The hot phase of Türkiye’s election campaign has begun, with parliamentary and presidential elections to be held simultaneously in the country on 14 May. After 20 years in power, Turkish head of state Recep Tayyip Erdogan faces the possibility of not being reelected – one of the reasons for which is massive criticism of the government’s crisis management that arose following the earthquake disaster in early February. Turkish citizens are also suffering from a massive 50-per-cent inflation. In addition, the country’s rapid economic upswing in recent years is likely to cool down for the time being.

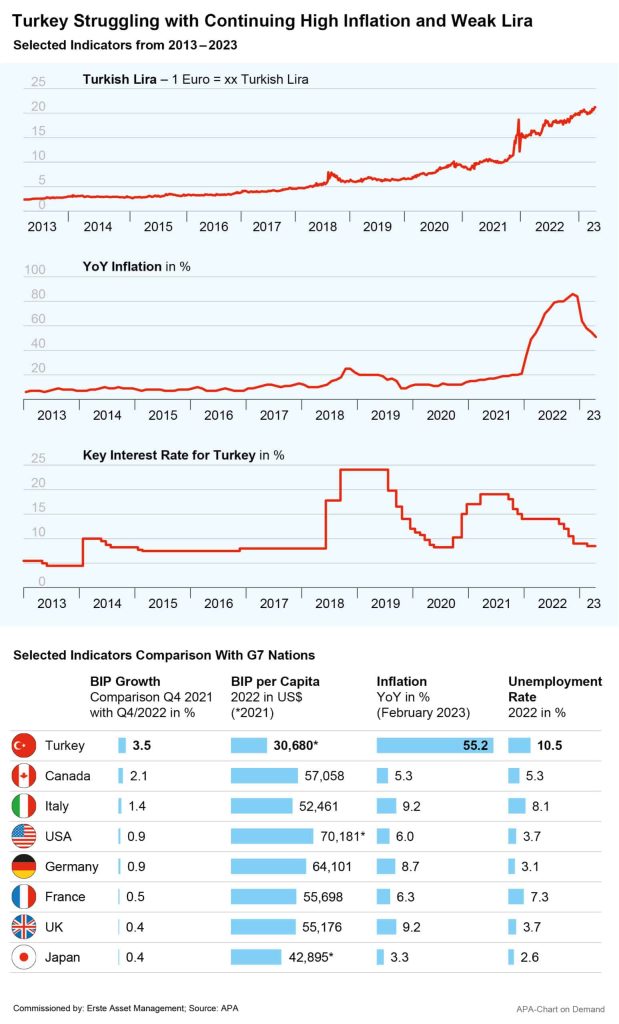

Although the inflation rate in the country recently pulled back from the 85-per-cent peak it reached in October, it was still a staggering 55 per cent in March. The inflation rate was recently dampened by the decline in energy prices compared with the previous year’s surge caused by the Ukraine war. On the other hand, food prices remain a strong price driver, increasing by almost 68 per cent year-on-year in March, according to the statistics bureau.

The situation is exacerbated by the Turkish lira’s continuing weakness. According to experts, Erdogan’s unorthodox monetary policy is also to blame for the lira’s weakness and high inflation. While central banks usually fight high inflation by raising key interest rates, Erdogan insists on the opposite approach, having made the central bank successively lower its interest rates despite high inflation rates in order to stimulate the economy.

Central Bank Cuts Interest Rates Further Despite High Inflation

Most recently, the central bank cut its interest rates in February to 8.5 per cent – the lowest level in three years. This is likely in order to cushion the economic impact of the devastating earthquake the country suffered; however, the central bank maintains it sees only short-term effects of the quake on the economy.

Türkiye’s exporters should continue to benefit from the interest rate cuts and the lira’s resulting weakness. The president of the Istanbul Chamber of Commerce recently called for a further cut in key interest rates to ease the burden on the export economy. Consumers, on the other hand, are suffering from the high inflation.

Inflation and the Earthquake’s Consequences Likely to Dampen Economic Growth

In addition, the economic consequences of the earthquake hit the industrial sector particularly hard and are most likely to adversely affect economic growth. Analysts at the Organization for Economic Cooperation and Development (OECD), for example, expect GDP growth of only around 3 per cent this year, down from 5.3 per cent in 2022. According to the OECD forecast, inflation is expected to decrease moderately, but still remain above 40 per cent. This is likely to further erode household purchasing power, the OECD said.

Against this background, many young Turkish citizens are already thinking of emigrating: According to a 2021 study by the Konrad Adenauer Foundation, around 73 per cent of 18- to 25-year-olds would prefer to live abroad. But according to experts, the country’s attractiveness for foreign investment is already suffering from inflation and the consequences of the earthquake.

Erdogan Focuses on Wage Increases and Major Projects in Election Campaign

According to polls, voters are becoming increasingly disgruntled about the economic situation. In view of this, Erdogan, the incumbent, recently launched his election campaign with promises of wage increases and further major projects to boost the economy. The wages of civil servants and pensions are to be raised regularly above the level of inflation, Erdogan said at his ruling Islamic-conservative party AKP’s campaign launch. Infrastructure projects are to provide additional support for the economy, with Erdogan promising “a super high-speed train line between Ankara and Istanbul” to be established.

Whether Erdogan can score points with voters with this remains to be seen. For the head of state, who has been in power for 20 years, the vote is likely to be the most challenging of his career, seeing as his poll ratings have been in a slump for some time. Meanwhile, however, the individual opposition parties are unable to achieve a clear majority. Either way, one challenger has already been determined: Kemal Kilicdaroglu of the largest opposition party CHP will enter the race as the joint candidate of an alliance formed by six parties.

Risk notes according to 2011 Austrian Investment Fund Act

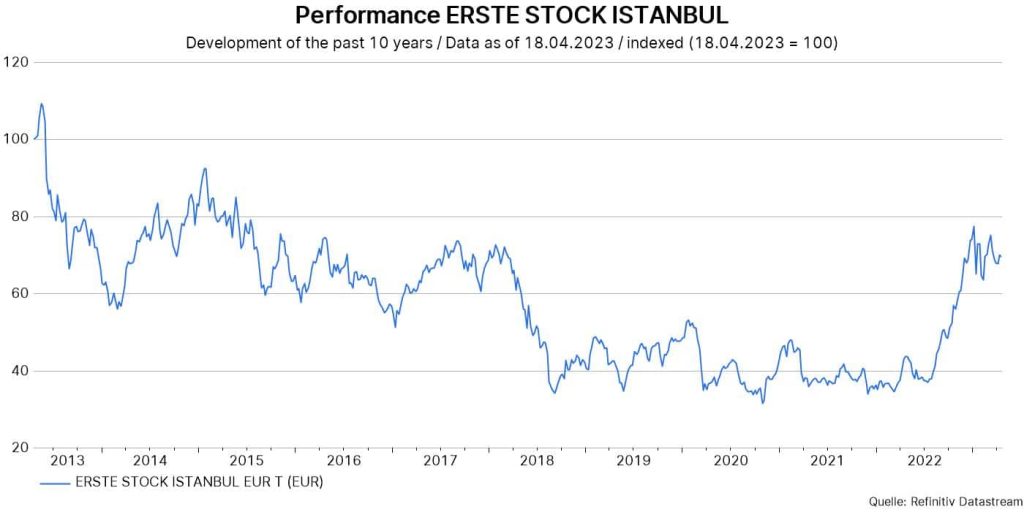

ERSTE STOCK ISTANBUL may exhibit increased volatility due to the composition of its portfolio: i.e. the unit value can be subject to significant fluctuations both upwards and downwards within short periods of time.

Advantages for the investor

- Broad diversification in selected Turkish companies with little capital investment.

- Active stock selection based on fundamental criteria.

- Opportunities for attractive capital appreciation for investors with large risk appetite.

- The fund is suitable as an addition to an existing equity portfolio and is intended for long-term capital appreciation.

Risks to be considered

- The price of the funds can fluctuate considerably (high volatility).

- Due to the investment in foreign currencies, especially in Turkish lira, the net asset value can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.