“If it passes, the US Inflation Reduction Act would be a landmark legislative achievement.”

Joseph Stiglitz

“The good news is that if this legislation is signed into law it would provide far more funding for energy efficiency and sustainable energy than has ever been invested before.”

Bernie Sanders

“If passed, it would be the most important climate bill in history by a huge margin.”

The Wilderness Society

These are just a few of the voices of economists, politicians and NGOs on the “Inflation Reduction Act 2022”, which was passed uniformly by the Democrats in the US Senate on August 7 and now only needs to be signed by President Joe Biden.

Admittedly, the bill does not have such a resonant name as the originally planned “Build Back Better”, which could not be implemented due to internal party resistance. Nevertheless, the “Inflation Reduction Act 2022” retains virtually all of the originally planned subsidies, especially in the area of climate protection, and in some cases even more. John Berger, CEO of the American solar company Sunnova, put it in a nutshell in the earnings call: “If you had to write a perfect law for private solar companies, this would be it”.

A climate bill at its core

It is no coincidence that the Inflation Reduction Act has just been passed: the polls for Joe Biden and the Democrats are at an all-time low, and the proposed bill fulfills one of the key election promises before the mid-term elections in the USA in November. In addition to a minimum tax of 15% on companies and changes in the healthcare system, it is above all the promotion of renewable energies that can be seen as the core issue of the bill.

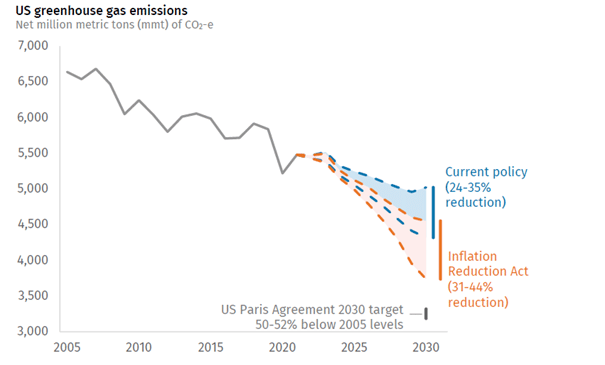

369 billion US-dollar are to be invested in renewable energies through various channels by 2030 and are intended to bring the USA closer to the goal set in the Paris Agreement of reducing CO2 emissions by 50% by 2030 compared to 2005.

As you can see in the following chart, the Inflation Reduction Act alone will not achieve this goal, but it does put the US back on track and re-establishes the United States as a leading force in the fight against climate change.

Strong tailwind for shares from the environmental sector

The subsidies are very broad and affect virtually every part of the renewable energy value chain – examples?

- 30 billion USD to build local manufacturing capacity for wind and solar

- 10-year extension for subsidies for wind and solar projects, depending on the share of domestic products, subsidies can be up to 50% (!)

- 30 billion USD in loan and subsidy programs to accelerate the energy transition

- Up to USD 7,500 subsidy for the purchase of electric cars

- 27 billion USD to promote technologies that reduce CO2 emissions

Admittedly, some of these examples are woolly and we will see how they are actually implemented. The bill has over 700 pages and has changed several times. The fact is that the Inflation Reduction Act will have a positive effect on topics such as solar, wind, hydropower, hydrogen, batteries, electromobility, energy efficiency, etc. The stock market has already responded: Sunnova, the solar company mentioned above, has made almost +50% since the announcement of the bill and is also one of the largest positions in our funds.

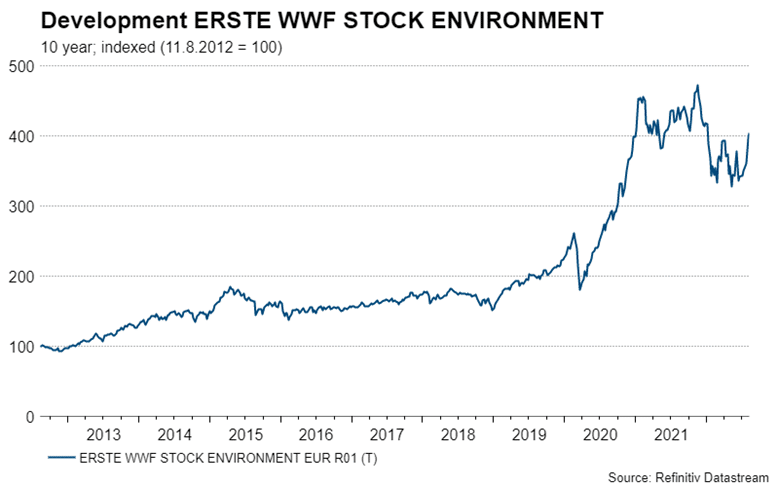

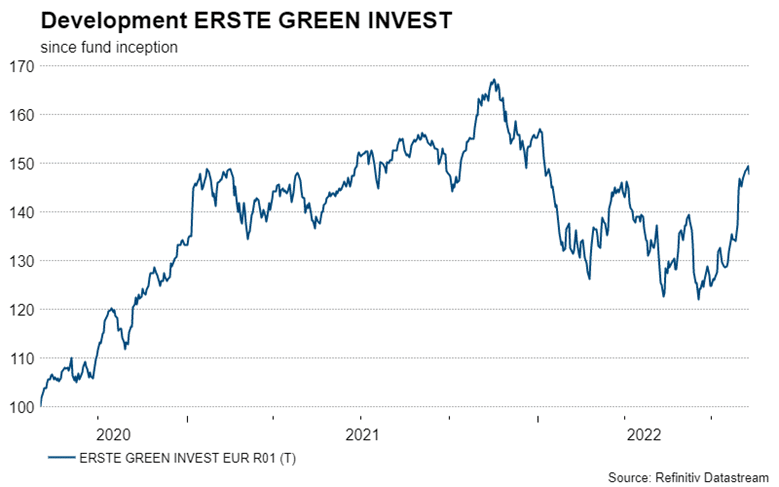

The ERSTE WWF STOCK ENVIRONMENT has gained more than 13% since the announcement on July, 27 – the ERSTE GREEN INVEST about 10%. In both funds we deliberately have an increased quota in the energy sector, which we have already built up after the outbreak of the Russia-Ukraine war. In the EU in May of this year € 600 billion were allocated for the promotion of renewable energies (REPower EU) – quasi for the same topics.

Almost ¾ of the fund is currently invested in stocks that will benefit from the Inflation Reduction Act and REPower EU. We therefore have a higher concentration in this segment than ever before – and we deliberately want to keep it high.

In a difficult market environment, it makes sense to focus on topics that have a structural advantage. For ERSTE WWF STOCK ENVIRONMENT and ERSTE GREEN INVEST, the global political tailwind, which has now also been cast into law in the USA, speaks for itself.

Having started with a quote from Joseph Stiglitz, I’d also like to end with one: “Development is about changing people’s lives, not just the economy.” The Inflation Reduction Act has the potential to accomplish both – we are confident!

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.