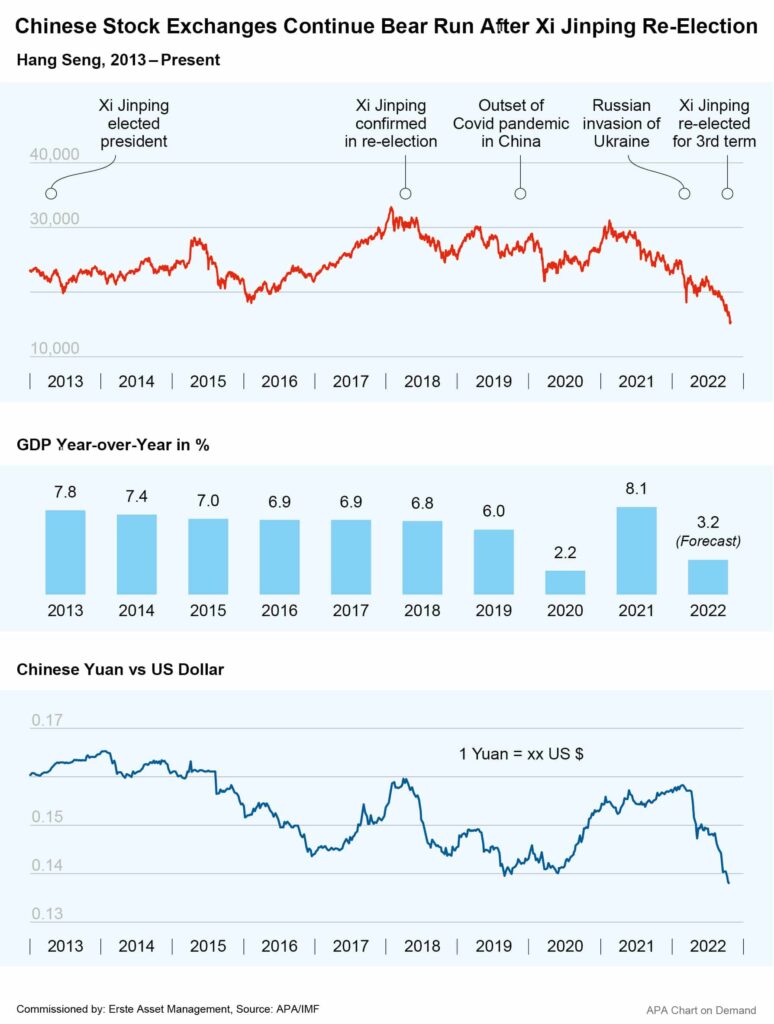

China’s state and party leader Xi Jinping’s recent re-election for another term, together with weak economic data, led China’s stock markets and the national currency, the yuan, into a downward trend last week. Concerns about China’s economy are now compounded by fears that Xi could use the consolidation of his position of power to strengthen state power and turn away from his pro-business course.

As expected, the Central Committee of the Communist Party voted the 69-year-old head of state into his third term a week ago. At the same time, the party congress also embedded Xi’s ideology and his permanent leadership role in the constitution more firmly. The head of state is thus defying previously respected age and term limits. Observers now expect Xi to use his strengthened position of power to turn away from a liberal course geared to economic growth and to pursue a more ideologically oriented policy.

According to experts, this is also supported by the personnel decisions for the new term in office. Politicians who were considered liberal, such as the previous prime minister Li Keqiang, were deprived of their power. The new leadership now consists exclusively of politicians who are considered loyal followers of Xi.

Chinese Technology Shares Under Pressure

This development was received negatively on the stock markets. Last week on Monday, one day after the plenary session of the Central Committee, the Shanghai Composite fell by 2.0 per cent. The Hang Seng of the Hong Kong Stock Exchange fell even by nearly 6 per cent. During the course of the week, this downward trend continued.

Since the beginning of the year, the Shanghai Composite has lost close to 20 per cent (10 years: +46 per cent) and the Hang Seng around 37 per cent (10 years: -31 per cent). Going by key figures such as the price-earnings ratio, Chinese shares are now calculatively cheaper than they have been for years, according to Bloomberg data, writes German finance Paper Handelsblatt.

Technology stocks such as Alibaba and JD.com came under particular pressure and intermittently dropped by more than 10 per cent. Many investors fear that the new powers of the head of state will also lead to stronger regulation of the Chinese technology sector.

National Currency Yuan Drops to Yearly Low

Xi’s re-election also made waves on the foreign exchange market. The Chinese currency yuan temporarily fell to this year’s lowest price, while the US dollar rose to nearly 7.3 yuan. According to insiders, Chinese state banks have sold US dollars in reaction to the yen crash in order to support their own national currency, news agency Reuters reported.

This political news comes at a time when the economy is already struggling. The world’s second-largest economy grew by 3.9 per cent in Q3, a marked acceleration from the previous quarter. However, China is expected to clearly miss its original growth target of around 5.5 per cent for this year. Experts polled by the Reuters agency see an average growth of only 3.2 per cent.

Purchasing Managers’ Indices Drop Just Below Growth Threshold

Current leading indicators are already pointing downwards. For example, the official Purchasing Managers’ Index for the manufacturing sector published on Monday stands at 49.2 points. Before that, its counterpart for the non-manufacturing sector had already slipped below the important threshold of 50 points that separates contraction from growth.

The country’s strict zero-covid strategy with hard lockdowns is putting a particularly heavy toll on the economy. At the end of October, rising infection numbers triggered a new wave of lockdowns. Entire districts with millions of inhabitants were rigorously sealed off to stop the coronavirus spread. Around 232 million people are currently affected by Corona restrictions, according to the financial services provider Nomura.

In addition, there is a severe housing crisis, high debt and weak domestic demand. Finally, declining global demand is also slowing the country’s export growth. Exports in September grew by only 5.7 per cent year-on-year in US dollar terms, according to the latest report from China Customs. High inflation and rising interest rates in many countries are likely to further curb demand for Chinese products.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.