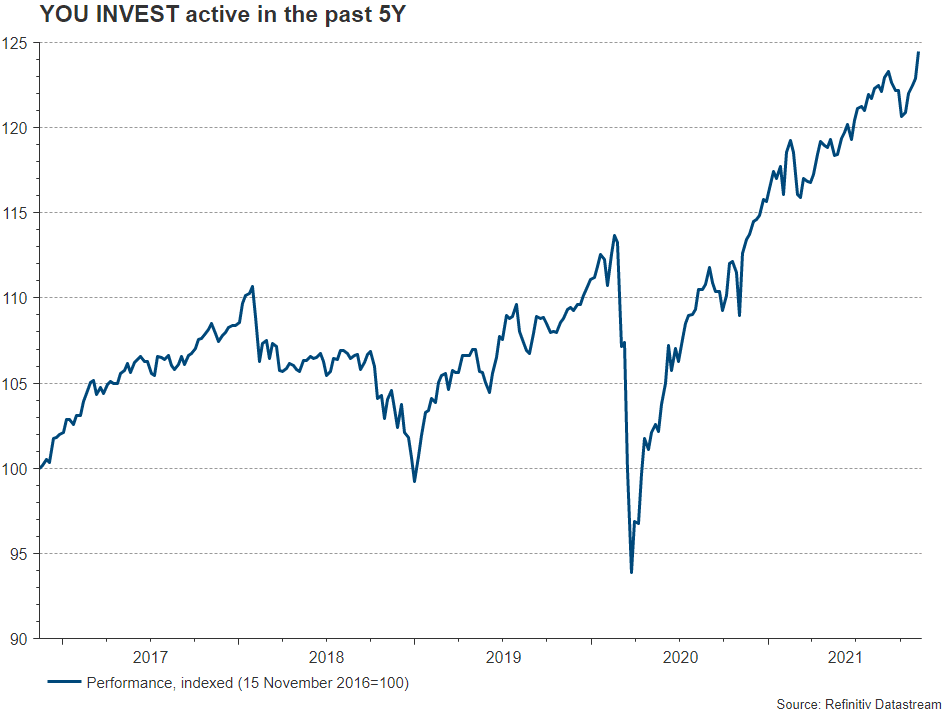

The months of November and December have traditionally always been the strongest months of the year on the stock exchange. The term “year-end rally” is sometimes used when prices are going up. The year 2021 has been a positive one for equity investors so far. The S&P 500 index, the index tracking the 500 biggest listed US companies, has gained about 25% in the year to date. Over the past five years, share prices have doubled on average (source: Refinitiv Datastream, as of 15 November 2021) despite the set-backs in the second half of 2019 and in spring of 2020 (the latter one due to corona).

More than 80% of companies exceeded their earnings estimates

In this article, we want to discuss the fundamental factors that have been driving the strong performance. How did the companies really do? Did they fulfil or even exceed their sales and earnings forecasts? In the USA, the Q3 reporting season is drawing to an end. By the beginning of the week, 92% of the S&P 500 companies had reported their results. Despite the dampening factors such as rising inflation, the sharply increasing covid numbers, and the supply bottlenecks in the industrial sector (especially due to shortages in the semiconductor segment), US companies reported surprisingly good figures: 81% of companies exceeded earnings expectations, 75% also exceeded sales expectations.

Q3 2021 earnings growth increased relatively to its referential 2020 figure by 39.1% y/y (source: FactSet). The consensus had estimated an increase of 27.4%, which would have already been significant. Historically speaking, this was the third-best Q3 ever. All sectors recorded positive growth, belying all those who had foreseen a slump in the economy after the lockdown rebound.

Financials and energy sector on top

The financial sector recorded the biggest gap between expected and actual results, while the energy sector posted the biggest discrepancy between analyst consensus and sales growth. At 12.9%, profit margins fell slightly short of expectations, but they remained close to the record highs of previous quarters and well above the 5Y average of 10.9%.

Valuations above long-term average

The relatively high equity valuations are the only fly in the ointment. At currently 21.2x, the 12M PE ratio is substantially above both 5Y (18.4x) and 10Y average (16.5x). The price hikes – mainly, but not only, in the energy sector – have affected the analysts’ estimates: for the ongoing Q4 they expect profit growth to continue at about 20% and sales growth to remain above 12%

YOU INVEST maintains high equity ratio

If you do not want to keep track of stock exchanges, inflation, and interest rates on a daily basis, YOU INVEST could be a comfortable way of building capital. YOU INVEST excels in flexible solutions, professional management, and high transparency. The variable allocation across several different asset classes is a crucial factor for a successful investment. Every asset class comes with different return chances and risks of losses. In order to establish an optimal ratio of risk and return, we diversify across a broad range of asset classes such as money markets, bonds, equities, and alternative investments. We also invest in various different regions and currencies. YOU INVEST is offered in various different types, depending on the degree of risk. We currently maintain a relatively optimistic equity ratio in all these types, which has paid off in terms of performance (please see the chart below).

YOU INVEST active, one of the types of the YOU INVEST line, offers investors a dynamic mix of different asset classes. The portfolio is continuously monitored by Erste Asset Management investment experts and optimised in accordance with the current opportunities in the market. The focus remains on equities, which account for the largest part of the portfolio at 42.8% (of a maximum of 50%). Due to the good economic environment and the earnings forecasts from companies, we also invest in high-yield bonds to optimise return. The fund remains underinvested in interest-sensitive government bonds that could be negatively affected by rising yields. Despite the positive growth outlook, stock exchanges may be subject to profit-taking and set-backs for other reasons at any time. It is therefore important to keep an eye on the risks of the markets. The fund managers of YOU INVEST active can quickly adjust the investment strategy to the market conditions and, for example, increase the bond or gold ratio.

CONCLUSION: the US companies have recorded high earnings and sales growth, as reflected in the drastic increase in share prices. If you do not want to keep track of the market on a daily basis but still want to benefit from return opportunities, YOU INVEST could be what you are looking for.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.