Nearly three thousand high-ranking representatives from the realms of politics, business and science came together again last week at the World Economic Forum (WEF) in Davos to discus global trends and risks at the five-day conference in the Swiss Alpine resort.

While one key topic was the geopolitical situation, in particular the war in Ukraine and the war between Israel and the radical Islamic organisation Hamas, concerns about AI, the climate crisis and economic and interest rate trends also dominated the talks.

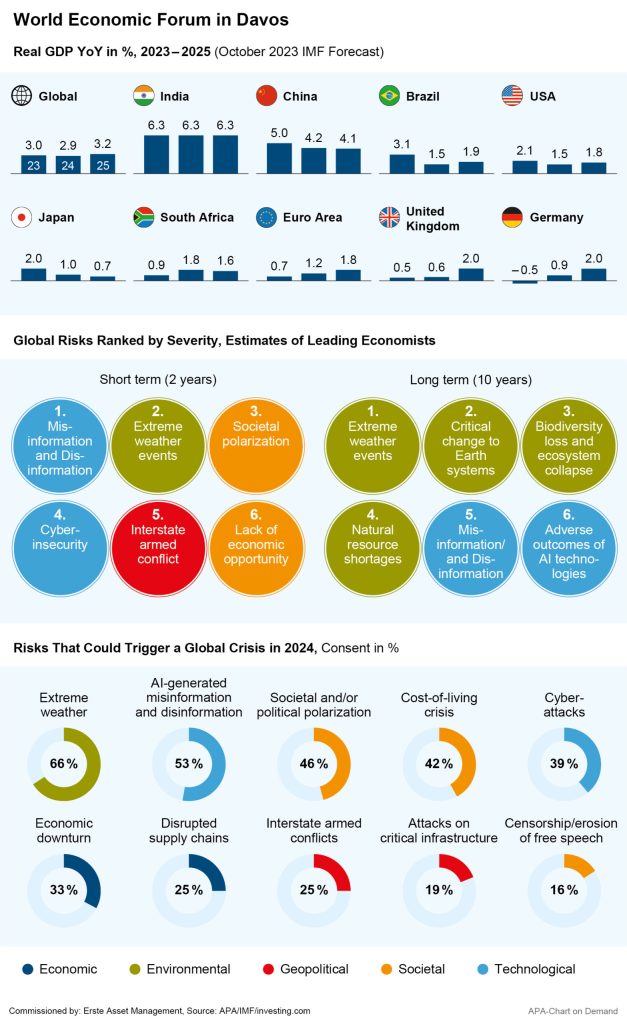

According to the Global Risks Report published by the WEF itself, the climate crisis is currently the greatest risk concerning experts. In a survey, 66 per cent of the experts polled for the report see extreme weather developments as the greatest global threat in 2024, followed by AI-generated disinformation (53 per cent) and societal division (46 per cent).

Note: Prognoses and past performance are not a reliable indicator of future performance.

EU Commission President Ursula von der Leyen also emphasized the importance of the climate transition in Davos, noting that there has been considerable progress in decoupling the European energy system from Russian gas supplies. 2024 marks the first time that more energy will be sourced from wind power and photovoltaics than from Russia, von der Leyen said in Davos. She also pointed out that, according to the latest figures from the International Energy Agency (IEA), capacity growth for renewable energies in the EU reached another record level in 2023. At the same time, the efficiency of energy consumption has increased by almost 5 per cent.

EU Commission President von der Leyen: Europe Must Get to Work on Ai

The EU Commission President called for more speed in Europe in the development of artificial intelligence (AI). “Europe must get to work,” von der Leyen said in Davos. With the right investments, the EU could “pave the way for the responsible use of AI”, she noted.

The future competitiveness of European companies depends on how quickly they utilise AI in their daily operations. “AI can increase productivity at an unprecedented rate,” emphasised von der Leyen. The EU must therefore use available industrial data to develop its own AI models and “lead the way in industrial AI.”

The Commission wants to support AI start-ups and give European companies access to supercomputers so that they can train models with a large volume of data, while a globally unique legal framework is to be put in place to regulate the use of artificial intelligence in the EU. In December, EU legislators agreed on a regulation that requires developers to clearly label AI-generated texts, sounds and images, among other things.

Huge benefits of AI according to OpenAI boss

The head of ChatGPT developer OpenAI, Sam Altman, understands the fears of many people regarding AI. “This technology is clearly very powerful, and we don’t know for sure what exactly is going to happen,” Altman said at the World Economic Forum. “I think it would be very bad if people weren’t careful and didn’t know what was at stake. So I think it’s good that people are nervous.”

There is also a sense of nervousness at OpenAI itself. However, he believes that the benefits of AI are so enormous that it needs to be developed further. It is the responsibility of the developers to make the technology safe with social and political input and to find safeguards. Altman believes that the current applications of generative AI have reached their limits. “We will have to invent new things,” he said. Altman described AI as “a system that is sometimes right, sometimes creative, but often completely wrong.”

China Courting Cooperation and Investment Partners

China’s role in the world was also a key topic. In Davos, Chinese Prime Minister Li Qiang called for international cooperation and presented his country as a driver of global economic growth. Li is the People’s Republic’s highest-ranking government representative to visit Davos since President Xi Jinping paid his respects to the WEF in 2017.

The head of government emphasised the need to break down barriers to cooperation and the importance of keeping supply chains “stable and smooth running”. The Chinese economy is making steady progress and will continue to be a driving force for the global economy, he said.

Li pointed out that the Chinese GDP was estimated at 5.2 per cent last year, exceeding the official target of around 5 per cent and proving the long-term growth trend unbroken. The industrial sector in the People’s Republic came under pressure last year due to weakening demand following the pandemic and the real estate crisis.

China remains “firmly determined” to open up its economy, emphasized Li, who courted foreign investment and promised to improve the environment for foreign companies. “The decision to invest in the Chinese market is not a risk, but an opportunity,” he said.

At the turn of the year, Beijing warned against a reversal of globalisation and even a trade war. This appeal from Beijing came in response to a statement by IMF Vice-Chair Gita Gopinath, who warned of a division of the global economy into two blocs in December. This scenario would see the USA and Europe primarily dividing the trade in the Western world among themselves, while a counterpart consisting of China and Russia forms in the East. According to the International Monetary Fund (IMF), such a bloc formation could reduce global GDP by 2.5 to 7 per cent.

Blinken wants to strengthen cooperation with China

US Secretary of State Antony Blinken also wants to seek closer political contact with China this year. Personal talks between top politicians are irreplaceable, especially when it comes to China, said Blinken at the World Economic Forum. “And I can imagine, I know, you will see more of this in the coming year.”

It won’t just be about stabilising relations and communicating differences very directly in order to avoid misunderstandings, he said. It is also about “seeing whether, despite these differences, despite the intense competition, there are also areas where greater cooperation is in our mutual interest.”

ECB Representatives See Inflation on Track, But Want to Wait for More Data

Another dominant topic in Davos was the question of when the slowdown in inflation will allow central banks to cut interest rates again. In ECB President Christine Lagarde’s opinion, the central bank is well on the way to bringing inflation in the euro area back down to two per cent. She is confident that the ECB will achieve this medium-term goal, Lagarde told Bloomberg TV on the sidelines of the World Economic Forum.

“We are on the right track, we are moving towards two per cent,” she said. However, she would not yet declare victory. The ECB will receive data from this year’s wage settlements in the countries in late spring. This data would give the ECB a good idea of how inflation will develop.

Other ECB representatives also professed uncertainties regarding inflation as well as pending central data. Francois Villeroy de Galhau, governor of France’s central bank, merely said on the interest rate course in Davos that the ECB would probably lower the key rates again this year. “We have to see how the data turns out,” said the President of the German Bundesbank, Joachim Nagel. Central bankers are also keeping a close eye on the upcoming US elections. This year, the elections could possibly determine the financial markets, Nagel said on the sidelines of the forum during an ntv panel discussion.

Tip: You can read a commentary by Erste AM chief economist Gerhard Winzer on the development of interest rates and inflation this year here.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.