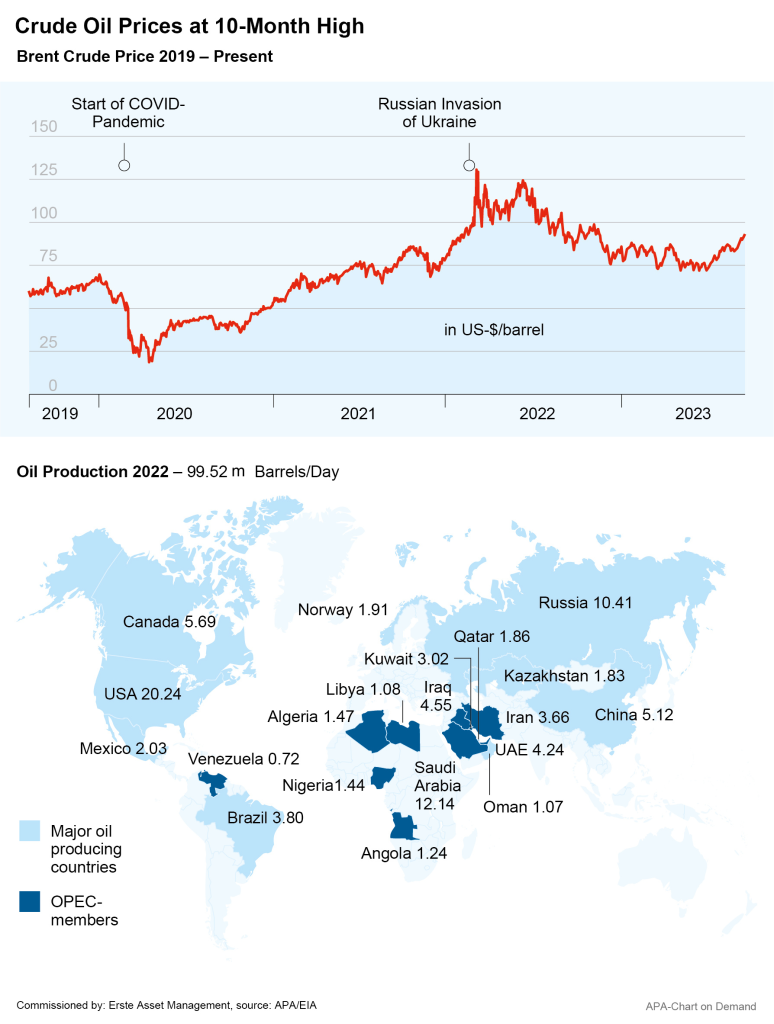

Crude oil prices continue to rise, recently reaching new 10-month highs after showing substantial gains since June. The main driver is the concern about the supply of large producing countries such as Saudi Arabia or Russia. In addition, a larger demand is expected in view of the economic upturn in China.

The price of North Sea Brent crude lay around 95 US dollars per barrel (159 liters) on Tuesday morning, up from around 75 dollars in late June and once again approaching the 100-dollar mark. Previously, prices for the crude oil benchmark had topped 100 euros in September 2022. A barrel of the American variety West Texas Intermediate (WTI) for October delivery was last traded at close to 91 dollars. These are the highest levels since November 2022 for Brent and WTI oil.

Oil prices have recently been driven by tight supplies as major producing countries are currently keeping their quotas tight. Saudi Arabia, the OPEC production cartel’s largest oil producer, had announced in early September that it would further extend the production cuts started in July, of one million barrels per day, until the end of the year. Output is thus expected to remain at 9 million barrels per day. Officially, this is intended to keep the market in balance, but many experts actually see the strategy as a means of increasing prices and revenues. At the same time, Russia announced it would continue to reduce its oil exports by 300,000 barrels per day through the end of the year.

IEA Warns of Supply Shortage

According to the International Energy Agency (IEA), the oil production cuts could lead to a significant supply shortage, expected from September and lasting for the remainder of the year, the IEA stated in its monthly oil market report last week. Oil stocks could fall to uncomfortably low levels while oil prices rise.

The Saudi and Russian decisions to extend their voluntary production cuts until the end of 2023 are proving to be a formidable challenge for oil markets, the IEA said, with a noticeable price increase already manifesting.

Production cuts by OPEC countries have recently been offset by higher supplies from producers outside the alliance, such as the US and Brazil. Iran, which is still under sanctions, also increased its production, according to the IEA. Most recently, Libya also resumed its oil production after a disastrous storm hit the country.

However, the OPEC cuts, combined with an expected increase in global oil demand, could lead to a daily deficit of 1.24 million barrels in the latter half of the year, the IEA expects. OPEC itself most recently forecast a daily deficit of more than three million barrels in Q4, which would mark the largest deficit in at least a decade.

Positive Numbers From China

China is responsible for 75 per cent of the expected increase in demand, the IEA report stated. Last year, Chinese oil demand dropped for the first time since 1990 due to the pandemic lockdown. In the first half of 2023, China ramped its oil imports back up to 11.4 million barrels per day, up 12 per cent from the 2022 average, according to IEA figures.

In addition, recent economic data suggests stabilisation in the struggling economy and, consequently, rising oil demand from China. Both industrial production and retail sales in the country rose more than expected in August, with industrial production up 4.5 per cent from last year as opposed to economists’ expectations of 3.9 per cent. Retail sales, a key indicator of private consumption, grew by 4.6 per cent. Analysts had expected a 3.0 per cent increase here, following an increase of 2.5 per cent in July.

In addition to production cuts and the expected increase in demand, data on US oil inventories have recently also fueled expectations of rising prices. Crude oil inventories in the US have decreased in recent weeks, reaching their lowest level since December 2022 in late August. The IEA also sees lower global oil inventories as another price driver and expects Brent oil prices to average USD 93 in Q4. However, global demand growth is expected to lose momentum again in 2024, according to the agency’s forecasts. Efficiency improvements, the rising number of electric cars and increased work-from-home activity should slow demand, the IEA states.

Natural Gas Prices Seeing Price Increases

Impending supply bottlenecks, triggered by a strike at Australian liquefied natural gas (LNG) plants, have also intermittently led to significant price increases for natural gas earlier this month. The country is the world’s largest exporter of this fuel type. For the time being, the unions have not reached an agreement with the operator Chevron on a new collective agreement and better working conditions. According to the news agency Bloomberg, the plants affected by the strike were responsible for about 7 per cent of global LNG production last year. According to experts, however, the strikes are unlikely to have an immediate impact on the supply situation, as European gas storage facilities are well stocked. Nevertheless, Europe is dependent on a steady supply of liquefied natural gas.

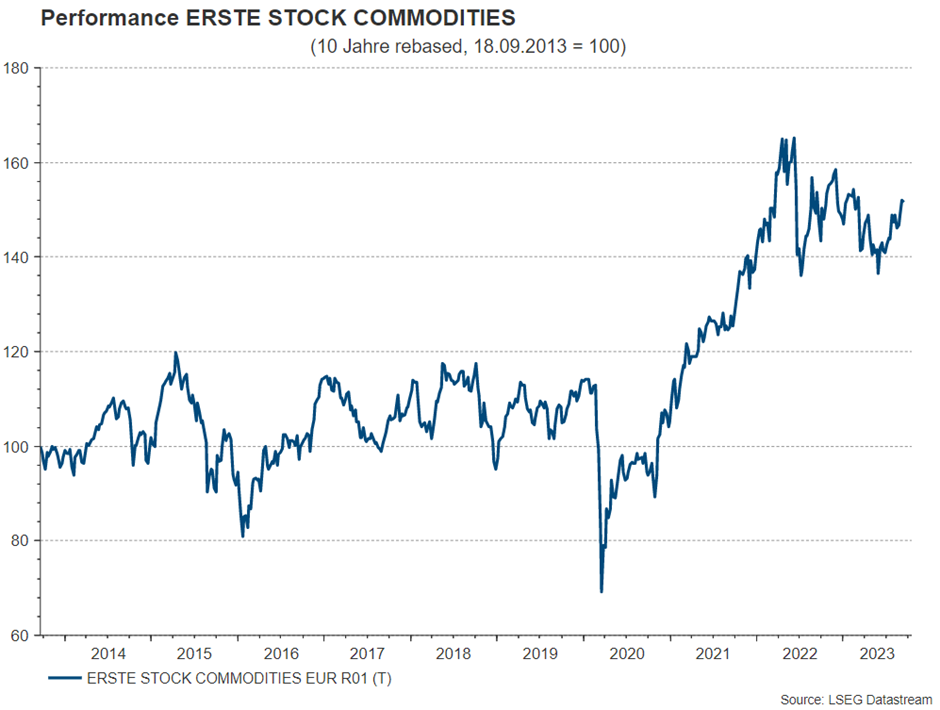

High oil price boost for companies of the ERSTE STOCK COMMODITIES

ERSTE STOCK COMMODITIES offers the opportunity invest worldwide in raw materials companies. The investment strategy seeks to have a balanced portfolio across the basic materials and energy sectors, with an overweight on developed market companies.

Legal note:

Prognoses are no reliable indicator for future performance.

As you can clearly see from the price chart, the prices have climbed significantly in parallel with the rising oil prices from June of this year. When investing, you must always take into account that the fund price can fluctuate greatly and that changes in the raw materials industry as well as exchange rate changes can affect the fund price. The chances of generating income from well-capitalized companies are good, especially in volatile markets.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.