So far in the new year, the stock market has picked up where it left off in 2023. Several important indices have recently reached new record highs. What are the reasons for the positive sentiment, what could move the markets this year, and what about the much-cited Magnificent 7? Fund manager Tamás Menyhárt talks about this in an interview.

Note: Please note that an investment in securities entails risks in addition to the opportunities described. Prognoses are not a reliable indicator of future performance.

The broad equity market staged a remarkable rally at the end of 2023 that has continued in the year to date. What are the reasons?

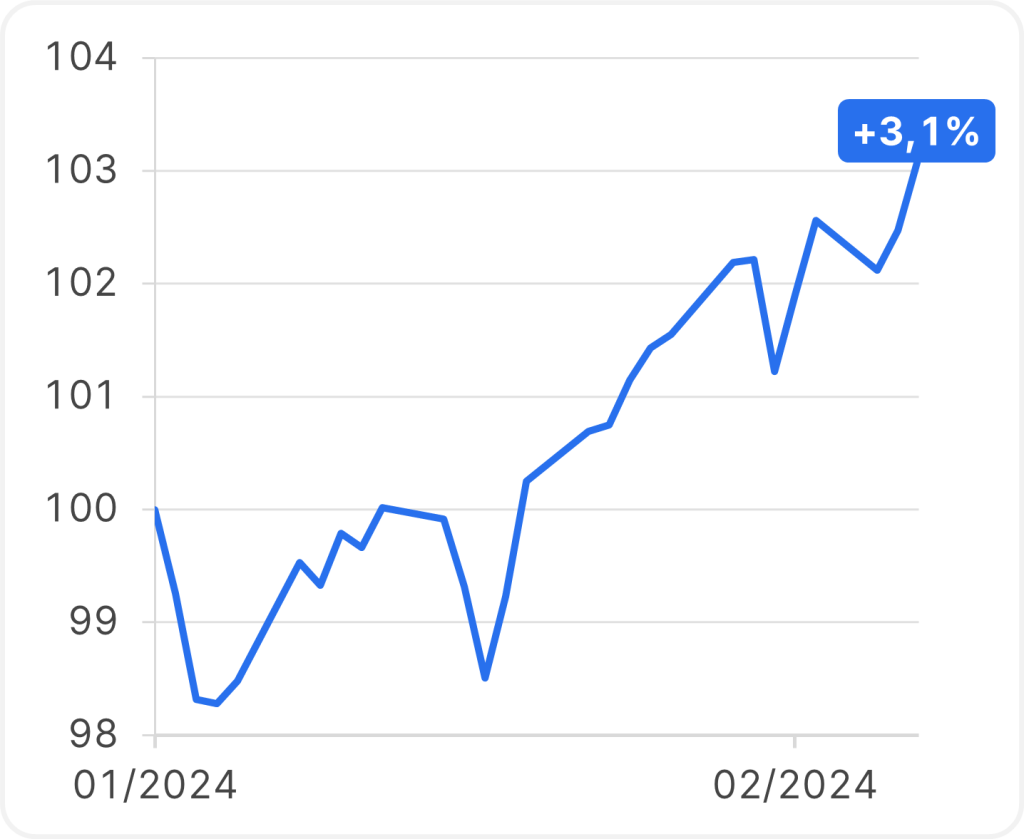

After a very strong finish to the year 2023, the developed market equity indices have continued their run upwards also in the current year. For the first time in over two years, the S&P 500 index set a new all-time high in January and currently trades at more than 3% above its previous high. The industrial-heavy Dow Jones index and the tech-heavy Nasdaq 100 also sit at record highs, and the same is true for the German DAX.

Note: Past performance is not a reliable indicator of future performance. Charts are indexed (5.2.2014 = 100), Source: LSEG Datastream, Data as of 8.2.2024. Representation of an index, no direct investment possible.

Performance MSCI World in US-Dollar

YTD and over the past 10 years

The drivers of the good performance remain pretty much unchanged vs. last year: elevated demand for AI-related products keeps pushing up prices of large cap shares such as Nvidia and Meta, and expectations of an easier monetary policy are supporting rather challenging valuations.

The ECB and the Fed are expected to cut interest rates this year. What is the market currently pricing in and how realistic are these expectations?

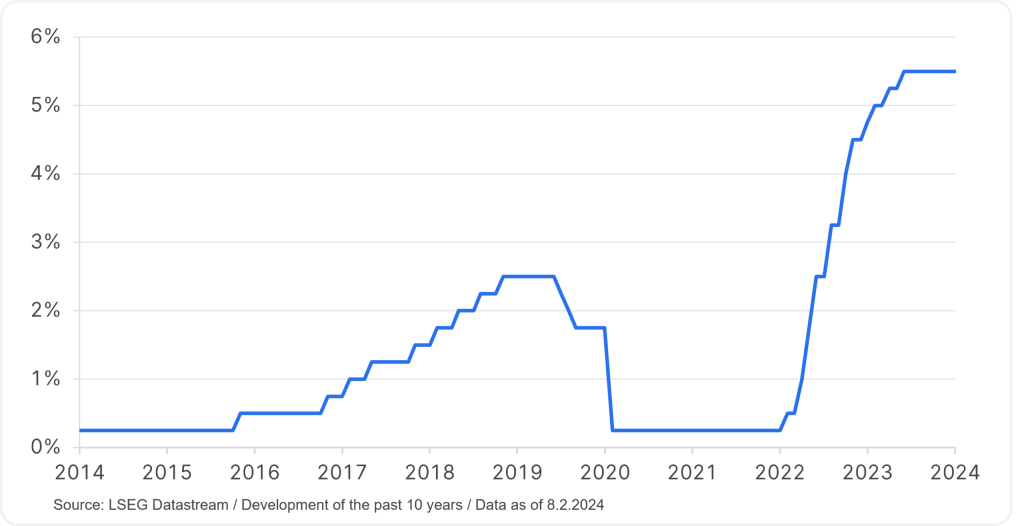

As inflation rates increased to levels not seen in decades, central banks all around the globe embarked on one of the most aggressive tightening cycles in history. The upper bound of the Fed funds rate currently stands at 5.5%, the highest since 2001. The ECB deposit rate is at 4%, an all-time high.

Tip: You can read more about what could happen with key interest rates in the latest blog post by Chief Economist Gerhard Winzer 👉 US key interest rates: What can we expect in the coming months?

Development Fed Funds Target Rate

Over the past 10 years

Inflation in both the US and the Eurozone has peaked in the second half of 2022, and has been on a declining path ever since. This has allowed central banks to pause rate hikes. Due to more encouraging inflation data as of late, the debate on the market has shifted towards the timing and magnitude of rate cuts. This shift has improved investor sentiment significantly and has led to a remarkable rise in indices like the MSCI World, which increased by almost 20% from the lows seen in October.

Market pricing regarding rate cut expectations has seen large swings since the start of the year. What has not changed, however, is that the market foresees more cuts to come than do the central banks. Currently, investors expect the Fed to first lower interest rates in June and to cut them at least five times this year, by 25 basis points (bps; i.e. 0.25 percentage points) each. Fed members, however, have only projected a median of three rate cuts for 2024. Similarly, market participants expect the first rate cut for the Eurozone to take place in June. And in this case also, it is expected that the ECB will reduce financing costs five times in total.

What scenarios for the global economy are currently possible and how would they affect the market?

Regarding the path of the economy, we can see three possible scenarios ahead of us. The first one is the so-called soft-landing or goldilocks scenario, in which central banks successfully pull off the combination of bringing down inflation without pushing the economy into a recession, allowing for a gradual decline in interest rates. Instead of a recession, economies would stick a “soft” landing, meaning that for a couple of quarters, growth would fall to below 1%. Currently, the market views this outcome as the most likely one, which explains why equities managed to rally even amid elevated bond yields.

The other two scenarios involve either a renewed uptick in inflation, which would diminish hopes for rate cuts and could even shift the debate towards a more aggressive monetary policy, or an hard landing of the economy, i.e. a significant recession which would hurt the economy and consumers, resulting in falling corporate profits. Clearly, at a time when equities are rather ambitiously valued (S&P 500 forward P/E of about 20x vs. a 5Y average of about 19x), none of these scenarios would bode well for the stock market.

AI was the market driver par excellence last year. Is there a chance that we will see something similar this year?

The market leaders that we saw in 2023 are identical to the market leaders in 2024 to date. Technology is the best-performing sector in Europe, having gained more than 30% in the previous year. In the USA, semiconductor shares are at the top of the performance list, a sector which roughly doubled in 2023. The top three performers in the Nasdaq 100, namely Nvidia, Meta and ASML, are all related to artificial intelligence. So, at this point, AI remains one of the most important market drivers, next to central banks and bond yields.

The Magnificent 7 companies (a group of strongly growing companies with high market caps, consisting of Nvidia, Google, Apple, Amazon, Microsoft, Tesla, and Meta) on average do not look extensively valued if you take their impressive projected growth rates into account. Over the last quarter, this group of equities have seen their earnings forecasts upgraded by analysts, whereas earnings expectations for other US shares have mostly been on a downward path.

Tamás Menyhárt

Fondsmanager

AI remains one of the most important market drivers, next to central banks and bond yields.

Q4 numbers have shown that in many cases, high expectations are warranted. The Dutch chipmaker ASML not only reported better-than-expected sales and profits, but also an order intake of EUR 9.2bn. That’s more than three times higher than in the quarter before. Meta`s share price surged by more than 20% on the day of its results. The company laid out its increasing focus on AI-related products and upped this year`s sales guidance well above market expectations.

Note: The companies listed here have been selected as examples and do not constitute an investment recommendation. Charts are indexed (5.2.2014 = 100), Source: LSEG Datastream, Data as of 8.2.2024. Representation of an index, no direct investment possible.

Performance Meta stock

Over the past 10 years

To sum up…

We currently find ourselves in a market which has rallied strongly amid improved risk sentiment, thanks to the anticipation of a more supportive monetary policy in the future and strong growth from AI-exposed companies with high market capitalisations. The low number of shares driving the performance is a risk to keep an eye on, as is the uncertainty regarding the inflation trajectory and central bank action. Nevertheless, if the soft-landing scenario turns out to be correct and corporate earnings don`t disappoint, investors could be in for another year of solid gains.

Tip ❗❕

You can invest in promising future technologies such as AI and cybersecurity with ERSTE STOCK TECHNO. Read more about the fund’s investment strategy and how you can invest here. Please note, however, that investing in securities involves risks as well as opportunities.

Risks and opportunities at a glance

Advantages for the investor

- Broad diversification in technology companies with little capital investment.

- Active stock selection based on fundamental criteria.

- Opportunities for attractive capital appreciation.

- The fund is suitable as an addition to an existing equity portfolio and is intended for long-term capital appreciation.

Risks to be considered

- The price of the funds can fluctuate considerably (high volatility).

- Due to the investment in foreign currencies, the net asset value in Euro can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. Please note that investing in securities also involves risks besides the opportunities described.

For further information on the sustainable focus of ERSTE STOCK TECHNO as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE STOCK TECHNO, consideration should be given to any characteristics or objectives of the ERSTE STOCK TECHNO as described in the Fund Documents.

Fancy more information about the stock markets? Here are more articles 👇

No Posts Found

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.