The USA and the EU are back on the same page as new President Joe Biden takes office. The new US climate envoy John Kerry, on his first visit to Brussels in this role, underlined the importance of the renewed climate alliance with Europe. “We are committed to renewing our strong alliance in the fight against the climate crisis,” the former US Secretary of State said in a joint statement with EU representatives last Wednesday.

Kerry also reaffirmed the high priority of climate policy for the new US administration and the importance of international cooperation in this regard. “We have no better partners for this than our friends here in Europe,” Kerry said during his visit, signaling a new start in transatlantic relations.

Kerry’s visit to Brussels is above all of great symbolic importance and represents the turnaround in US climate policy under its new President Joe Biden. During the election campaign, Biden had already announced increased international cooperation and ambitious climate goals as important cornerstones of his policy, sharply distinguishing himself from the course of his predecessor Donald Trump.

Biden reverses Trump’s withdrawal from climate protection agreement

At the outset of his term, Biden has already taken several steps in the fight against global warming – one being to impose a temporary drilling ban in the Arctic in January – and is currently planning the international climate summit “Earth Day” on 22 April. Furthermore, Biden has also reversed the US withdrawal from the Paris Climate Agreement announced by former US President Donald Trump.

The agreement, signed by 195 countries and the EU at the UN Climate Change Conference in Paris in 2015, aims to limit global warming to two degrees Celsius above pre-industrial levels. During his visit to Brussels, Kerry called for even more ambitious goals to manage the consequences of climate change: “Paris alone is not enough to accomplish this task,” said Kerry.

Europe and US aim for climate neutrality by 2050

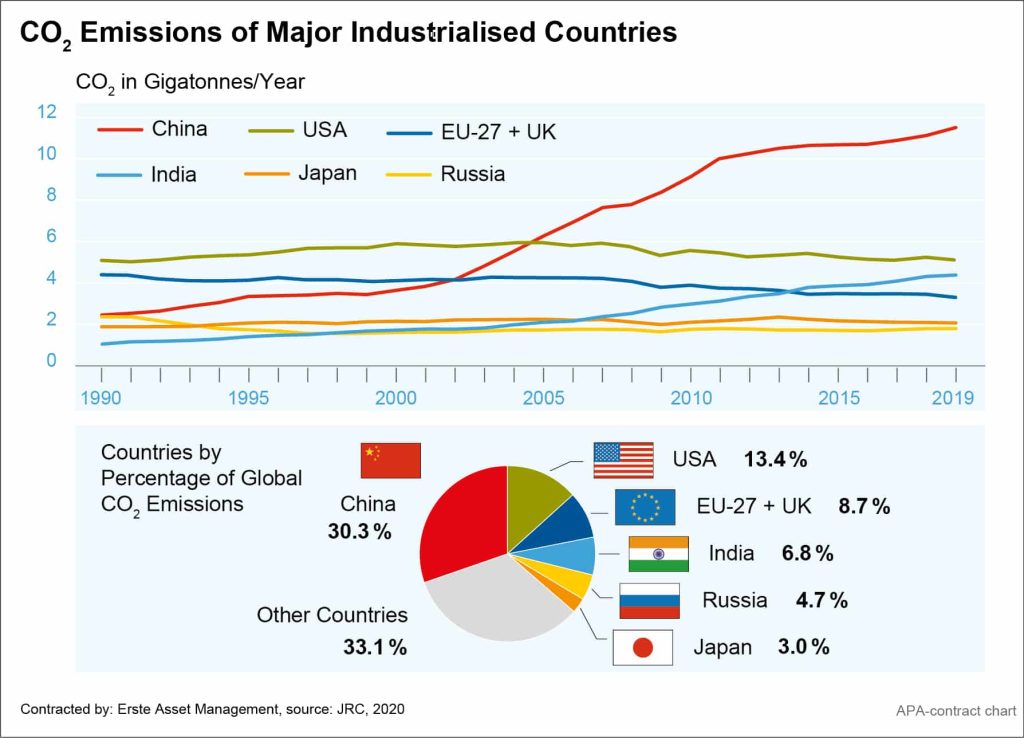

In order to meet the two-degree target set forth in the Paris Agreement, emissions of greenhouse gases such as carbon dioxide (CO2) must be capped. In their joint declaration, the US and Europe reaffirmed the goal of zero greenhouse gas emissions by 2050 at the latest. The EU wants to have Europe climate-neutral by then, which means eliminating as many CO2 emissions as are produced. By 2040, the EU wants to reduce greenhouse gases by 55 per cent compared to 1990 levels, according to its new target, which was tightened last year. By comparison, in 2019, EU CO2 emissions were some 25 per cent below 1990 levels, according to an EU report.

Kerry and EU representatives also called on other countries to follow the common goal of climate neutrality to limit global warming, emphasizing that the fight against global warming cannot succeed without the help of other major producers of greenhouse gases. The large emerging industrial nations are called upon here. Above all, countries such as China or India are responsible for the further increase in global CO2 emissions in the 21st Century, an EU report shows: in 2019, China was responsible for 30.3 per cent of global carbon dioxide emissions, according to EU data.

In addition to growth and other targets, China itself has actually included a climate target in the country’s 14th five-year plan, adopted in mid-March. The country wants to be climate-neutral by 2060. Raising the share of non-fossil energy sources in energy consumption to one-fifth by 2025 and 30 per cent by 2030. To achieve this, however, the capacities of nuclear power plants are to be increased.

Corporations and the super-rich jumping on the “climate bandwagon”

Corporationsare also increasingly adapting to the climate goals. Among the pioneers are automobile companies. Volkswagen, for example, wants to sell 70 per cent of all vehicles of its core brand VW in Europe with electric drive by 2030. For China and the USA, the car manufacturer is aiming for an electric car quota of at least 50 per cent. With the boom of EVs, the demand for lithium-ion batteries is also likely to increase massively. By 2025, the EU wants to be able to produce battery cells for at least seven million electric cars every year.

Finally, the initiatives of the super-rich are playing an increasingly important role in the fight against global warming. Amazon founder Jeff Bezos, for example, plans to step down from his chief executive position in the course of the year – among other things, to be able to devote more time to private projects such as the fight against climate change. Bezos, the second-wealthiest person on the planet, plans to donate USD 10bn towards this purpose. In a first round, his newly created Bezos Earth Fund will distribute USD 791m to organisations and projects committed to climate protection.

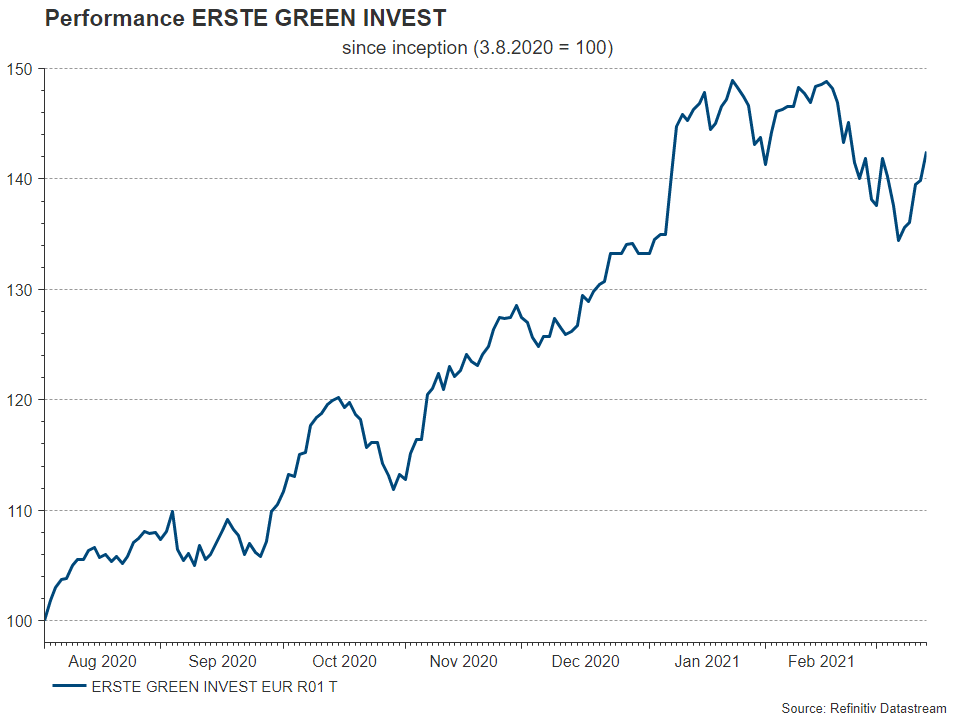

ERSTE GREEN INVEST: Potential for environmentally friendly technologies

In this promising long-term environment, the outlook for shares in companies that develop or exploit new environmental technologies is also positive. Given the increased valuation levels on the stock markets, interim corrections are possible and “healthy” at any time. The above-average growth rates of “green companies” should translate into better earnings opportunities for funds with a focus on ecology and environmental technology in the long term.

ERSTE GREEN INVEST invests worldwide primarily in companies in the field of environmental technology. The investment process of the fund is based on fundamental company analysis. Furthermore a measurable positive impact on the environment or society is paramount in the investment decision making. The selection of stocks takes place with a focus on companies in which an environmental benefit could be identified and which are primarily active in the areas of water treatment and -supply, recycling and waste management, renewable energy, energy-efficiency, mobility, transformation and adaption.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.