Life has become significantly more expensive since the inflation rate more than tripled compared to 2021, and there is still no end in sight to the wave of rising prices. While we can feel the effects directly and immediately at the petrol station, in the supermarket, or in the restaurant, another arena is easily overlooked: millions of savings accounts are gradually losing value due to inflation. What can be done against this creeping loss of wealth? One answer is to invest in real assets, as is possible through the ERSTE REAL ASSETS fund. It offers opportunities for return in trying times like these, but naturally also comes with risks.

At the moment, it seems the only way is up for prices

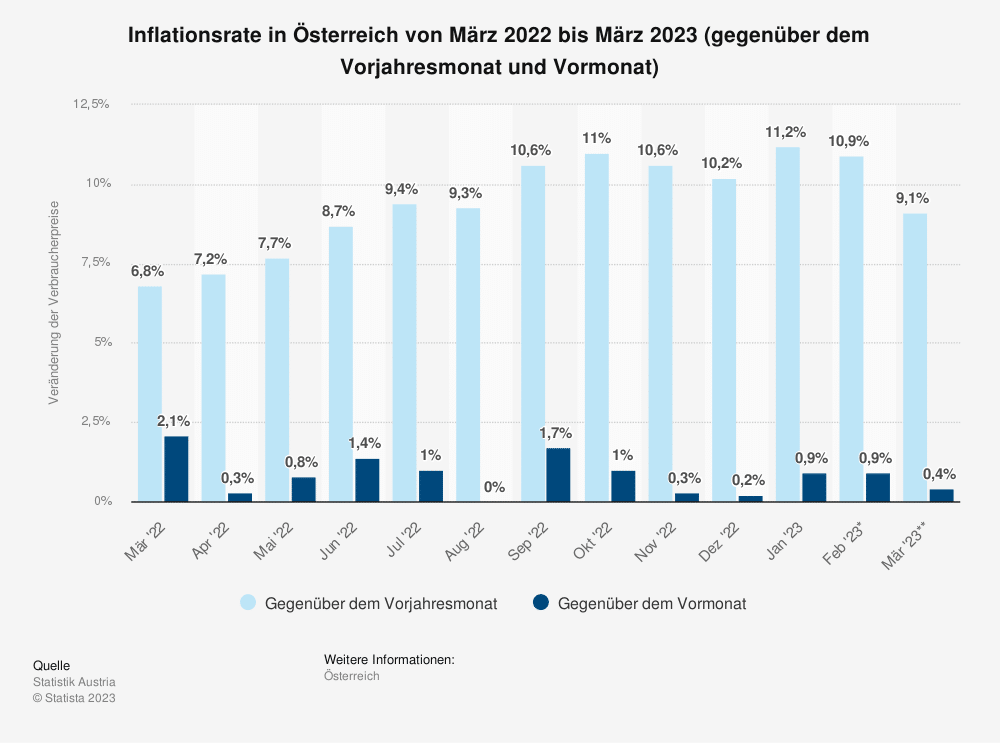

Statistical data confirm what we can feel on a daily basis in all areas: in 2022, consumer prices increased by 8.6 % compared to the previous year. Most recently, inflation had even increased to double-digit terrain.

Inflation rate in Austria, February 2022 to February 2023 (month-on-month and relative to the referential month of the previous year)

A look at specific price drivers that have recorded particularly marked increases over this period is also revealing:

What prices have increased the most in the past year:

- Flight tickets + 58.2 %

- Energy + 37.0 %

- Pets + 18.2 %

- Home maintenance + 17.9 %

- Food + 16.5 %

- Cars + 14.1 %

- Non-alcoholic beverages + 14.0 %

- Fuels + 13.5 %

- Restaurants + 13.7 %

- Furniture and carpets + 13.7 %

- Accommodation + 13.1 %

- Newspapers/magazines + 12.9 %

Reference period: 02/2022 – 02/2023, Source: Statistic Austria (personal inflation calculator)

https://www.statistik.at/persoenlicher_inflationsrechner/index_en.xhtml

What is the outlook for inflation?

There is no ultimate answer to this burning question, but there are many indications suggesting that inflation will weaken slightly. According to the current inflation forecast of Oesterreichische Nationalbank (OeNB), i.e. the Austrian central bank, the inflation rate in relation to the harmonised consumer price index is expected to decline significantly in the course of the year. That being said, it will still amount to 6.9% for the whole year of 2023. The easing inflationary pressure from energy prices will be coming at a time when domestic price pressure from wage settlements will be on the rise. If OeNB’s forecast is to be trusted, the inflation rate is expected to fall to 4.0 % in 2024 and to 3.2 % in 2025 – which, however, is still higher than the European Central Bank’s target of 2%.

What does all this mean for investments?

In short, those who have money are among the losers due to inflation. In particular, money held in low-interest savings accounts and low-yield investments has been, figuratively speaking, melting away since interest rates fell below the rate of inflation, as was the case in 2015. The capital and the vanishingly small interest income are currently being eaten up by inflation. Even since the last interest rate increases by the European Central Bank, conventional forms of savings have hardly yielded any interest. Those who have their money in a savings book are therefore continuously losing massive amounts of wealth.

This is how negatively increased inflation and zero interest rate policies affect real purchasing power:

| Year | Purchase power | Inflation rate |

| 0 | 100,000 € | 5 % |

| 1 | 95,000 € | 5 % |

| 2 | 90,250 € | 5 % |

| 3 | 85,738 € | 5 % |

| 4 | 81,451 € | 5 % |

| 5 | 77,378 € | 5 % |

| 10 | 59,874 € | 5 % |

Source: own calculations

Therefore, the declared goal for all those with disposable money should be to achieve a return that is permanently above the rate of inflation. Only this scenario ensures the maintenance of the value of capital in the long term. Since this goal does not seem to be achievable with traditional forms of saving for the time being, alternatives are increasingly coming into focus.

Real assets in demand

We can currently see a strong trend towards tangible assets – i.e. assets with material value – among investors who want to invest their money without losses and without taking major risks. Due to their limited nature, they promise a stable development of value that is not influenced by inflation. “Land register instead of savings book” is the motto of this development in a nutshell. Gold, too, will always be an option due to its physical value, especially in times of crisis. However, investing in tangible assets also involves a high degree of organisation, personal involvement, and add-on costs. This includes the difficult question of real estate selection, the search for reliable tenants, and the question of where to store gold safely and protect it from theft.

If you’d rather do without these hurdles, you can also opt for an investment fund that invests in tangible assets – ERSTE REAL ASSETS, for example.

Please note that investing money in investment funds also involves risks.

Investing in assets with continuity

The fact that ERSTE REAL ASSETS is one of the most popular funds among Erste Bank and Sparkassen customers is no coincidence: its composition is geared towards stable value development, which is to be ensured by a mix of approx. 50% global equities, 33% gold[1], and 17% real estate funds or commodities.

[1] Acquisition usually in the form of exchange-traded commodities (debt securities). Physical delivery of the precious metals mentioned is not permitted. The currency risk of the gold component is predominantly hedged in euro.

Real investment in companies

When you invest your capital in shares, you receive real value in return. You become co-owner of a real company that generates real sales and profits.

Companies constantly adjust the prices of their products to the current economic environment. Rising costs for raw materials or wages are passed on to end customers, which cushions inflationary developments. Depending on the economic cycle, shares can therefore contribute to wealth preservation.

Stable return through real estate investments

Given that ERSTE REAL ASSETS also invests in real estate funds, investors hold an indirect interest in a large number of properties. The value of assets depends on the current income and its risk. Real estate is a durable and stable asset. It generates ongoing income through tenants. As a rule, rents are adjusted for inflation. This can help absorb the risk of purchase power losses.

Gold is forever

Unlike the money supply, the amount of gold available is limited and cannot be controlled at will. This ensures a certain safeguarding of purchasing power. History has shown that the demand for gold and thus its value increases especially during economic and political crises. Gold in the portfolio ensures even broader risk diversification and may also work as an additional source of income.

It’s all in the mix

In a nutshell, broad diversification – that is, a wide spread of risk – is the best protection against inflation. Negative outliers in individual asset classes are usually offset by gains in other areas. Even if the bears had the upper hand on the stock market in 2022, real assets such as shares, real estate, and gold generally have significantly more return potential than a conventional savings book.

Information helps to take sound decisions

If you have your money in a savings account and do not want to watch it getting eaten up by inflation, you need to take action. Comprehensive information is crucial. At Erste Bank and Sparkasse you will get competent advice on all of your options.

Interesting to know: since 31 March 2022, ERSTE REAL ASSETS has also been eligible for the s Fund Plan, i.e. the ERSTE fund savings plan. It takes as little as EUR 50 per month to sign up.

For further information on fund savings plans, please visit: Fund saving (erste-am.at)

For more information on ERSTE REAL ASSETS: ERSTE REAL ASSETS Retailtranche: EUR R01 – Factsheet (erste-am.at)

The fund pursues an active investment policy and does not follow a benchmark. The assets are selected at our discretion, without any constraints to the latitude of judgement on the investment company’s part.

Benefits for the investor:

- Investment focus on real assets

- The investment goal is long-term capital growth

- The diversification of the investment across various asset classes may reduce the risk of capital loss

- Investment funds are special assets

Risks to bear in mind:

- The price of the assets the fund is composed of may be subject to significant fluctuations

- Due to investment in foreign currency, the value of the fund may be affected by foreign exchange fluctuations

- Alternative asset classes contain a higher risk potential

- Capital loss is possible

- The following risks may be of particular relevance to the fund: credit risk, counterparty risk, liquidity risk, deposit risk, derivative risk, and operational risks. For comprehensive information on the risks of the fund, please refer to the prospectus and to the information for investors according to sec. 21, part II, chapter “Risk notices” of the Austrian Alternative Investment Fund Managers Act

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Important legal notice:

Forecasts are no reliable indicator of future performance.

Please note that an investment in securities also involves risks in addition to the opportunities described.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.