The first evaluations of this year’s voting season by our proxy partner ISS (Institutional Shareholder Services) reveal a striking picture: although environmental and social issues (E&S) dominated the shareholder motions, support for such motions from investors declined.

340 motions had been brought forward by June 2023, according to ISS, up from only 300 in 2022. But whereas the average support for E&S had been at 26% in 2022, it dropped to only 19% in 2023. 37 of these motions were able to find majority support in 2022, whereas in 2023 only 8 succeeded in doing so (N.B. evaluation January to June).

Anti-ESG movement in the US

This trend is probably in part due to a bureaucratic aspect: motions that could still be held back by companies in 2022, e.g. because they contained too detailed regulations, were submitted this year. The decisive factor here was the amendment of an SEC regulation, which favoured this restraint in recent years, but was adapted this year. The lack of support for such motions was reflected in the voting behaviour.

But the anti-ESG movement originating in the USA also played a role. For the first time, more motions were put to the vote that could be classified as “anti-woke” and, for example, questioned the positive cost/benefit ratio of emission reduction targets. The discrimination of non-minorities relative to minorities was also emphasised. In most cases, however, such motions achieved less than 5% support. The politicisation of ESG in general also took a toll. This year, as the Financial Times reported, several houses were seen to change their voting behaviour to the detriment of ESG, despite warnings from liberal-minded US pension fund managers and politicians not to turn away from commitments to ESG issues.

Erste AM steps up the support of E&S

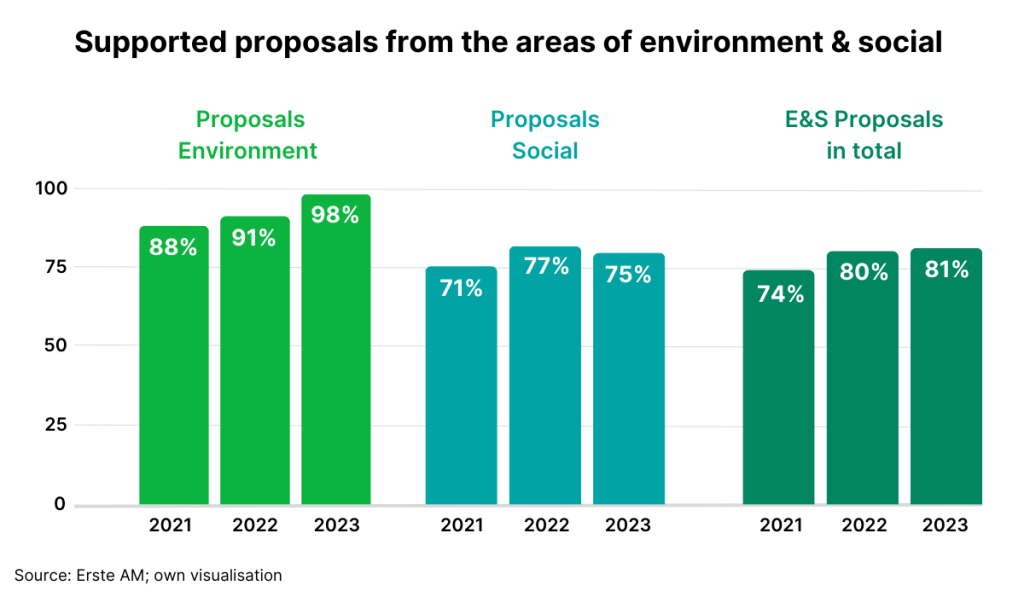

After evaluating our voting policy this year with our partner ISS, we have decided to be more supportive of E&S issues in general and have found a proprietary solution for this implementation. Motions to be voted on will be carefully reviewed by ISS analysts and our ESG team. If, for example, the requirements of a motion were too difficult to fulfil, we would not approve it. Overall, however, we can show that our support for E&S has grown over the years:

Especially in the environmental field, our approach has become clear: the number of motions we have supported has increased from 15 to 50 within the past three years. We have had a clear focus on climate policy & reporting.

While a large proportion of the 2023 climate motions called for climate targets to be aligned with the Paris climate goal, climate lobbying and fossil fuel financing were also among the issues raised. The adoption of transition plans of various companies by their shareholders was also voted on. We supported some of these motions, such as the one from Schneider Electric. The majority of shareholders supported the demand for more transparency regarding climate lobbying at New York Community Bancorp and the consideration of methane emissions at Coterra Energy, as reported by ISS.

Climate disagreement

The different expectations regarding the handling of the global climate crisis and the increasingly politicised sides of the issue were apparent at this year’s Chevron Annual General Meeting. Majority Action, an initiative that calls on investors to hold companies accountable for compliance with ESG standards, demanded that the board of directors not be supported or re-elected this year because relevant climate risks were not sufficiently taken into account. Reduction targets would not sufficiently take into account a minimum of 95% of all Scope 1&2 emissions, as well as relevant Scope 3 emissions, and future capital allocation was not aligned with the Paris climate target.

By contrast, a motion by David Bahnsen called for the establishment of a committee to evaluate the risks arising from decarbonisation. In view of the obvious contradiction between the demand of the latter proposal and the steps needed for the transition to a lower-carbon future, we did not support this motion.

At this year’s Shell AGM the company was again confronted by considerable protests. Due to rising energy prices, the group had achieved record profits but still aimed to reduce emissions to zero by 2050, as CNBC reported. Investors demanded that Scope 3 emissions, which could be understood as those emissions that occurred upstream or downstream along the value chain, should therefore be given increased consideration in the definition of climate targets or conformity with the Paris climate targets.

According to Carbon4 Finance, these amount to around 85% of total emissions in the oil & gas segment. This year, the corresponding motion was supported by 16.75% of all shareholders; we were among the supporters.

Already noticeable consequences of the climate crisis, such as the global water shortage, came into focus at Kraft Heinz. While the company had succeeded in setting water intensity targets and implementing water risk assessments at production sites, shareholders also believed that it would be desirable to address water risks in the upstream agricultural supply chain, as future bottlenecks were to be expected there. Due to the growing pressure from the advancing climate crisis, the quality as well as the quantity of the remaining available water resources should be reported and made known to the shareholders. This motion also received our support.

For more information on our voting behavior, please visit our website.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.