Many investors focus on capital gains while disregarding the significance of dividends. And are wrong in doing so, from my point of view. The total return of a share is after all the sum of capital gains (i.e. rising prices) and dividend income. Income from dividends is of particular relevance for investors with a long-term investment horizon.

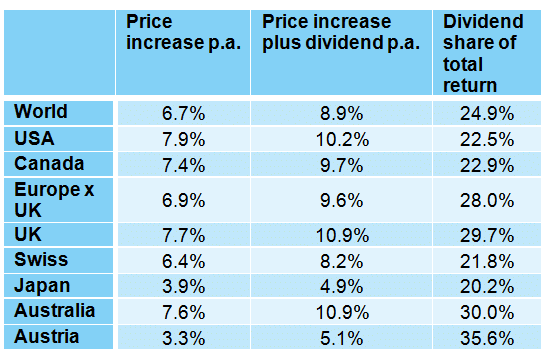

Fact 1: Dividend income accounts for 20% to 30% of the total return of equity investments

A look back into history (40 years) reveals the power of dividends. Let’s have a look at the total return of a global equity strategy – the MSCI World index in this case (in local currency, i.e. without foreign exchange fluctuations affecting the bottom line). From 31 January 1977 to 31 January 2017, the MSCI World index gained an average of 6.7% per year. When dividends are taken into consideration (and withholding tax is taken off), total return increases to 8.9%.

The dividend portion is particularly high in countries that traditionally show a high dividend yield, among them the UK, Australia, and also the Vienna stock exchange. In Switzerland, the share of dividend return over this period was about 22% – at the Vienna stock exchange, even 36% (see the following table).

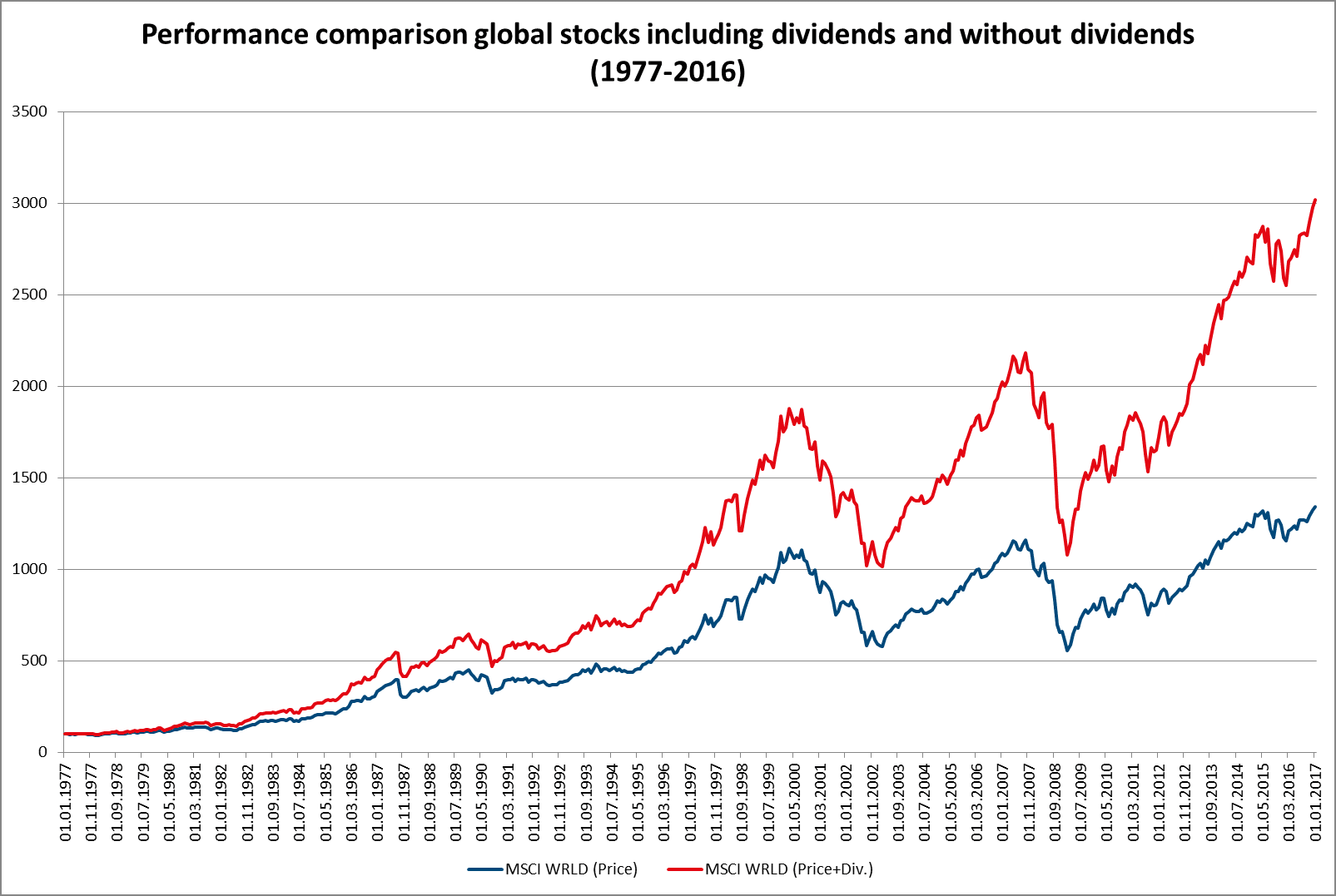

Fact 2: If the dividends are reinvested in equities, the compound interest effect works in the investor’s favour

Building on the aforementioned example of an investor with a long-term investment horizon, we assume his/her holdings consist of an equity portfolio over a period of 30 years; dividends are reinvested on the equity market (taking into account a withholding tax of 28%). Total return is twice as high as it would be without dividends. If he/she holds the equities even longer, the majority of income will be from dividends and reinvested dividends.

Fig. 1 (Source: Datastream)

Value calculated on the basis of the OeKB method. The performance does not allow for fees or taxes (exception: withholding tax on dividends of 28%). The one-off load falling due at the time of purchase and other costs diminishing return such as account and depositary fees have not been considered in the graph. Past performance is not indicative of the future development.

As the performance chart shows (fig. 1), the investment that includes dividends clearly outperforms a strategy that does not take into account dividends.

Fact 3: Cost average effect with reinvested dividends

Especially in a phase of strongly fluctuating prices with significant corrections and setbacks, the investor benefits by acting anti-cyclically. If prices fall, the investor can buy more shares with his/her dividends. The so-called cost-average effect fully benefits the investor. This of course is based on the idea that the investor reinvests the dividends immediately and without hesitation.

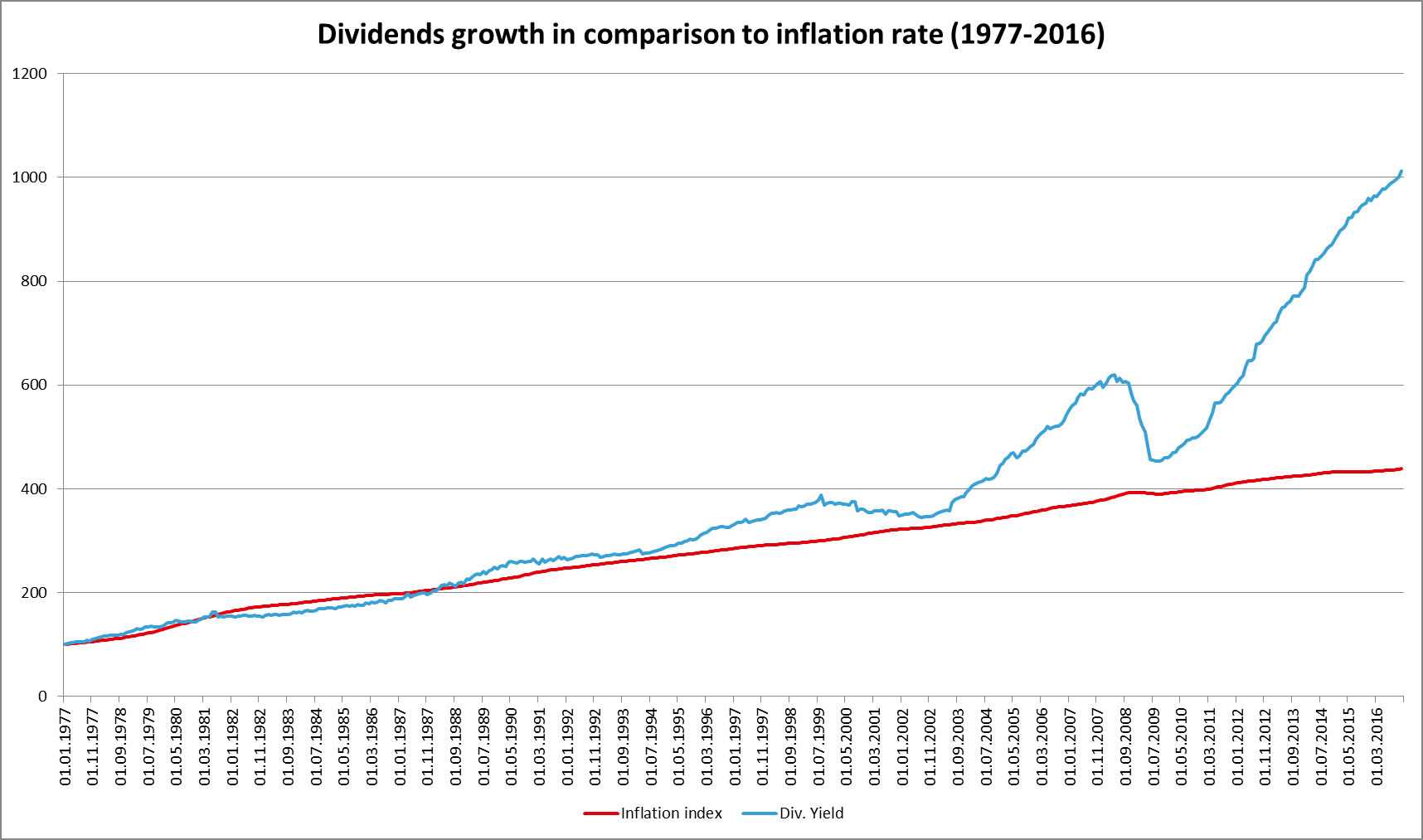

Fact 4: Dividends are inflation-protected

In contrast to bond coupons, the dividend payments of companies rise over time. The average increase of the dividends of MSCI World companies has been 5.9%. Over a period of 40 years, this equals a tenfold increase. From the 1970s to late into the 2000s, dividends would offer excellent protection against inflation. Since the financial crisis, dividends have even increased more significantly than inflation.

Fig. 2 (Source: Datastream)

Value calculated on the basis of the OeKB method. The performance does not allow for fees or taxes (exception: withholding tax on dividends of 28%). The one-off load falling due at the time of purchase and other costs diminishing return such as account and depositary fees have not been considered in the graph. Past performance is not indicative of the future development.

Generally speaking, there is a strong connection between inflation and dividend yield. When inflation is high, dividend yield tends to be high as well. That being said, at an inflation of 5% and above, the two parameters decouple, and there is also no correlation between the two during deflation. If inflation rises, dividend yield will also increase, all other things being equal. On the basis of this rationale, we can globally extrapolate an expected inflation rate of 2.4% from the currently observed dividend yield of 2.5%.

Fact 5: Dividend papers benefit from low interest rates and rising commodity prices

Equities with high dividend pay-outs do not behave in quite the same manner as the overall market does. This means that there are periods where the performance may be better or worse. An investor who deliberately invests mostly in shares with high dividends has to accept that. Falling or low government bond yields and at the same time rising commodity prices (especially the oil price) are the optimal environment for shares with a high dividend yield. When bond yields are on the rise, investors reallocate their assets from equities (with high yields) to bonds that are gradually becoming more attractive, and vice versa. In the long run, these phases of outperformance and underperformance even out. However, a comparison with the overall market may be misleading. Preferably investors should compare the performance of equities with high dividends with an according benchmark.

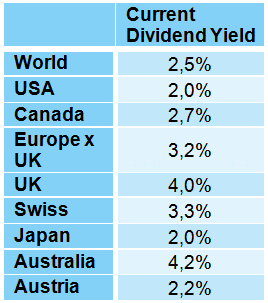

Dividend yield of selected countries:

Generally speaking, the dividend yields in most countries are currently at their historical average. The USA is the exception, with the dividend yield at the moment falling about 30% short of its long-term average. I ascribe that to the fact that the index composition has drastically changed over time. Technology companies such as Amazon or Google command a strong weighting in the indices while at the same time remaining typical growth shares with low dividends ratios, or no dividend pay-outs at all. This is one of the main reasons why the share of dividends in terms of total return has fallen from 30% to 20% in the USA. This tendency may well reverse once these companies have completed their strong growth phase and are starting to distribute some of their earnings as dividends to the investors. In this context it would be interesting to look at the past development of share buybacks and dividend payments. But this is a story for a another blog entry…

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.