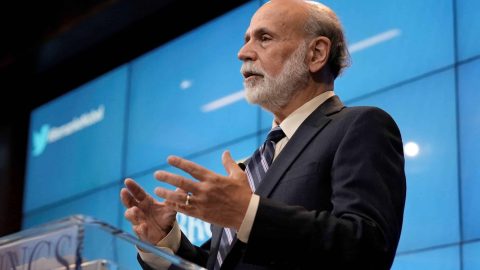

As the Royal Swedish Academy of Sciences announced on 10 October, the three US economists Ben Bernanke, Douglas Diamond, and Philip Dybvig will be awarded the Nobel Prize in Economics for their research on banking and financial crises.

In their work, the economists have contributed significantly to a better understanding of the close ties between banking and economic crises. As a consequence, political leaders have been able to take the right decisions during times of crisis. “It was an important result of their research to illustrate why preventing banks from collapsing was of crucial relevance”, as the Royal Swedish Academy pointed out in its statement.

The connection of banking and economic crises

The Committee explained that the three US researchers had provided key insights into the tasks, the functioning, and the vulnerability of banks to crises. The question why banking crises tend to come with long-term effects and can have a lasting impact on the economic development of the affected countries was a particularly important aspect. The research, dating largely back to the 1980s, concludes that financial crises worsen as soon as the people lose their trust in the stability of the system. The scientists thus supported the hypothesis that preventing banks from collapsing was of preeminent importance so as to keep a negative spiral from dragging down the economy.

Financial crisis 2008 as litmus test

When, some 15 years ago, the investment bank Lehman Brothers filed for bankruptcy, one banking crash was followed by another, with the world holding its breath. It was a dramatic moment that almost nobody was prepared for – except for a few scientists, one of whom was chair of the US Fed then: Ben Bernanke. Their insights played a decisive part in getting the situation ultimately under control. It was known that banks were in imminent trouble if customers were suddenly withdrawing their savings in fear of a bank insolvency. The dangerous momentum of such a bank run was stopped by the fact that several states reacted by issuing a deposit guarantee, ensuring that the money on private accounts was safe. The know-how gained by the three US economists was also of great value during the corona virus pandemic.

Understanding crises – mastering crises

Ben Bernanke as well as Douglas Diamond and Philip Dybvig analysed the background and particularities of financial and economic crises in their research.

- In his studies, Ben Bernanke focused in particular on the Great Depression of the 1930s and was of the opinion that it had been caused by bank runs. Employing statistical methods, he proved that the situation only improved once the government stepped in to prevent further bank panics.

- Douglas Diamond and Philip Dybvig were able to illustrate in their research the susceptibility of banks to rumours about a collapse and at the same time suggest ways in which governments could prevent this worst case from unfolding

Why did the jury nominate precisely these three economists for the Nobel economics prize? The Royal Swedish Academy of Sciences points out that they have drastically improved our understanding of the role of banks in our economy, especially during the financial crisis. They also pointed out ways in which the financial markets could be regulated.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.