Last week, leading politicians and economic experts from all over the world came together at the World Economic Forum in Davos, Switzerland, to discuss strategies for solving global problems. After a two-year forced break due to the pandemic, the invited political and economic leaders gathered at the annual World Economic Forum (WEF) meeting in the alpine village under very much changed circumstances. The world is no longer the same after the outbreak of the coronavirus pandemic and the Ukraine war. Accordingly, “History at a Turning Point” was the overarching theme, on which around 50 heads of state and more than 2000 delegates from economy and academia exchanged views.

The World Economic Forum was founded in 1971 by economist Klaus Schwab. Once a year, the Forum invites leading politicians, managers, scientists and media representatives from all over the world to its annual meeting in Davos to discuss important global issues. In recent years, however, Schwab has increasingly opened up the conference to opponents of globalisation as well as social and environmental organisations. This year, the opening speech was given by Ukrainian President Volodymyr Selenskyj. In a video address, he called on the international community to impose “maximum” sanctions against Russia, suggesting that there should be “no more trade with Russia”.

Pandemic and Ukraine War Have Exacerbated Global Problems

The pandemic and, right on its heels, the war in Ukraine have created many new problems and further aggravated existing ones. This was the gathered experts’ baseline opinion at the Forum. The pressure on climate policy for one, but also the debt crisis faced by poor countries has further intensified. More than a quarter of a billion people are at risk of descending into extreme poverty in 2022, according to a report published in Davos by the emergency aid and development organisation Oxfam.

Before the pandemic, inequality between countries was on the decline, but is now increasing again. The recovery is made more difficult by the high foreign debt many countries owe. According to Oxfam, 60 per cent of low-income countries are on the verge of insolvency. A survey of leading economists by the World Economic Forum shows a similar picture: 81 per cent of the economists surveyed expect the risk of default by low-income countries to have increased since the outbreak of the Ukraine war. Only 37 per cent expect a higher risk for the industrialised nations.

Focus on Supply Chain Problems, Food Shortages and Climate Change

A growing problem for the global economy is also the ongoing supply chain bottlenecks and the risks of high dependence on certain suppliers and countries. Most recently, the severe lockdowns in China have again exacerbated supply problems. Top politicians such as the German Minister of Economics, Robert Habeck, left no doubt in Davos that turning away from globalisation is no solution to the problems. But the rules will have to change to ensure greater resiliency, the Green politician said.

“To be honest, the situation regarding the lockdowns in China is the biggest challenge right now because it has a huge impact on transport,” said Volvo Chief Purchasing Officer Andrea Fuder, calling it a historic supply crisis. The supply problems could reverse the trend towards globalisation and international integration of manufacturing chains. Thus, 79 per cent of the economists surveyed by the WEF expect a higher fragmentation of goods markets.

The food shortage, which was partly triggered by the climate crisis, has also been further exacerbated by the Ukraine war. David Beasley, head of the UN World Food Programme, spoke of the greatest humanitarian crisis since World War II, as the “breadbasket of Europe” is mostly out of the equation following the Russian invasion. Experts and politicians are warning of a global food crisis and hunger in many parts of the world.

Since the war began, world market prices for wheat have risen sharply. That in itself would be problem enough, but food will also become scarce, warns Beasley. Even before the war, estimates put 44 million people in 38 countries on the brink of famine. Now, another 40 million could be added to that number by the end of the year.

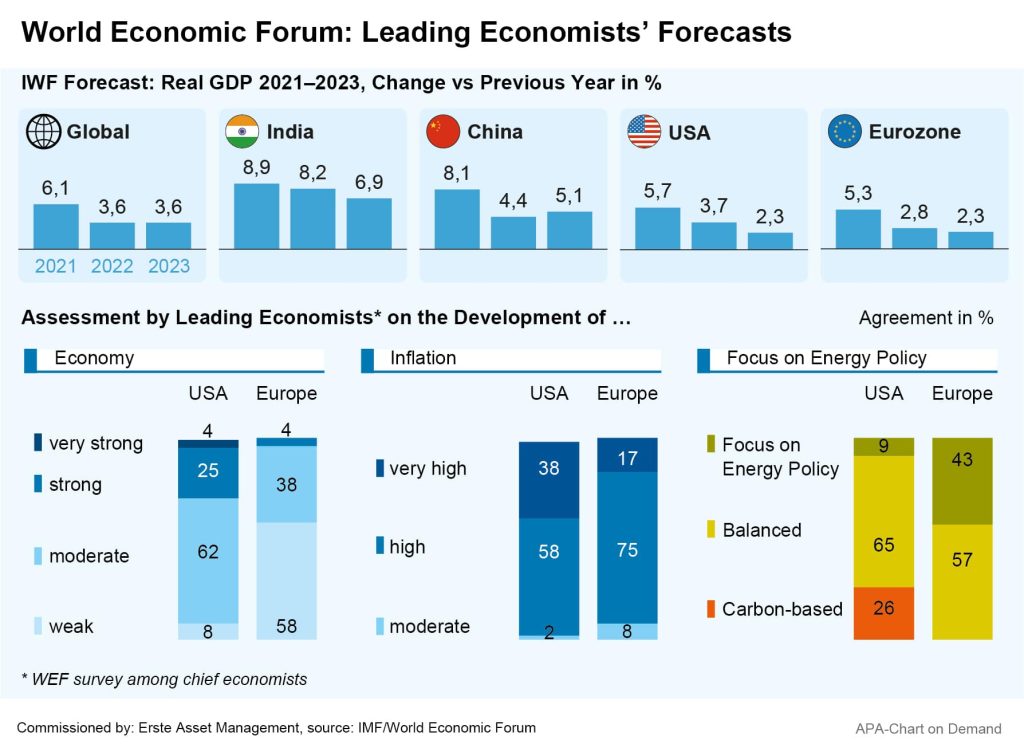

Climate policy also continues to be a key issue. Society has fallen far behind in the fight against climate change, said US investor George Soros. It is possible that climate change is already irreversible, Soros said. However, the Ukraine war and the Western nations’ sanctions against Russia have also forced and accelerated the transition to sustainable energy sources in many countries. Europe is likely pushing towards green energy harder than the US, according to the WEF survey. 43 per cent of economists expect a stronger move towards green energy sources in Europe, compared to only 9 per cent for the US.

Energy and Food Prices Fuel Inflation, but no Recession on the Horizon

Food and energy shortages are also likely to continue to drive price increases. Accordingly, the problem of high inflation rates was also a topic in Davos. The US Federal Reserve has already initiated an interest rate turnaround in the fight against inflation, the ECB only recently signalled an interest rate increase for July. In Davos, ECB chief Christine Lagarde affirmed that key interest rates could be back in the green by the end of the third quarter.

Lagarde cited a number of forces that acted as a counterweight to the pressures of the Ukraine war. Among other things, she pointed to low unemployment and high household savings. Lagarde does not expect a recession despite the war in Ukraine. “At the moment, we do not see a recession in the Eurozone,” the ECB president said. An economic downturn is currently not a base scenario for the central bank.

According to IMF chief Kristalina Georgieva, a global recession is also not in sight. The global economic growth of 3.6 per cent forecast by the International Monetary Fund is far from a recession, Georgieva said at the WEF Annual Meeting. In general, the economic experts gathered in Davos have become more cautious in their world economic outlook. 58 per cent of the economists surveyed by the WEF expect weaker economic growth for Europe. For the USA, 62 per cent of the experts expect moderate growth.

For a glossary of technical terms, please visit this link: Fonds-ABC | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.