How the yield curve of a bond looks depends on several factors. In his article, fund manager Tolgahan Memişoğlu explains what this means and why yield curves could become steeper again in the future.

Article on tag "bonds"

Capital Market Outlook 2023: Upward potential for funds after market corrections

After months of market turmoil, the experts of Erste Asset Management can see light at the end of the tunnel despite the global economic challenges. There is a chance that the predicted recession in 2023 would not hit, or if it did, it would do so only mildly, as stated at the press conference on the Capital Market Outlook 2023.

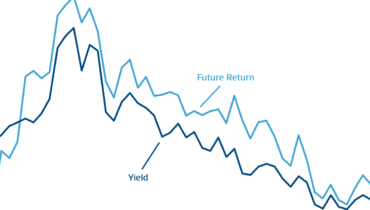

Yield and Return on Bonds

How are interest rates and future bond returns related? Why can the yield be higher than current interest rates? Our blog looks at the correlations in fixed-income investments.

Outlook: Development of the neutral real interest rate

This year brought a turning point in the monetary policy of the major central banks. The crucial question is whether this turning point is cyclical or structural. It is therefore worth taking a look at the neutral interest rate, as this captures structural macroeconomic changes.

Good nerves and stamina required

The mood on the capital markets has deteriorated further over the last months. In a comprehensive market update, Gerald Stadlbauer, Head of Discretionary Portfolio Management at Erste Asset Management, explains why stamina is needed in the current situation.

Mixed outlook for the second half of the year

Ahead of the upcoming reporting season, several negative factors dominate the markets. Tamás Menyhárt, Senior Fund Manager at Erste Asset Management, sums up the stock market year so far and shares his views on the further development.

Alternative investments defy market losses

The losses of equities, bonds and gold since the beginning of April have put the limelight on the asset class of alternative investments. What are the characteristics of such an asset? Can this slow the downturn? And how can you invest?

Investing – a long term story

We have seen some extraordinary years speaking about equity and multi asset performance. Interest rates were low, volatility – representing the average daily price changes – was comparably low. What is the situation today?

Italy is electing a new president

Italy is about to elect a new president of state. The election that will be held from 24 January 2022 in several ballots is going to determine the successor of the current, 80-year old President Sergio Mattarella, whose mandate expires in February 2022. This was announced by the president of the chamber of deputies of […]

Pandemic year three: what are the challenges ahead?

We are now into the third year of the pandemic. Since the spring 2020 collapse, economic activity and markets have shown exceptional resilience. This is not to be taken for granted. After all, the list of potential negative influences (“challenges”) is long.