How do alternative investment strategies actually work and how can investors invest in them? To get to the bottom of these questions, we will discuss two common strategies from the world of alternative investments in this blog post.

What is Alternative Equity?

Alternative Equity offers access to the world of hedge funds. Investors follow regional, sectoral or factor-based approaches to equities – i.e. they usually invest in different regions, sectors or factors. The addition of hedge funds, an area with a great deal of independence, creates direct advantages. This results in more broadly diversified equity investments.

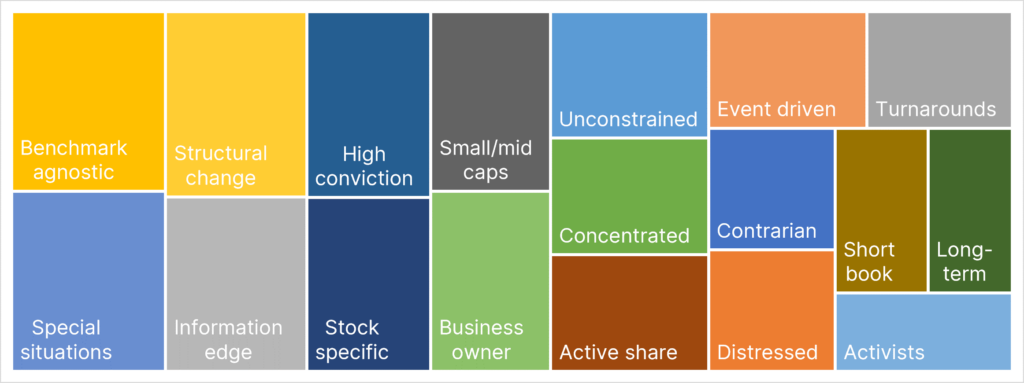

Alternative Equity funds focus on company-specific events. Their analytical capacity is focused on a limited number of shares in order to gain an information advantage and provide a corresponding scope for the fund result. Consequently, benchmark indices take a back seat. The “active share”, the portion of the portfolio that does not correspond to a benchmark, becomes high.

Graphic: The wording of alternative equity

In any case, concentrated portfolios – i.e. a stock selection with high conviction – are a fixed point. In most cases, the reason for this approach is an expected, significant event (“special situations”).

Fields that lie outside the focus of analysts at large investment banks offer well-connected specialists a rewarding basis and are therefore part of Alternative Equity. These include stocks with low market capitalization (“small/mid-caps”) and the Asian region, which requires very country-specific access and local representation.

Alternative Equity funds can see themselves as “business owners” in the sense that capital is invested in a limited number of companies strictly according to their business model. Investments can also be made in companies that are themselves “owner-managed”.

Alternative Equity includes the “contrarian” strategy. Contrarian funds specifically look for companies that are currently not enjoying the favor of the market, but where an extremely detailed analysis shows that a “turnaround” is conceivable and likely.

What are the advantages of Alternative Equity and what are the potential risks?

It refers to equity strategies that differ from conventional equity funds. Alternative Equity opens the door to hedge funds. This segment should be taken into account by investors in order to be more differentiated in their equity investments. However, it should also be noted that the asset class is not comparable with traditional asset classes such as equities or bonds.

What is meant by Alternative Trend?

Alternative Trend comprises precisely those strategies with the lowest dependency (correlation) to equities and bonds. Alternative Trend thus facilitates the construction and diversification of mixed portfolios. In critical stress phases, this low dependency leads to “crisis alpha” via the isolated part of the portfolio.

❔ What means “crisis alpha” ❔

“Crisis alpha” stands for an investment result that is independent of equities and bonds, which occurs when a part of the portfolio is “isolated” during a critical stress phase on the stock markets. A stock market crash in particular can be very detrimental – this is precisely where it is useful for one element to remain stable and largely unaffected.

Managed Futures and Global Macro are the components of Alternative Trend. Both strategies are mixed (multi-asset) portfolios with a built-in “shorting” option, i.e. with the freedom to profit from falling prices. This possibility does not exist for traditional equity funds and bond funds.

Note: Past performance is not a reliable indicator of future performance. Presentation of indices, no direct investment possible. The indices mentioned were only used for comparison. The benchmark index has no influence on the discretionary powers of the management company when selecting the assets of ERSTE Alternative Equity and ERSTE Alternative Trend. Source: Bloomberg; as at 31.12.2023; Global Equity Index = MSCI ACWI Index, Managed Futures Index = HFRX Systematic Diversified CTA Index

Asset classes managed futures and equities

The Managed Futures and Global Macro strategies set themselves the task of identifying the trends currently determining all global investment opportunities. They differ in that Managed Futures is a systematic, i.e. purely model-driven approach, while Global Macro is subject to the ongoing assessment of the situation by a fund manager. Leveraged positions can be taken within asset classes with lower volatility, such as government bonds.

What are the advantages of Alternative Trend and what are the potential risks?

Alternative Trend offers additional diversification within a portfolio of equities and bonds that is otherwise almost impossible to achieve – due to the low dependency (correlation) – as well as crisis alpha in critical stress phases. Investors should also be aware that the fund price can fluctuate significantly from time to time.

Conclusion

For investors who want to swim against the tide of equity funds and bond funds, alternative investments offer the opportunity. We have presented strategies in the equity and trend areas in this article. It is important to note that investing in securities involves risks as well as opportunities.

How can investors invest?

In the area of alternative equity and alternative trend, it makes sense to combine several managers in one product in order to take comprehensive account of the diverse approaches. At Erste Asset Management, ERSTE Alternative Equity and ERSTE Alternative Trend are the direct access to alternative investments.

Note: The funds pursue an active investment policy and are not based on a benchmark index. The assets are selected on a discretionary basis and the discretion of the management company is not restricted. Please note that investing in securities entails risks in addition to the opportunities described above.

Advantages for the investor

- UCITS-compliant fund for equity-based hedge fund strategies / absolute return fund of funds.

- Broad diversification across several investment strategies and asset managers.

- The foreign currency risk is largely hedged.

Risks to be considered

- The asset class is not comparable with traditional asset classes.

- The net asset value can fluctuate significantly.

- Limited transparency of sub funds.

- Possibility of a total loss.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.