On November 26, the traditional “Black Friday“ of discount deals in the US and many other countries officially kicks off the immensely important Christmas shopping season for many industries. However, in view of the trend towards online shopping, which has accelerated since the start of the coronavirus pandemic, restrictions that are still in place or have been reinstated, supply bottlenecks and rising inflation rates, the mega-shopping day constitutes a rocky start to this year’s Christmas season.

The shopping day, which is advertised with many promotions, originated in the US as a bridging day after the Thanksgiving holiday on the third Thursday in November. It has long been a popular day for Christmas shopping and by far one of the strongest sales days of the year. Numerous retailers celebrate Black Friday with special Christmas offers and discount promotions, with many goods offered at half price or even less. Americans traditionally flock to shopping malls on this day, some of which open as early as midnight.

In the 2000s, with the increasing trend toward online shopping, Black Friday saw the addition of Cyber Monday, the Monday after Thanksgiving, on which numerous online retailers offer their goods online at heavily discounted prices. In 2020, according to an estimate by the market researchers at Adobe Analytics, Americans are likely to have spent more than USD 10.8bn on purchases online on Cyber Monday – which means that it has overtaken Black Friday as the shopping day with the highest sales.

Meanwhile, Black Friday and Cyber Monday have also become increasingly established in European and Asian countries. According to a current forecast by the German Retail Association (HDE), German retailers are expecting record sales of around EUR 4.9bn on these two days this year, an increase of 27 per cent compared to the previous year.

Surveys Raise Hopes of Higher Spending than Last Year

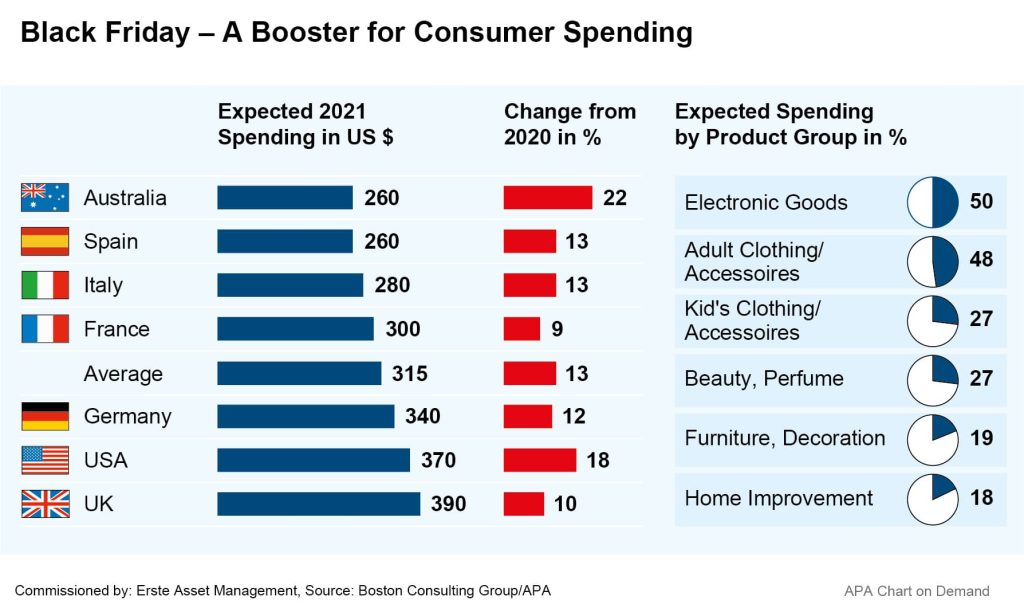

Retailers but also the financial markets are now eagerly awaiting the upcoming Black Friday. The day should provide a good indication of the overall Christmas business, and this is particularly important in the US economy, which is heavily dependent on domestic consumer spending. Initial forecasts are cautiously optimistic about the shopping weekend. A survey by Boston Consulting for eight major industrialized nations, for example, showed that 27 per cent of the consumers surveyed intend to spend more this year than last year. Only 14 per cent expect to spend less during this year’s Black Friday and Cyber Monday sales than they did in 2020.

The survey shows the strongest expected increases for the US, where 33 per cent of respondents plan to spend more than last year. Only 12 per cent expect their Christmas shopping to be more frugal this year. According to the survey, Americans are likely to spend an average of around EUR 370 per person this year during the two discount days. The UK slightly exceeds this value with EUR 390, while Germany is slightly below with EUR 340 per person. Recent announcements from companies also give reason to hope for stronger US Christmas sales: US retail giant Walmart for instance raised its forecasts for the entire year as part of its quarterly results presentation in anticipation of a good Christmas season.

A survey conducted by management consultants PwC for Germany came to a similar conclusion: 69 per cent of the German consumers surveyed plan to take advantage of Black Friday and Cyber Monday offers this year, intending to spend an average of EUR 266, 25 euros more than last year.

Once again, electronics and fashion items are at the top of the shopping lists. In the international survey conducted by Boston Consulting, one in two consumers stated that they also intend to buy consumer electronics this year. One in two Germans is also likely to be on the hunt for technology bargains, according to PwC. 36 per cent plan to buy fashion articles, shoes and accessories.

The trend toward online shopping, which has further been accelerated by the coronavirus pandemic and lockdowns in 2020, is likely to continue. 74 per cent of consumers surveyed by PwC, for example, plan to shop primarily online. Only 23 per cent intend to look for bargains in brick-and-mortar shops. The anti-coronavirus measures are likely to continue to make shopping sprees significantly less attractive, to which is added the fear of catching the virus in stationary retail, the PwC experts explain. According to the Boston Consulting survey, however, online retailing is unlikely to dominate to quite the same extent as in the previous year: Whereas 57 per cent of those surveyed by Boston had stated in 2020 that they only wanted to shop online, this figure was “only” 53 per cent in 2021.

Supply Bottlenecks and Inflation Could Curb People’s Enthusiasm for Shopping

However, people’s desire for shopping could be dampened this year by a number of additional factors. For example, the global computer chip supply bottlenecks are likely to affect the availability of the smartphones, computers and video game consoles that are in such high demand at Christmas. “Due to the strained supply chains, there may be bottlenecks in some product categories this year,” expects Christian Wulff of PwC for one. For example, many products are likely to be missing from store shelves in physical retail, while in online retail many consumers fear longer delivery times this year.

In addition, inflation is likely to put a further strain on Christmas sales. Recent price spikes could make it harder to grant discounts in key gift categories such as consumer electronics, and higher prices could reduce consumers’ willingness to buy. Rampant fear of inflation has already sent US consumer confidence to its lowest level in a decade in November. The University of Michigan’s consumer sentiment index fell 4.9 points to 66.8 this month, its lowest level since 2011.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.