Interview with Wolfgang Zemanek,

Head of Fixed Income Fund Management, Erste Asset Management

The year 2021 has begun with a large leap of faith for risky assets. The start of the vaccination programmes against Covid-19 as well as the strong company results have caused the prices of shares and speculative corporate bonds to increase. Are investors maybe too euphoric in view of the prolongation or even tightening of the lockdown? Or is the optimism justified?

I would like to answer this question in two parts: looking at the real economy, we can say that the situation has changed from just a few months ago. The economic data have clearly improved, and the economic growth forecasts have been revised up by a significant degree. For example, the US Fed expects the US economy to grow by 6.5% in 2021. In December, that forecast had been at 4.2%. Also, the USA has passed a massive stimulus package of USD 1,900bn, which might support consumption and exports even further. In Asia, the economic engine has been humming away for some time. That is why the positive sentiment of investors is justified. Europe is trailing this development: some countries have problems rolling out the vaccine. The numbers are not yet where the governments would like to see them. That being said, the situation will improve on the European continent as the vaccination protocols unfold. At Erste Asset Management, we expect the European economy to pick up speed as the strain from the pandemic subsides throughout the year.

US Treasuries have experienced a drastic increase in yields and a weaker US dollar. Do you see us at a point where the potential of yield increases has been fully exploited yet (for now) – not the least in view of the steadfast announcement of the central banks to continue buying government bonds?

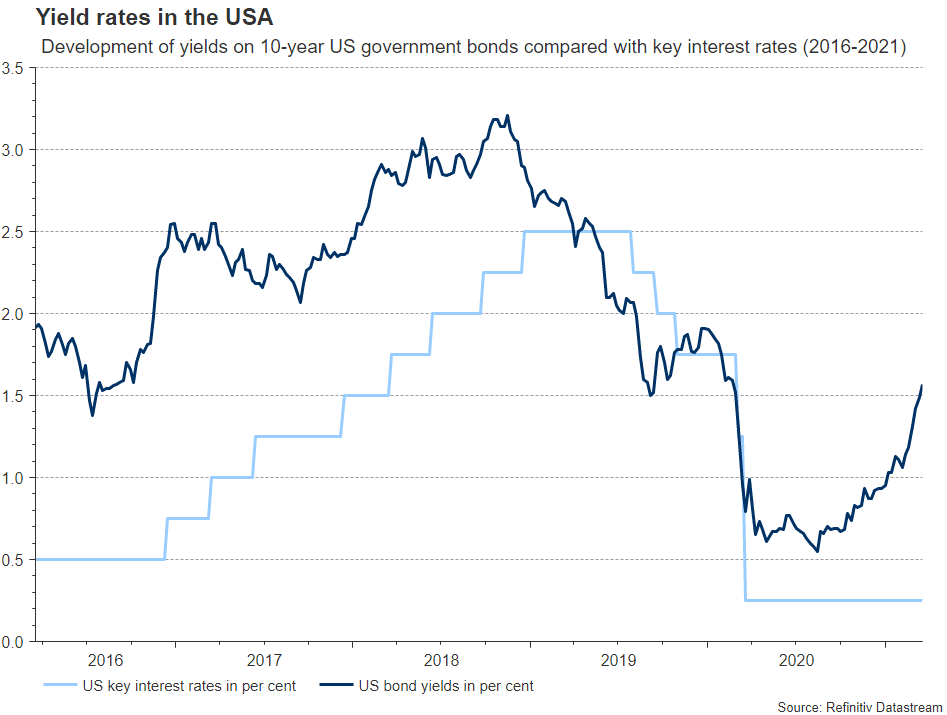

At the moment, we can see strongly rising company earnings, rising US Treasury yields, and continued activities by global central banks permanently expanding their balance sheet total by buying securities. The discussion about a possible return of inflation and rate hikes coming sooner than previously expected by analysts has emerged. This is particularly true for the USA due to the positive outlook, and because many central banks have been monitoring the deflation risk (i.e. the long-term decline in the level of prices) since the financial crisis in 2008. Banks were worried for years about the development of inflation and growth and the fact that they were not in line with what they regarded as called for.

What we now have is the result of the loose monetary policy of the central banks, which – judging by their rhetoric – might last a while longer still, and of the fiscal packages, especially in the USA. The US central bank is not even entertaining the idea of raising interest rates. Fed President Powell has recently said that despite an upswing in the economy, the central bank was still far off its defined targets for employment and price development. In other words: inflation is a spectre that is being called on because it (i.e. inflation) is connected to excessiveness. A moderate inflation of about 2% is actually the declared target of the central banks, and it is a healthy one at that. The monetary policy will therefore remain unchanged for the time being. The key-lending rates will probably remain around zero until 2023. The ECB does not see any reason to raise the rates either.

“The key-lending rates will probably remain around zero until 2023”

Wolfgang Zemanek,

Head of Fixed Income Fund Management

Erste Asset Management.

Foto: Copyright Huger

The yields of US Treasuries have picked up noticeably in the run-up to recent announcements by the Fed. Do you think they have peaked for now, or will they continue to rise?

Let’s put this into perspective. We have come from very low levels, and a level of 1% to 2% is not really high for 10Y US Treasuries – just look at the yields ten years ago. Due to the economic optimism we think it is possible and indeed likely for yields to go further towards 2%. This substantiates our base case scenario of a normalisation. It also leads to the steepening of the yield curve, i.e. the increase of the difference between the interest rates at the short end and at the long end.

What is your medium-term scenario for economic growth, inflation, and interest rates? Do you think they could pick up substantially in Europe as well? Is inflation being underestimated?

Much like in the USA, we can also see a normalisation in Europe. While Europe is lagging behind somewhat, the gap could narrow over the year. Therefore, sooner or later the pressure will rise on yields in the Eurozone as well. However, we believe that the yields will increase at a much slower pace than in the USA, if at all. The policy of the ECB is significantly looser than that of the US Fed. The ECB’s pandemic emergency purchase programme (PEPP), a purchase programme with expiry date for bonds from public and private debtors, will continue to support liquidity on the market. Initially, the programme was budgeted at EUR 750bn. On 4 June 2020, the ECB Council increased the volume by EUR 600bn, and on 10 December 2020 by EUR 500bn to a total of EUR 1,850bn. The ECB wants to make sure it does not throttle the delicate economic upswing.

What is the positioning of Erste Asset Management vis-à-vis bonds in the current environment? Are US Treasuries or euro government bonds attractive again, or do you continue to give them a wide berth? Where can bond investors find the best opportunities?

We have positioned ourselves in proximity to the investors and market participants. The overarching topic on the markets is the search for yield and normalisation. This is driving investors into asset classes which offer yields that allow them to offset their inflation-induced losses. We are still a bit cautious with US Treasuries, because the upward potential for yields has not yet been fully exhausted. The situation is different in the Eurozone: here, the ECB is pre-empting any potential yield increases with its aforementioned PEPP. From our point of view, bonds with a certain spread currently offer an attractive risk/return profile; more specifically, high-yield bonds from Europe, and globally speaking, sustainable high-yield bonds. In addition, emerging markets corporate bonds remain an asset class we have liked for a long time. For more conservative investors, investment grade corporate bonds offer a good chance to increase their rate of return.

Funds holding bonds that we referred to in the interview

High-yielding corporate bonds with currency hedging in euros

ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD

Global high-yield corporate bonds with a focus on sustainability

Corporate bonds from emerging markets, with foreign currency risk hedged against the euro

Investments with subordinated bonds with currency hedging in euros

Legal note:

Prognoses are no reliable indicator for future performance.