When I wanted to attend the Asia Conference organized by Bank of America in Hong Kong for the first time in October 2019, the peak of the mass protests at the time had just been reached and the conference was cancelled. 4 years later, I had the opportunity to attend the Asia Conference again. What has actually happened 3 years after the adoption of the Chinese National Security Law (July 1, 2020), I asked myself?

The fact is that the rule of law has deteriorated in Hong Kong and the free flow of information is under threat, as many Hong Kong Chinese could confirm to me. Beijing’s stated principle that China and Hong Kong are “one country” but “two systems” is blurred and certainly raises questions about Hong Kong’s status as a “Special Administrative Region” with separate legal, administrative and judicial systems from the mainland. The concern about the erosion of freedom, human rights and free information is unmistakable.

A lot has changed in Hong Kong since the Chinese National Security Law was passed in 2020. (c) Thomas Oposich

Real estate crisis

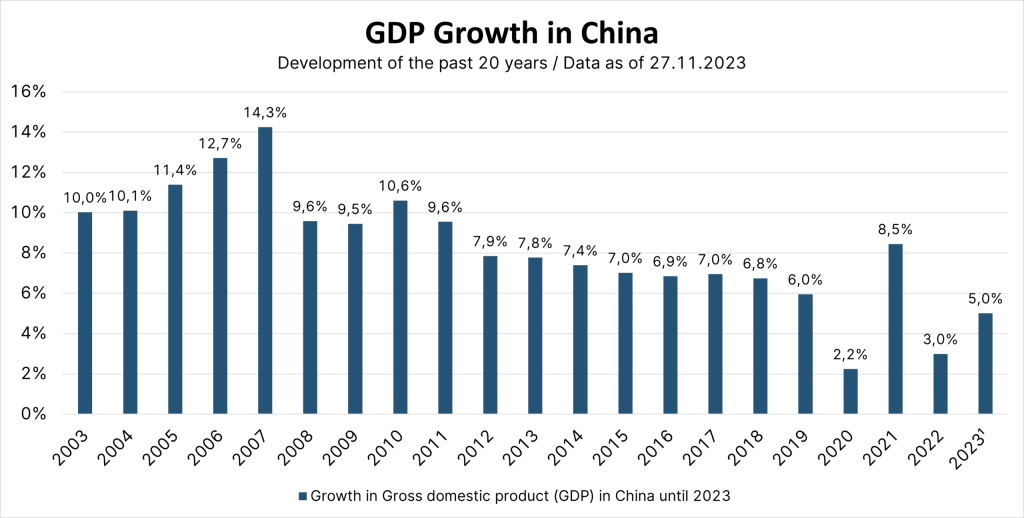

During the panel discussions, some speakers noted that worrying trends are also emerging in the Chinese economy. This is because the growth rate of the Chinese economy is lower than expected after Covid. After the boom years, an adjustment is taking place in the real estate market, which is driving a slowdown in economic growth. It has been almost two years since perhaps one of the biggest bubbles in financial history began to burst: In September 2021, China’s second-largest real estate group, Evergrande, stopped making payments on maturing bonds. Since then, its insolvency has been delayed with state aid. Two years later, the emerging market fire has been richer in bad news and has still not been extinguished.

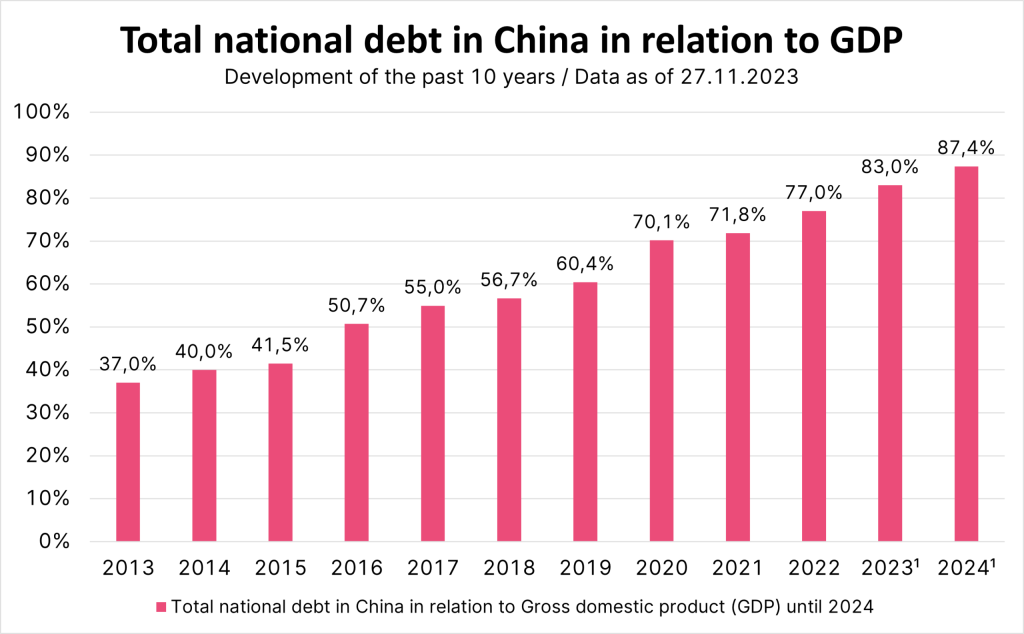

Consumer growth and the willingness to invest have also declined, while exports have stagnated. Gross debt has piled up and the unemployment rate has continued to rise since 2020, especially among the younger generations.

Source: statista.com / IMF; 1 prognoses

Note: Past performance is not a reliable indicator of future performance.

Reshoring

China is not only confronted with internal challenges (real estate crisis) but also with external challenges, above all the tensions with the USA. The loss of confidence on the part of companies investing or planning to invest in China is causing worry among those responsible. The reshoring effect (withdrawal of existing investments or reorientation of new investments to other countries) has led to a gradual decline in export and economic growth since 2020. In terms of the winners in reshoring and friendshoring, Singapore, Indonesia and Malaysia in particular are leading the way when looking at the development of foreign direct investment data from the recent past.

Loss of confidence at home

A loss of confidence at home is also a challenge for the Chinese economy. Nowadays, people are more hesitant to invest, which is dragging down real estate prices further. The weakness is primarily due to the rising unemployment rate with lower salaries, weak expectations for Chinese economic growth and concerns about defaults by real estate developers.

Source: statista.com / IMF; 1 prognoses

Note: Past performance is not a reliable indicator of future performance.

Central government supported

Although overall debt in China is increasing rapidly, external debt is low and manageable, and the risk of local government debt can largely be absorbed by the central government’s strong balance sheet.

However, the government’s scope for further direct support measures is limited. This is because announced measures, such as lowering the equity requirement and mortgage interest rates, will only have a limited impact on reviving the real estate market. The central bank is definitely not a supporter of the “whatever it takes” camp. Rather, the impression is that policymakers prefer to forgo a percentage point or two of growth to avoid losing control, so that no new bubbles form in the real estate sector

It is therefore important that the government conveys the message that it is prepared to use the capital market to support growth. Some options would be, for example, to expand the fiscal space of local governments. The central government could set up a “support fund” to absorb the debt of local governments, including LGFVs (Local Government Financing Vehicle). This could complete unfinished projects by real estate developers and boost the confidence of home seekers. To revive investment, the central government could reduce taxes to stimulate new investment spending and create employment opportunities.

Decoupling

Some conference speakers argued that the Chinese domestic market is large enough to grow on its own. This could be facilitated thanks to home-grown technologies, which are also stimulated by the decoupling trend between China and the West. An analysis by the European Patent Organization shows that China is registering more and more patents. This trend can also be read as an indicator that China is developing into the world’s leading economic power.

However, whether short-term measures or longer-term urgent reforms, a revival will not be possible without time and patience.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.