outlook US companies

In the medium and long term, share prices are in line with corporate earnings and the earnings outlook. The following chart shows an evaluation that measures whether the outlook of companies currently going public has improved or deteriorated. Now “improvement” or “deterioration” is not an exact science, but the ratio may be meaningful. The ratio has worsened since around the beginning of the year (red area):

Source: Bloomberg; Erste AM Multi_Asset_Chartbook

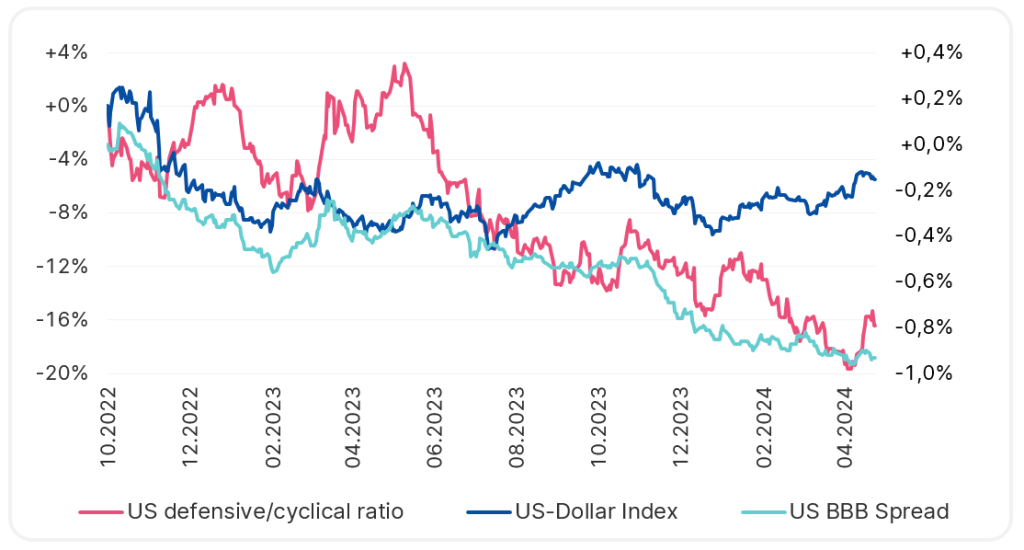

Cyclical indicators

Common short-term indicators can be used: The ratio of defensive to cyclical stocks (defensive stocks perform relatively better in a crisis); the US dollar (tends to show strength when equity markets are under pressure); and the credit risk premium on corporate bonds (US BBB spread). They are plotted on the following chart:

Note: Past performance is not a reliable indicator of future performance. Investments in securities entail risks in addition to the opportunities. Representation of an index, no direct investment possible.

Source: Bloomberg; Erste AM Multi_Asset_Chartbook

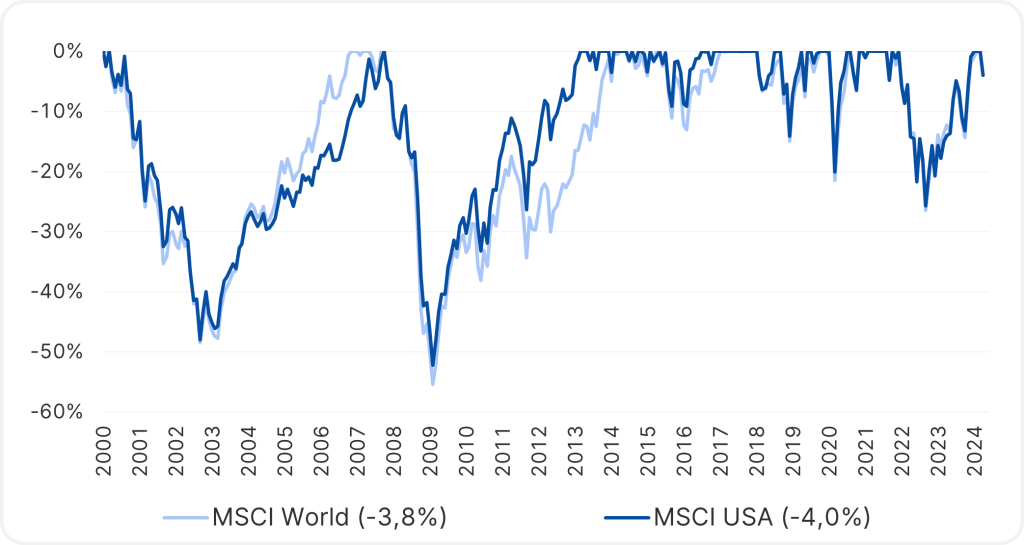

Loss phases for equities, monthly data

However, these values are more descriptive than predictive. Stress can be read, but not predicted.

Every losing phase in equities ends – ideally, the starting point would have been used for a reduction in order to take advantage of the opportunity for a re-entry. The following chart shows these drawdowns: massive loss phases such as those from 2000 onwards and the 2008 financial crisis alternate with more limited fluctuations. For “normal” drawdowns, a range of -10% to -20% may indicate a certain lower limit:

Note: Past performance is not a reliable indicator of future performance. Investments in securities entail risks in addition to the opportunities. Representation of an index, no direct investment possible.

Source: Bloomberg; Erste AM Multi_Asset_Chartbook

Conclusion

There are no completely reliable indicators for recognizing turning points on the stock markets in advance, but there are a number of charts that can provide clues.

Note: Please note that investing in securities involves risks as well as opportunities.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.