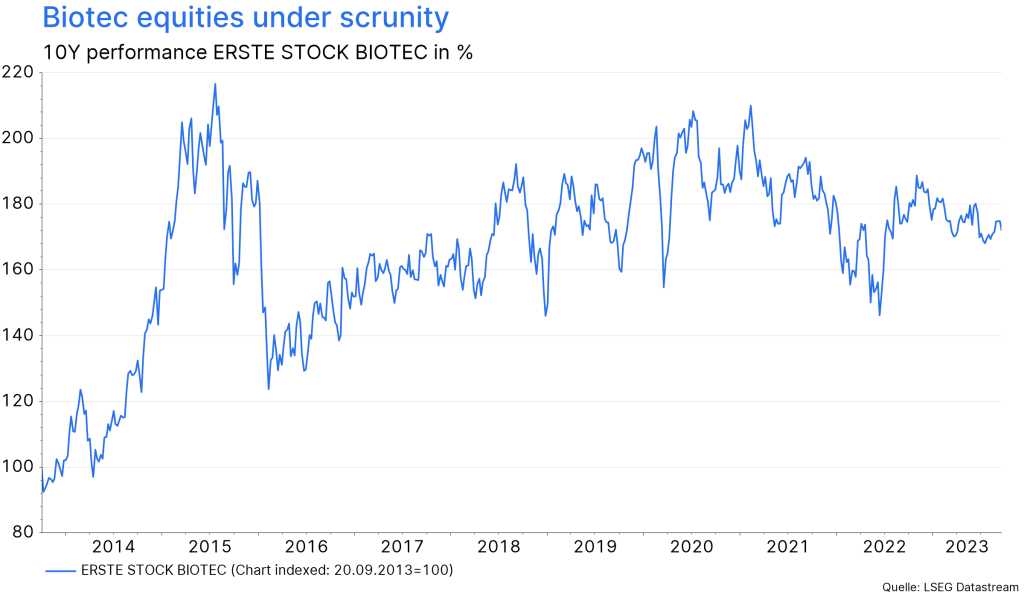

Shares in the biotechnology sector were performing well during the pandemic, driven by significant progress in the development of vaccines and therapeutics. In the first half of 2023 shares of the biotechnology sector came under pressure.

But the signs are changing. The possible high in interest rates in Europe and the USA could boost biotech shares again, as ERSTE STOCK BIOTEC fund manager Harald Kober explains in an interview.

The first half of the year was difficult for the biotechnology sector, especially the first quarter of 2023. What were the reasons for the comparatively weak performance compared to value shares?

In the first quarter of 2023 shares of the biotechnology sector came under pressure. The economic activity after the Covid-19 pandemic gained momentum and with it, rising inflation. Central banks in America and Europe continued the cycle of interest rate hikes started in 2022 to curb inflation. High interest rates are weighing on the entire sector.

“We have no doubt that the biotechnology market will continue to grow as technology and research continue to improve.”

Harald Kober, funds manager ERSTE STOCK BIOTEC

So, large-caps have been able to outperform small-caps this year so far?

The biotechnology sector as a growth sector came under more pressure than the broad market. As in other downturns in the past, the large caps with solid sales and earnings held up better than the small- and mid-caps, which are often still far from real sales of drugs and are still mainly investing in the research of such. Rising interest rates hit companies that were not yet making profits. These are dependent on debt financing or equity investments and permanently need new money. In this respect, these companies are competing with the high yields on the bond market.

Can you see signs of small-caps staging a comeback?

A trend reversal was starting to emerge in the second quarter: growth shares were increasingly sought after again, and investors shifted from value back to growth. In addition, takeovers were picking up momentum. ERSTE STOCK BIOTEC was able to benefit from this. The takeover of Seagen by Pfizer in March had a very positive effect on the fund. With this acquisition, Pfizer secured several promising drugs against metastatic cancers. Another highlight was the takeover of IVERIC BIO by Astellas Pharmaceuticals in April, which specialises in rare forms of dry age-related macular degeneration. *

What do you expect for the rest of the year?

The mood has brightened considerably, even if this is not yet reflected in the performance of ERSTE STOCK BIOTEC as much we would like. Investor sentiment in the biotech sector is currently still gloomy, as can be seen in the large number of small biotech companies trading at a negative enterprise value (market capitalisation plus debt minus cash).

It looks like the interest rate hike cycle could now come to a halt and bond market yields could fall. This would be a good environment for growth shares and thus also for the biotechnology sector. It is now a matter of positioning oneself in time for the next upswing.

How are the companies currently valued?

The large pharmaceutical and biotechnology groups still have bulging coffers. Valuations in the biotech sector remain very attractive, especially for small- and mid-caps. Many companies are trading well below their cash levels. Takeover targets are likely to be increasingly companies that already have an approved compound or are about to receive approval for one.

What does the future hold for biotechnology shares?

We have no doubt that the biotechnology market will continue to grow as technology and research continue to improve. The focus of the industry is on the development of innovative therapies for many diseases that were previously incurable. Biotechnology also facilitates the development of personalised medicine tailored to the individual needs of patients.

Note: The performance is calculated in accordance with the OeKB method. The management fee as well as any performance-related remuneration is already included. The issue premium which might be applicable on purchase and as well as any individual transaction specific costs or ongoing costs that reduce earnings (e.g. account- and deposit fees) have not been taken into account in this presentation. Past performance is not a reliable indicator of the future performance of a fund.

What are your specific priorities for ERSTE STOCK BIOTEC?

With the positive news on their Alzheimer’s research in the first half of 2023 by Biogen and Eli Lilly, the foundation has been laid for an exciting development of these shares. We prefer companies with a promising business model and promising drug developments, but not so much Covid vaccine companies.

Examples are the shares of:

- Sarepta Therapeutics (gene therapy against rare muscular diseases)

- Gilead (strong focus on oncology; last year, the company took over Immunomedics for a promising breast cancer drug)

- Biogen (has published positive data from a phase 3 trial of a new Alzheimer’s drug designed to reduce protein deposits in the brain and thereby slow the progression of the disease; the drug has already been approved in the USA and should be ready in Europe in early 2024)

- AstraZeneca (focus on oncology; strong sales and profit growth expected for the coming years)

- Amgen (Lumakras against lung cancer, could also be used for other cancers such as colon cancer)

With ERSTE STOCK BIOTEC, investors can conveniently invest in all of these interesting segments and do not have to restrict themselves to just one or two applications due to liquidity considerations. *

CONCLUSION

The future of biotechnology seems promising. With the ERSTE STOCK BIOTEC fund, investors can invest in this growing segment of the healthcare sector. As with any investment, the risks should also be taken into account, especially the failure of research projects or the rejection of drug approvals by regulatory authorities, which can lead to disappointment and price fluctuations and losses. Conversely, in the case of drug approvals, above-average price increases beckon, which would benefit the shareholders of the fund.

Notes ERSTE STOCK BIOTEC

*) Portfolio positions of funds disclosed in this document are based on market developments at the time of going to press. In the course of active management, the portfolio positions mentioned may change at any time. The companies listed here have been selected as examples and do not constitute an investment recommendation.

The fund employs an active investment policy. The assets are selected on a discretionary basis. The fund is oriented towards a benchmark (for licensing reasons, the specific naming of the index used is made in the prospectus (12.) or KID “Ziele”). The composition and performance of the fund can deviate substantially or entirely in a positive or negative direction from that of the benchmark over the short term or long term. The discretionary power of the Management Company is not limited.

For further information on the sustainable focus of ERSTE STOCK BIOTEC as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE STOCK BIOTEC, consideration should be given to any characteristics or objectives of the ERSTE STOCK BIOTEC as described in the Fund Documents.

Advantages for the investor

- Broadly diversified investment in biotechnology companies with little capital investment.

- Active stock selection based on fundamental criteria.

- Opportunities for capital appreciation.

- The fund is suitable as an addition to an existing equity portfolio and is intended for long-term capital appreciation.

Risks to be considered

- The price of the fund can fluctuate considerably (high volatility).

- Due to the investment in foreign currencies the net asset value in Euro can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

Legal note:

Prognoses are no reliable indicator for future performance.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Bitte beachten Sie die rechtlichen Hinweis bzw. die Vor- und Nachteile am Ende des Beitrags.

Bitte beachten Sie die rechtlichen Hinweis bzw. die Vor- und Nachteile am Ende des Beitrags.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.