Exactly 20 years ago, on 11 September 2001, the USA was shaken by the worst terrorist attacks in its history: Islamist terrorists crashed three hijacked planes into the World Trade Center in New York and the Pentagon near Washington. Another hijacked plane crashed in Pennsylvania. Roughly 3,000 people fell victim to the attacks.

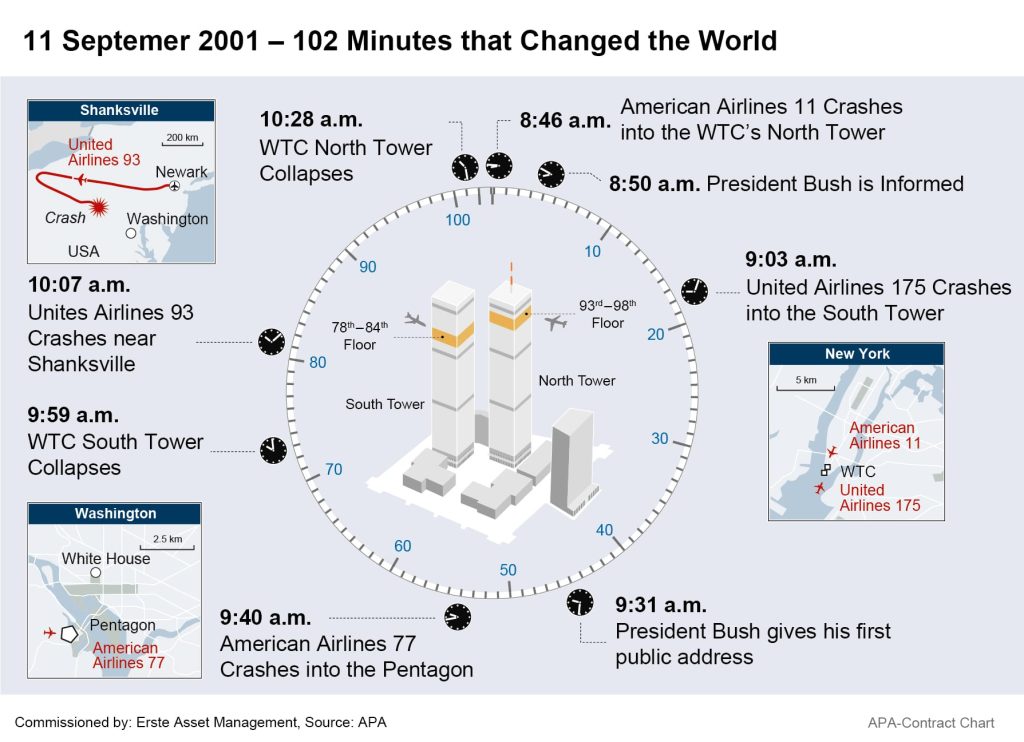

The whole world was in shock, witnessing the tragic deaths of countless people on live TV as the iconic World Trade Center’s two towers collapsed. War-like images came directly from one of the Western world’s most prestigious centres. 102 minutes passed between the first plane hitting one tower and the collapse of the second one – a little over an hour and a half, during which the apparent sense of security in the Western world itself was irrevocably damaged.

Terrorist Attacks also Triggered Panic Reactions on the Stock Exchanges

On the stock exchanges, the so-called Nine-Eleven attacks initially caused panic. On the day of the terrorist attacks, the German stock index DAX dropped by 11.4 per cent, the British FTSE by nearly 6 per cent. Share prices of airlines and insurance companies around the world plummeted – Lufthansa shares, for example, lost up to 23 per cent in value. Munich Re shares dropped by more than 10 per cent. In the deeply shocked city of New York itself, trade did not even open; the US Securities and Exchange Commission (SEC) closed all stock exchanges in the US.

The attacks also were a hard blow to the already battered real economy. After a ten-year economic boom, the US economy had declined in the third quarter – the terrorist attacks now sparked fears of an even weaker fourth quarter and, by definition, a slide into recession.

This was corroborated by direct economic effects, such as the temporary standstill of air traffic, but also by the rapid decline in consumer sentiment under the impact of the terrorist attacks. The consumer sentiment index compiled by the Conference Board research institute still held at 114.3 points in August; however, after the attacks the index fell to 82.2 points by November, a seven-year low. The US economy is particularly dependent on domestic consumption, so weak consumer sentiment is an ominous sign for economic development in the US. At the time, a recession was also feared for other important economic regions such as Europe and Japan.

The Threat of Recession was Averted

As a result, however, consumer sentiment and the US economy recovered quickly in Q4, averting the recession. The US stock markets, after hitting three-year lows in September, recovered significantly during the rest of the year. Overall, the terrorist attacks probably cost the country only 0.5 percentage points of growth in 2001, according to a study by the US Department of Homeland Security on the economic consequences of 9/11. While the average forecast for GDP growth in 2001 was 1.6 per cent just before the attacks, this consensus value fell to 1.1 per cent in their wake. According to the study, this difference can be used to indirectly infer the influence of the attacks.

The following years were also marked by a recovery of the economy and stock markets: US GDP grew by 2.4 per cent in 2002, driven by a significant recovery in the service industry, and by an even higher 3.1 per cent in the following year. However, the increasing economic revival did not affect the labour market – a phenomenon known as “jobless growth”. By mid-2003, the unemployment rate had climbed to over 6 per cent. With its focus on domestic demand, the US economy also relies heavily on a solid labour market.

US President Bush Reacted with Retaliatory Strikes

As severe as the economic consequences in the aftermath of the terrorist attacks were, the consequences for foreign politics were more severe. In response to the attacks, then-US President George W. Bush launched several retaliatory strikes: the invasion of Afghanistan, where the Taliban had given shelter to al-Qaida, was followed by the invasion of Iraq in 2003. But the US forces also launched drone strikes in numerous other countries, for example in Pakistan, Somalia and Yemen.

As a consequence, the US did not suffer another attack like the one on 11 September, al-Qaeda leader Osama bin Laden was shot dead by US elite soldiers in Pakistan in 2011, Iraqi dictator Saddam Hussein was overthrown and executed, and elections and women’s rights were introduced in Afghanistan.

But the US grew weary of war over the years. While President Barack Obama withdrew US troops from Iraq in 2011, his successor Donald Trump agreed with the Taliban on a complete troop withdrawal from Afghanistan in 2020, which was finally completed by his successor Joe Biden. In the meantime, the militant Islamist Taliban have taken power in Afghanistan again. Coinciding with the 20th anniversary of the attacks, Afghanistan’s new government will be sworn in on Saturday.

Biden Plans to Focus more on China and Other Geopolitical Challenges

“We are now coming to the end of a strategic cycle, and a bracket is closing in which international jihadism was the only declared enemy,” believes French political scientist Elie Tenenbaum. The strategic competition between the great powers is now likely to come back into focus.

Former National Security Advisor John Bolton recently warned that Afghanistan could once again become a “refuge” for terrorist groups. However, 20 years after the attacks, US President Biden now wants to take a new course, with US foreign and security policy focusing more on other regions in the future, particularly on emerging China, which is now seen as the greatest geopolitical challenge.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.