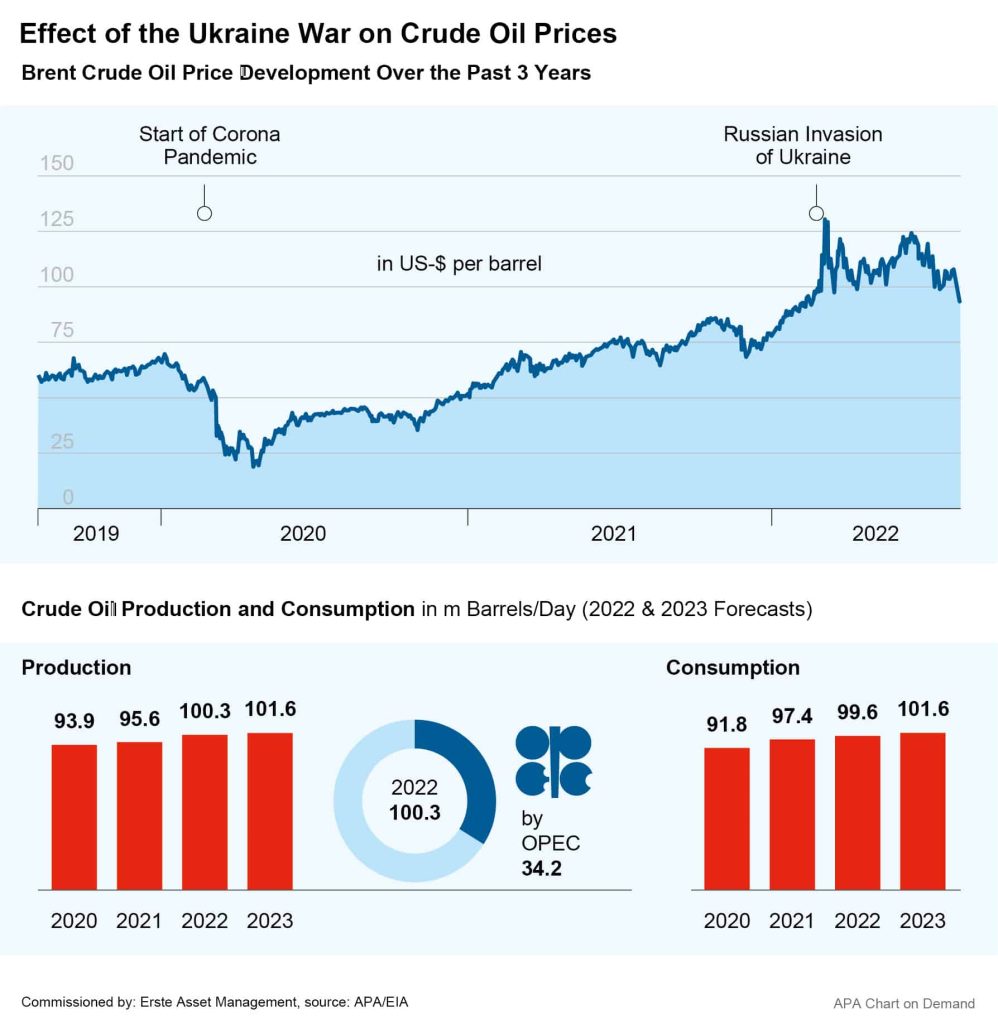

At its highly anticipated meeting last week, the extended alliance of oil producing countries, OPEC+, agreed a minimal increase in production volumes starting in autumn. Following the recent increases, the joint daily production target will be extended by 100,000 barrels (1 barrel = 159 litres) from September. OPEC justified its decision by referring to its low spare capacity. Thus, capacity has suffered from the lack of investment in the oil sector. The decision was met with disappointment in some quarters, as a much larger increase was widely expected in order to ease the supply situation and curb the soaring oil prices.

US President Joe Biden, for example, travelled to Saudi Arabia in July for a state visit – among other things, with the aim of achieving an increase of 400,000 to 500,000 barrels. In view of the high petrol prices at the filling stations and the skyrocketing inflation, Biden has a strong political interest in keeping oil prices low.

Europe has also been hoping for a larger increase in production from OPEC. This is because the EU oil embargo against Russia, imposed due to the Ukraine war, will come into force in December and prohibit Russian oil imports by ship. Many countries must therefore increase oil deliveries from other countries or even look for new suppliers to compensate for the loss.

Saudi Arabia Plans to Further Increase Oil Production in Case of Shortage

Saudi Arabia has already signalled its willingness to increase oil production significantly if necessary, should supply bottlenecks occur during the winter. According to insiders, Saudi Arabia, the Emirates and some other members of the export cartel have additional production capacities of 2 to 2.7 million barrels per day. Many other exporting countries, on the other hand, can hardly meet even the current quotas because their production facilities are dilapidated due to lacking investments.

Kazakhstan, for example, has recently dampened hopes for an expansion of oil deliveries to Europe. According to the Russian news agency Interfax, the country’s energy minister, Bolat Aktschulakov, recently said that Kazakhstan could not simply replace the quantities that would be lost through the renunciation of Russian oil. Oil production is not comparable to a water tap that can simply be opened up wider. “To produce such quantities of oil, you have to invest a lot of money in the fields and drill wells,” Aktschulakov said, adding that this requires a lot of time and money. For Austria, Kazakhstan is the most important importing country for oil, with a share of 40 per cent.

In any case, there are signs of a partial easing on the crude oil market: After oil prices rising for months, driven by the Ukraine war and the end of most pandemic-related restrictions, they have been coming back down from their highs in the last few weeks. The price of a barrel of Brent, the important reference oil grade, has recently fallen below 100 dollars per barrel and is now trading at about the level it had at the beginning of the Russian invasion of Ukraine. On Monday, Brent price lay at around 95 dollars.

ECB: Economic Impact of Oil Price Increases Manageable

The dampening effect of the oil price increases could also turn out to be less severe than feared. According to a recent study by the European Central Bank (ECB), a sustained oil price surge would only reduce the growth potential of the eurozone to a moderate extent. A prolonged price surge of 40 per cent over the next four years compared to 2017 to 2020 would reduce the growth potential for the eurozone by about 0.8 per cent in the medium term, according to an ECB study published in early August.

According to the experts, this would only be a “limited shock”. The EU Commission, for example, assumes a combined increase in growth potential of about 5.2 per cent over the next four years. The ECB refers to studies in which recent oil price increases are compared with the oil price crisis of the 1970s. According to the studies, the economy’s dependence on oil has decreased significantly since then. In 1973, for example, about one barrel of oil was needed to generate about 1,000 dollars in economic output (GDP). Today, less than half that amount is needed. According to the ECB’s calculations, a one per cent increase in oil price would reduce the growth potential of the eurozone by about 0.02 percent in the medium term.

In the view of the ECB experts, a central bank can mitigate the medium-term consequences for growth if it reacts to the inflationary pressure resulting from an oil price increase and thereby controls inflation expectations. “Moreover, current technological and economic conditions are very different from those that prevailed during previous oil price shocks,” the experts write.

Oil Companies Report Record Profits

Naturally, the beneficiaries of the high oil prices were the big oil companies. OMV, Repsol, Shell and TotalEnergies reported record profits at the close of July, with an increase from the previous year’s figures many times over. OMV, for example, roughly doubled its turnover and profit in the second quarter. The oil and gas group’s CCS operating profit before special effects, adjusted for inventory effects, rose to a record of EUR 2.9bn.

The French group Total increased its profit by 158 per cent to USD 5.7bn despite a write-down on a stake in a Russian gas producer. Adjusted for special effects, the result climbed to a record USD 9.8bn. Its industry peer TotalEnergies increased Q2 profits by 158 per cent to USD 5.7bn.

Spanish Repsol doubled its net profit to more than EUR 2.5bn. The Italian energy group Eni closed the first half of 2022 with a net profit of EUR 7.4bn. Although the volumes produced at Eni fell slightly, the extraordinary prices more than made up for that.

The British oil giants have also seen profits soaring recently. Shell made an adjusted profit of USD 11.5bn. That is more than twice as much as in the previous year. At the bottom line, the company earned USD 18bn, quintupling the previous year’s figure. BP tripled its profit in Q2 compared to the same period last year to USD 9.3bn.

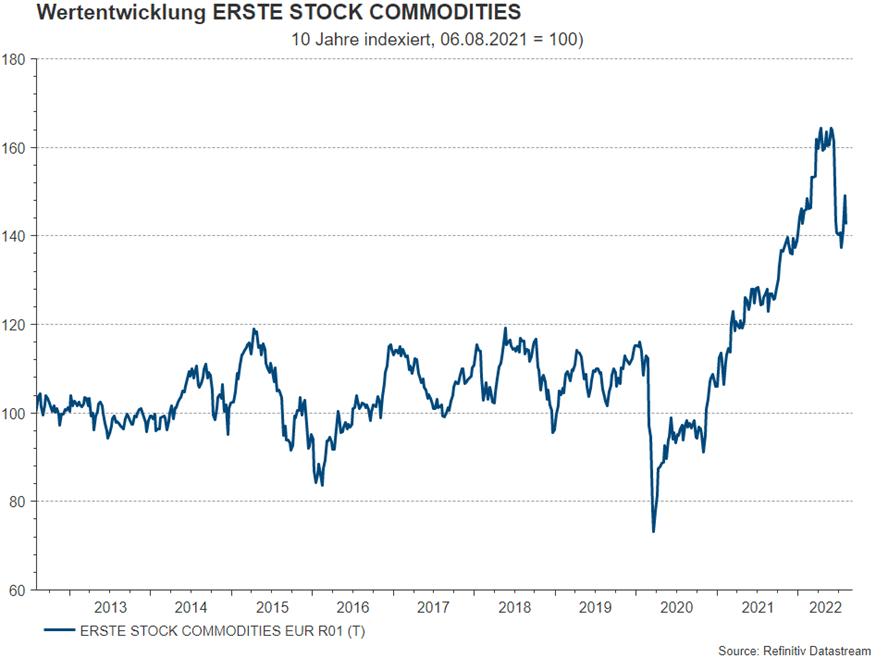

ERSTE STOCK COMMODITIES on the rise

Those who want to profit from the current high oil prices have the opportunity to invest in the world’s most important oil producers with the ERSTE STOCK COMMODITIES fund. This equity fund invests in commodity companies that are listed on the stock exchange. The investment strategy provides that the portfolio is divided in a balanced way into basic materials and energy. Preference is given to companies in the developed markets.

Despite the difficult first half of the year on the stock markets, the fund has performed well this year. Over a ten-year period, the average increase in value is 4.34% per year (source Erste AM, OeKB as of the end of June 2022, excluding front-end load and custody fees).

ERSTE STOCK COMMODITIES – Commodity stocks of developed markets

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.