Equities got off to a terrible start into 2016. At the end of February, a short but intense sell-off was triggered by the emergence of concerns over a slump of the global economy in connection with China. However, since mid-February the international indices have been on the rise without any significant breaks. Not even the much-feared Brexit vote managed to dent the upswing. Although share prices were down in the immediate wake of the decision of the UK to leave the EU, they rebounded very swiftly.

Scepticism due to falling earnings

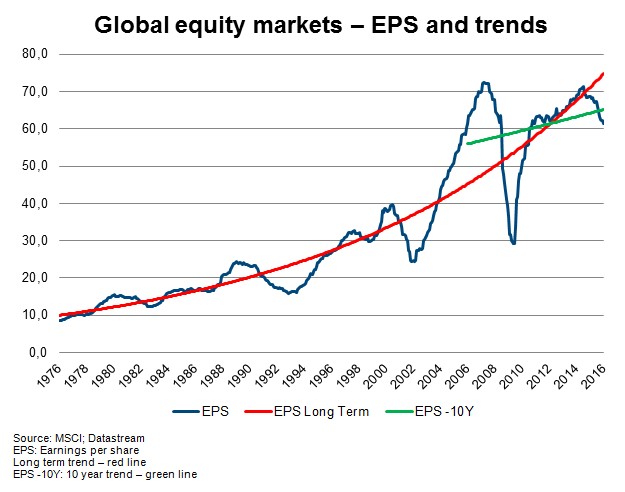

What is the reason for the broad cloud of scepticism that has been hovering over the rising prices? A glance at the current earnings development of the shares contained by the MSCI World index illustrates why investors are astonished by the performance displayed on the market:

The chart shows that earnings have been on a continuous decline for one and a half years. In the past 40 years there have been only five periods during which EPS were falling for longer – and only during a recession as well. This means that for the first time since the 1970s we have a period of falling earnings without a recession! It is part of the basic working knowledge of any investor that earnings drive prices in the long run. And if not current earnings, then at least expected earnings.

Developed markets are expensive

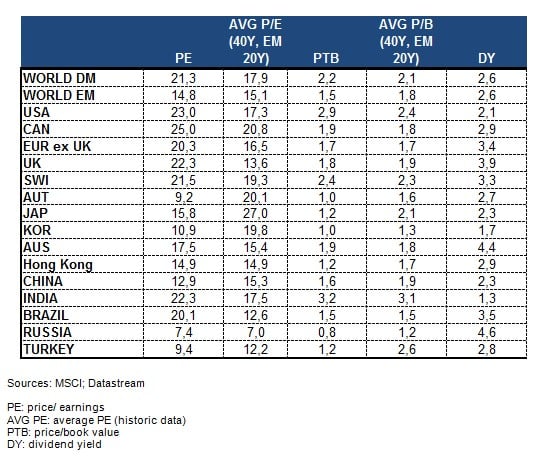

From a fundamental perspective, prices can also rise without rising earnings: when the markets command attractive valuations. In the long run, valuations tend towards their average, i.e. every attractive valuation will tend towards a “normal” valuation.

The valuation table highlights the fact that the developed markets in particular are relatively expensive. This means that currently share prices are not rising to balance any undervaluation.

Low yields fuels hunt for dividends

This begs the question: what, if not earnings or valuations, is driving share prices up? A possible, and likely answer is, the lack of alternatives. Savings book rates are as low as they can go. Bond yields around zero push investors into risky investments. This may also explain why shares with strong dividends have shown a particularly good performance; in the absence of bonds that pay positive yields, conservative equities with an attractive dividend yield are the next-best thing. As long as yields remain low, the hunt for shares with strong dividends may continue even though earnings are falling and equities are expensive from a historic perspective.

That being said, falling earnings and high valuations should still make for a cautious approach on the investor’s part. Buying the market indiscriminately can come with disastrous results. In this environment, a selective approach is more and more important. However, neither the earnings development nor valuations are suitable as timing instrument.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.