“Higher for longer” has become the mantra of powerful central bankers in recent months. For example, the British central banker Andrew Baily recently said “we will need to keep interest rates high enough for long enough to ensure that we get the job done”. Jay Powell and Christine Lagarde also adopted a similar tone in their most recent interest rate decisions at the end of September. While the ECB raised rates again to 4.5%, both the Fed and the Bank of England paused. Regardless of whether the major central banks will follow up with a final rate hike in autumn, one can confidently claim that the interest rate peak has essentially been reached and that “the worst” should be behind us.

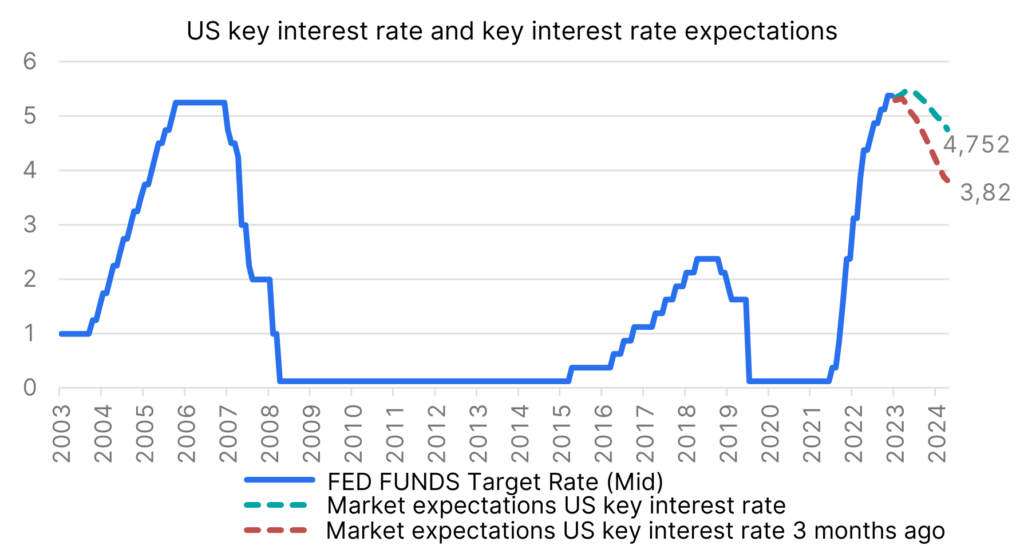

After all, we have seen the most aggressive rate hike cycle in recent history with an unprecedented 10 (ECB) or 11 (Fed) rate hikes within a few months and whether the key interest rate peaks at 5.5% or 5.75% in the case of the US is ultimately irrelevant. Much more important than the level is the duration of this restrictive environment and here the assessment among market participants has recently changed noticeably. As the chart below shows, key interest rate expectations in particular have shifted significantly upwards in the coming year, which has had a noticeable impact on the bond markets in particular, but also on the equity markets.

Source: Bloomberg; Note: Past performance is not an indicator of future developments. Prognoses are not a reliable indicator for future performance.

In this environment, the price of oil is literally adding fuel to the fire, and its recent rise has come at an inopportune time for the fight against inflation. The black gold climbed almost 30% in the last quarter, primarily due to OPEC production cuts and lower US crude oil inventories. However, given that the oil price increase is supply-side induced, the pass-through effects to other inflation components should be limited.

However, with the USD 100 per barrel mark approaching in the meantime, the pressure on inflation and its expectation is increasing, which in turn confirms the central banks in their course. In addition, the labour market in the USA remains extremely robust and the economy is not showing any signs of weakening despite the high interest rates. For example, the model-based estimate of the Federal Reserve Bank of Atlanta signals growth of 4.9% in the fourth quarter.

Even if this is probably overstating the case, it can nevertheless be said that the US economy is currently far from the feared recession. Even the battered industrial sector seems to be recovering, as the latest publication of the ISM Purchasing Managers’ Index for the manufacturing sector shows – with 49 instead of the expected 47.9, not only was the surprise particularly positive, but the index is also approaching the expansionary range again. The “soft landing” mentioned in the preface thus remains a thoroughly valid scenario in the view of many market participants. The situation in Europe is different, where above all the former growth engine Germany is weakening and the entire Eurozone is heading for economically difficult times.

O’zapft is!

Regardless of any growth worries in Germany, thousands and thousands flocked to Munich’s Oktoberfest (which, interestingly enough, takes place primarily in September) in recent weeks and indulged in the fun. Even the price of €13.75 for a “Maß” beer is unlikely to have deterred any guests, because after all, the demand after Corona is still catching up. Moreover, this year’s Wiesen visitors (following the colleagues from Berenberg Research) could actually afford more beer in real terms than in previous years. While the price of the “Maß” has risen almost twice as much as the general basket of goods since 1990, this year’s beer price increase of 4.2% was even below the current overall inflation of 4.5%. In addition, German wages climbed by 6.6% year-on-year, so there was nothing to stop the celebration.

When looking at the chart below, however, at least politicians and many CEOs should lose their celebratory mood. The much-observed ZEW indicators paint a gloomy picture of the German economy – although forward-looking expectations have stabilised at a low level, the current economic situation is seen as being as bad as in the initial phase of the Corona pandemic. The German economy is weakening and even the “sick man of Europe” has been increasingly mentioned recently.

Source: Bloomberg; Note: Past performance is not an indicator of future developments. Prognoses are not a reliable indicator for future performance.

However, a comparison with the late 1990s, when Germany was struggling with high unemployment and low productivity, is probably not appropriate. Our big neighbour is currently suffering particularly badly from external shocks such as China’s economic weakness and the energy crisis. In addition, the German export economy has focused strongly on cyclical goods such as cars or chemicals. It is therefore hardly surprising that Germany suffers more than service-oriented economies such as France or Spain in a phase of economic weakness in the global economy.

Even though Germany is likely to be the only developed economy to experience a contraction in 2023, all is not lost. Similar to the US, the labour market is close to full employment and due to the shortage of skilled workers, the number of job vacancies is extraordinarily high, which implies a certain resilience. In terms of resilience, the solid SME sector, which is responsible for almost 60% of employment and thus represents the backbone of the German economy, should also help, as it does here.

In addition, Germany’s public coffers are well-filled – with a debt ratio of 65.9% (compared to Austria: 80.6%), the German government would have plenty of financial leeway for fiscal stimulus, increased investment in infrastructure, some of which is getting on in years, or the overdue climate and energy turnaround. The problems are known, the funds are available and the political will for change also seems to be there – so it remains to be hoped that the traffic light coalition will also find the necessary unity for reforms.

“Golden” or “stormy” autumn?

From a meteorological point of view, autumn is definitely “golden” in view of the current late summer temperatures. In terms of the capital markets, however, a turnaround would be needed soon to be able to issue the same predicate here. The situation as mentioned remains extremely complex – while numerous leading indicators point to difficult economic times, the US economy surprises with strong growth month after month. The accompanying central bank policy thus remains restrictive for longer in any case and inflation is falling, albeit more slowly than hoped. As the Hamas attack on Israel at the weekend showed, the geopolitical tensions are becoming more rather than less, unfortunately. The effect on the capital markets seems to be limited – but another conflict means another source of uncertainty, and uncertainty often leads to increased volatility.

Even though the current environment is characterised by a high degree of uncertainty, it is important to note that this uncertainty has so far not had a noticeable negative impact on the global consumer and therefore not on the economy. Corporate profits remain resilient and the medium-term profit outlook is also quite positive.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.